On Wednesday, Bitcoin retested the $89,000 level after failing to recover to $93,500 in the previous trading session. The move surprised investors and triggered roughly $144 million in liquidations from leveraged BTC positions. Despite the factors driving the correction, the derivatives market has remained steady, suggesting a potentially bullish setup.

-

Bitcoin Futures: The monthly futures premium stayed near 4% above spot markets on Wednesday, slightly below the 5% level typically considered neutral. Some analysts noted that the metric briefly turned negative when Bitcoin traded under $89,200 on Tuesday, but aggregated data from major exchanges indicates otherwise. A discount in futures contracts generally signals excessive confidence from bears.

-

Traders Remain Cautious but Unpanicked:

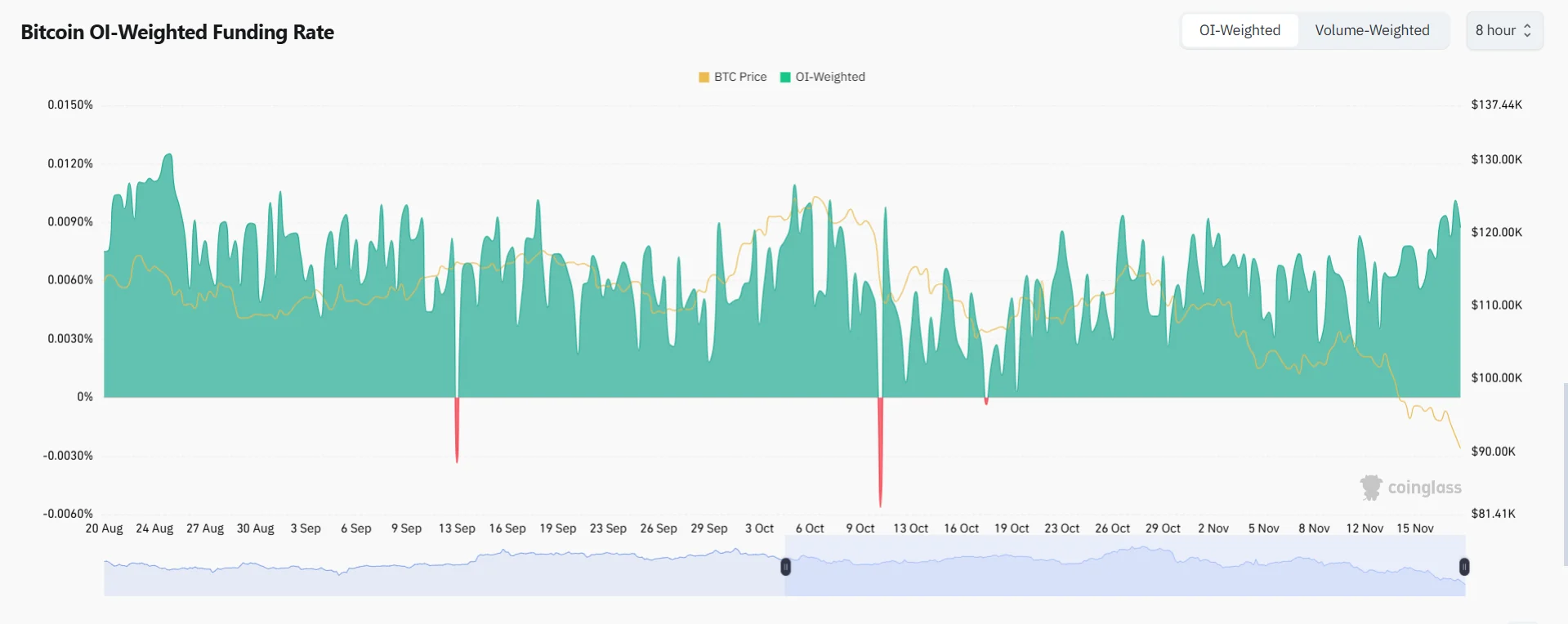

To assess the impact on retail traders, perpetual futures are a useful indicator, as they closely mirror spot markets and use funding rates to balance leverage. Under normal conditions, buyers (longs) pay 6–12% annualized to maintain positions; levels below this suggest a bearish backdrop.

The BTC perpetual futures funding rate hovered around 4% on Wednesday, in line with the two-week average. This reflects a cautious sentiment without signs of panic or excessive confidence from bears. The weakness appears backward-looking, as Bitcoin has been trending lower since reaching its all-time high on October 6. -

BTC Options Delta Skew: Remaining around 11% over the past week, indicating traders have not materially adjusted their risk expectations. Caution persists as put options trade above the neutral 6% premium relative to call options, showing that whales and market makers remain wary of downside exposure, though the current level is far from extreme stress.

-

Pressure from Bitcoin ETFs: Market sentiment has also been pressured by five consecutive sessions of net outflows from Bitcoin ETFs. Over $2.26 billion has exited these products, generating steady selling pressure as market makers typically distribute execution throughout the trading day. While notable, this figure represents less than 2% of the total Bitcoin ETF market.

Moreover, macroeconomic factors are affecting investor sentiment. Some of the world’s largest tech companies have fallen 19% or more over the past 30 days, including Oracle (ORCL US), Ubiquiti (UI US), Oklo (OKLO US), and Roblox (RBLX US). The shift toward risk-off positioning is not limited to cryptocurrencies and also reflects concerns about the U.S. labor market. Riskier segments, particularly those tied to AI infrastructure, have experienced the steepest losses.

Additional pressure comes from the consumer sector, which has been affected by the U.S. government shutdown lasting until November 12. Retailer Target (TGT US) lowered its full-year profit outlook and warned of a softer holiday season as affordability pressures persist. Inflation remains a major concern, limiting the U.S. Federal Reserve’s ability to cut interest rates.

Even with Nvidia’s upcoming quarterly results, some analysts have questioned the “nature of some of Nvidia’s AI investments in its own customers,” according to Yahoo Finance. The factors driving investors away from Bitcoin’s “digital gold” narrative remain unclear, but at this stage, BTC’s chances of reclaiming $95,000 are closely tied to improvements in macroeconomic conditions.