Bitcoin’s price fluctuates constantly, but the $65,000 to $71,000 range is acting as a safety net, helping the market maintain stability.

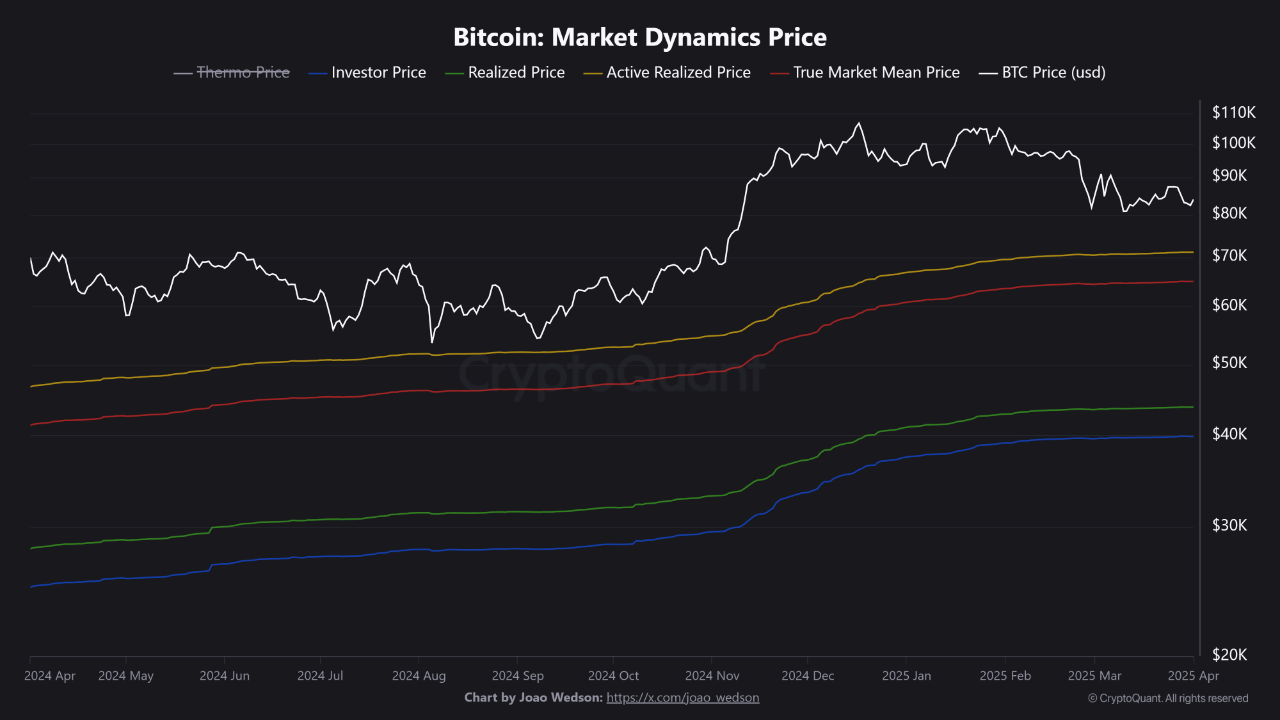

Currently, Bitcoin’s realized price hovers around $71,000, while the market’s average realized price establishes solid support at $65,000. This presents an attractive opportunity for long-term investors to accumulate more during price corrections.

This support zone not only reflects investor behavior but also plays a crucial role in determining price trends. With the active realized price at $71,000—where Bitcoin sees the highest trading volume—and the market’s average realized price at $65,000, a strong foundation has been established, limiting the risk of a deep decline even amid volatility.

Market data indicates that Bitcoin’s momentum aligns with this support zone. The convergence of three key metrics—the realized price, active realized price, and market’s average realized price—within the $65,000 to $71,000 range suggests that long-term holders (LTH) remain confident and are largely unaffected by short-term fluctuations.

The narrowing gap between these metrics also indicates that recent price movements are primarily driven by actual investor participation rather than mere speculation. This rare occurrence suggests that the market is solidifying its perception of Bitcoin’s value within this price range.

The $65,000 to $71,000 zone is not only a crucial accumulation area for long-term investors but also a potential profit-taking point for short-term holders (STH) when prices reach local peaks. If Bitcoin retraces to this range, short-term investors may opt to sell to secure profits, whereas long-term investors may seize the opportunity to buy more, viewing this price level as strategically valuable.

This dynamic may lead to short-term volatility, but strong buying pressure could quickly stabilize prices. Should Bitcoin enter this support zone, demand could surge as long-term investors continue accumulating, while short-term investors may sell due to concerns over further declines. However, if demand remains steady, Bitcoin has a strong chance of holding its value and rebounding, turning this support zone into a robust cushion against sharp downturns.