Bitcoin continues to “dance” around the $94,000 level, currently trading at $93,117 with a 24-hour trading volume of $81 billion. The world’s largest cryptocurrency has gained 3% on the day, sitting just 1% below today’s high of $93,929 and about 3% above the weekly low near $90,837.

Circulating supply has reached 19.96 million BTC, closing in on the fixed 21 million cap. Bitcoin’s global market capitalization has climbed to $1.86 trillion, marking a 3% increase over the same period.

A “late-cycle reset” and renewed accumulation

Analysts note that Bitcoin briefly dipped below its Metcalfe-based fair value for the first time since 2023. This occurred after a sharp 36% correction last week that pushed BTC toward $80,000, flushing out excess leverage and speculative positions.

Network economist Timothy Peterson says periods when Bitcoin trades below its fundamental network value have historically delivered strong gains. Twelve-month returns have averaged 132%, with 96% of these periods showing positive performance.

Long-term holders have also stepped back in, accumulating around 50,000 BTC in the past 10 days, reversing months of steady distribution. The shift from short-term trading to long-term storage reduces selling pressure just as Bitcoin attempts to reclaim higher levels.

Bitcoin has recovered above $90,000 this week and reached an intraday high of $93,978 on Wednesday.

Macro conditions lend further support

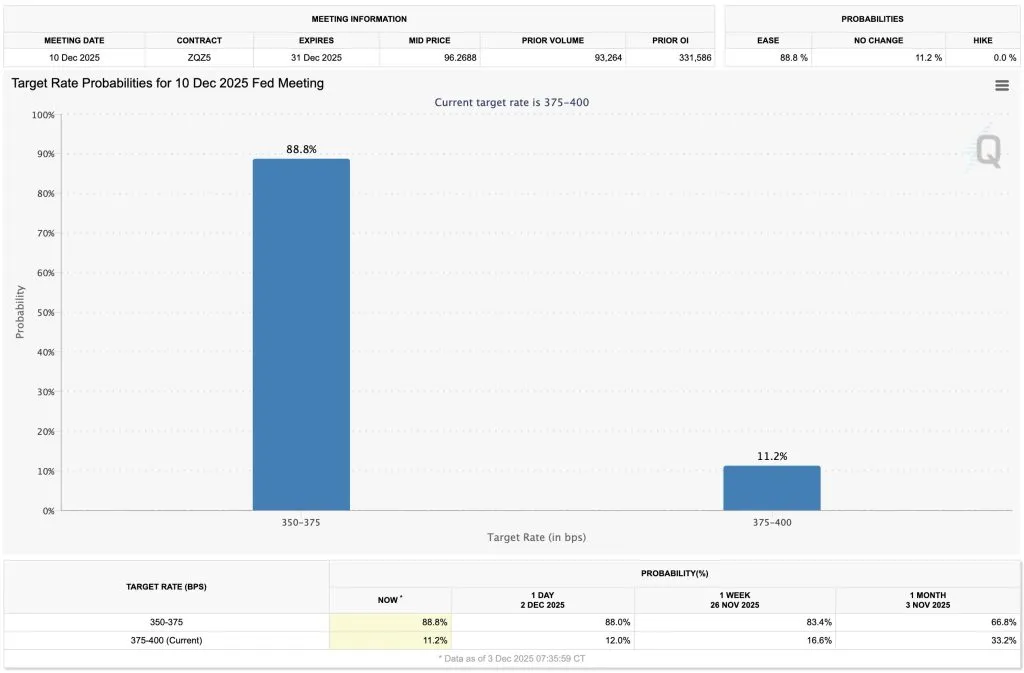

Macro factors are increasingly aligning with bullish on-chain signals. The Federal Reserve has officially ended Quantitative Tightening (QT), and markets are now pricing in a near-certain interest-rate cut in December.

Historically, every QT reversal has coincided with major Bitcoin rallies — including the explosive 2013 cycle and the post-2019 surge that eventually sent Bitcoin to $67,000.

Other business-cycle indicators are turning as well. The copper-to-gold ratio, a leading gauge of U.S. manufacturing sentiment and future PMI strength, appears to be bottoming.

Bitcoin’s recent stagnation — despite growing global liquidity — suggests that investors have been reacting more to weakening economic sentiment than to crypto-specific catalysts. A rebound in risk appetite would likely benefit Bitcoin after months of consolidation.

Short-term risks remain

Despite improving tailwinds, the short-term outlook is still fragile. November closed with a bearish monthly candle, confirming a MACD cross, a signal that often precedes periods of slower momentum.

Key support levels remain at $85,000–$84,000. Analysts warn that a breakdown could lead to a deeper test of $75,000.

Bitcoin remains well below its all-time high of $126,000 set in October, though volatility has eased as liquidations cool off.

Institutions continue to ramp up exposure

Institutional participation has strengthened despite market turbulence:

-

BlackRock increased internal exposure to its IBIT ETF

-

JPMorgan issued a structured note linked to the same ETF

-

Strategy Inc. expanded Bitcoin holdings and set aside a $1.4 billion reserve to avoid forced selling

-

Charles Schwab announced plans to offer Bitcoin trading in early 2026

-

BlackRock CEO Larry Fink reversed his stance, admitting he was “wrong” about Bitcoin

-

Coinbase CEO Brian Armstrong stated there is “no chance” Bitcoin goes to zero

At the NYT DealBook Summit, Larry Fink called Bitcoin an “asset of fear”, bought during periods of geopolitical tension, financial instability, and currency debasement. He emphasized that despite its volatility and leverage-driven behavior, Bitcoin can serve as meaningful portfolio insurance.