Bitcoin continues to face intense pressure in recent days as the bears take full control, pushing the price down to a multi-month low of just under $92,000.

Ethereum is also struggling, dipping below the crucial $3,000 support level, amid a surge in liquidations caused by excessive leverage used by traders.

Less than a week ago, Bitcoin had surged past $107,000 thanks to positive developments in the U.S., but that rally was short-lived. The market quickly faced a strong correction, sending Bitcoin back into five-digit territory last Thursday, and it has yet to recover.

What’s striking about this current crash is that there’s no clear culprit. Unlike previous downturns caused by industry crises, global pandemics, or macroeconomic uncertainty, this correction seems primarily driven by excessive leverage, according to the Kobeissi Letter. Analysts also note that Bitcoin has entered a new structural bear market, with prospects continuing to deteriorate.

Ethereum is faring no better, falling below $3,000, down over 15% this week and more than 22% in the past month. Other altcoins are also under heavy pressure: XRP has dropped 3.6% in a day, while SOL plunged over 5%.

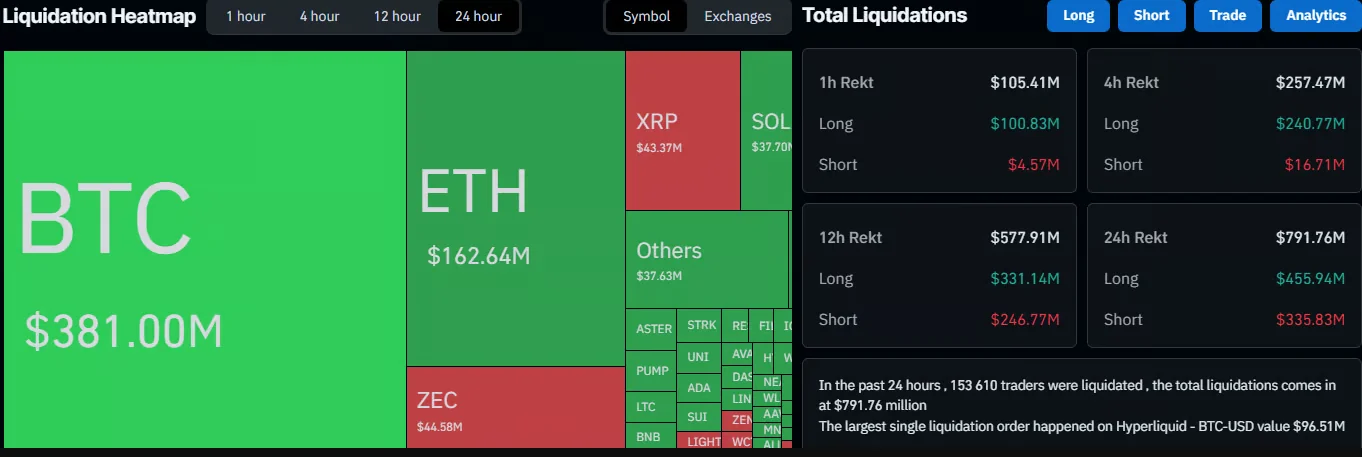

The widespread use of leverage has taken a heavy toll on traders, with more than 150,000 positions liquidated daily. The total value of liquidated positions has reached nearly $800 million, with the single largest liquidation recorded on Hyperliquid at $96.51 million, according to CoinGlass data.