BTC has plunged to its lowest level since April, sending fresh waves of uncertainty across the market. While short-term sellers panic and dump their holdings, long-term holders (LTHs) are quietly accumulating — though not enough to shift the overall trend.

Key Highlights

-

Bitcoin drops below $90,000, hitting a multi-month low.

-

Extreme fear, thin bid liquidity, and weakening support trigger the crash.

-

LTH accumulation spikes, but panic selling from short-term traders dominates.

-

Critical support zones: $89,400 – $82,400; long-term CVDD buy zone far below at $45,500–$50,000.

Bitcoin in a Freefall

Over the past 24 hours, Bitcoin has broken below the $90,000 mark, extending a downtrend that has persisted throughout the week. Hourly charts show deep red candles as selling pressure intensifies and volume climbs.

The RSI has plunged into oversold territory at 24, while the CMF remains below zero – clear signs of a seller-driven market. Buyer attempts to stabilize the price have been brief and ineffective.

Farzam Ehsani, CEO of VALR, commented:

“Bitcoin has been under heavy pressure since the sharp decline on November 11th. Over the past week, the asset has lost more than 11% of its value, returning to levels last seen in the spring.”

LTHs Quietly Accumulate Despite Panic

Fresh data reveals a strong surge in demand from long-term holders, reaching levels seen during past pre-rebound phases. Meanwhile, short-term holders (STHs) continue to sell aggressively amid widespread fear.

Even investors who typically enter only during periods of deep stress are beginning to step in — a sign of underlying long-term conviction, though still not enough to offset current selling pressure.

Ehsani added:

“The coming weeks will be turbulent. Instability in the tech sector and the lack of macroeconomic benchmarks create a backdrop of uncertainty. Still, some major players maintain cautious optimism, viewing this period as the ‘autumn season’ of the four-year cycle.”

Critical Levels to Watch

As volatility mounts, the market is focusing on key support zones that will determine Bitcoin’s next direction:

-

$89,400 – the Active Realized Price, now under heavy testing.

-

$82,400 – the True Market Mean Price, a strong support in July 2021 but now appearing weaker.

-

For high-risk traders, potential entries lie around $89,000 and $82,000, paired with tight stop-losses.

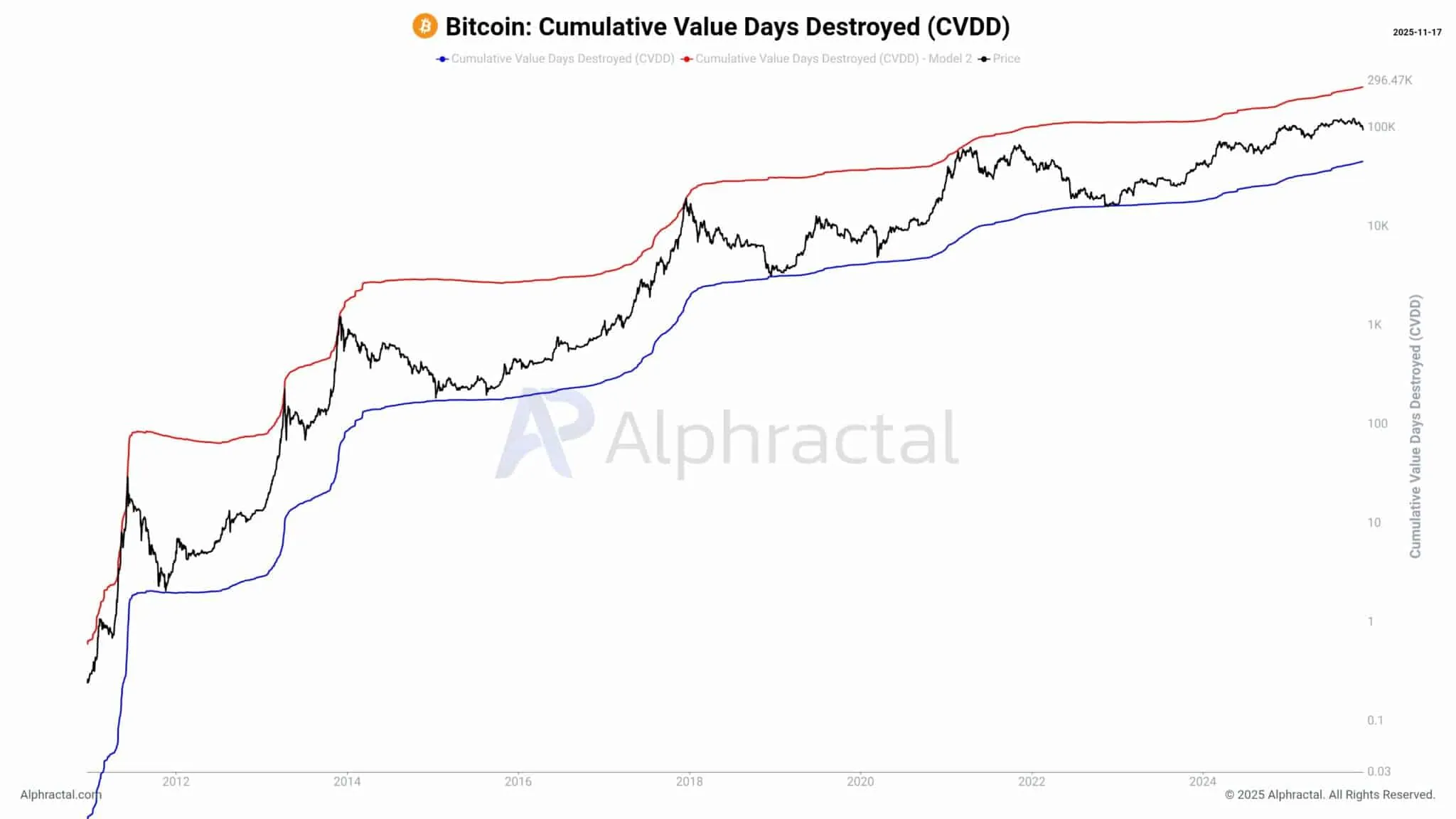

If the decline worsens, Bitcoin may fall toward the CVDD long-term buy zone at $45,500–$50,000, historically the region where true cycle-bottom demand returns.