Bitcoin is coming under renewed selling pressure as global markets increasingly price in a near-certain interest rate hike by the Bank of Japan (BOJ) next week. The move is expected to tighten global liquidity conditions, weighing heavily on risk assets such as cryptocurrencies.

Has the BOJ Rate Hike Already Been Priced In?

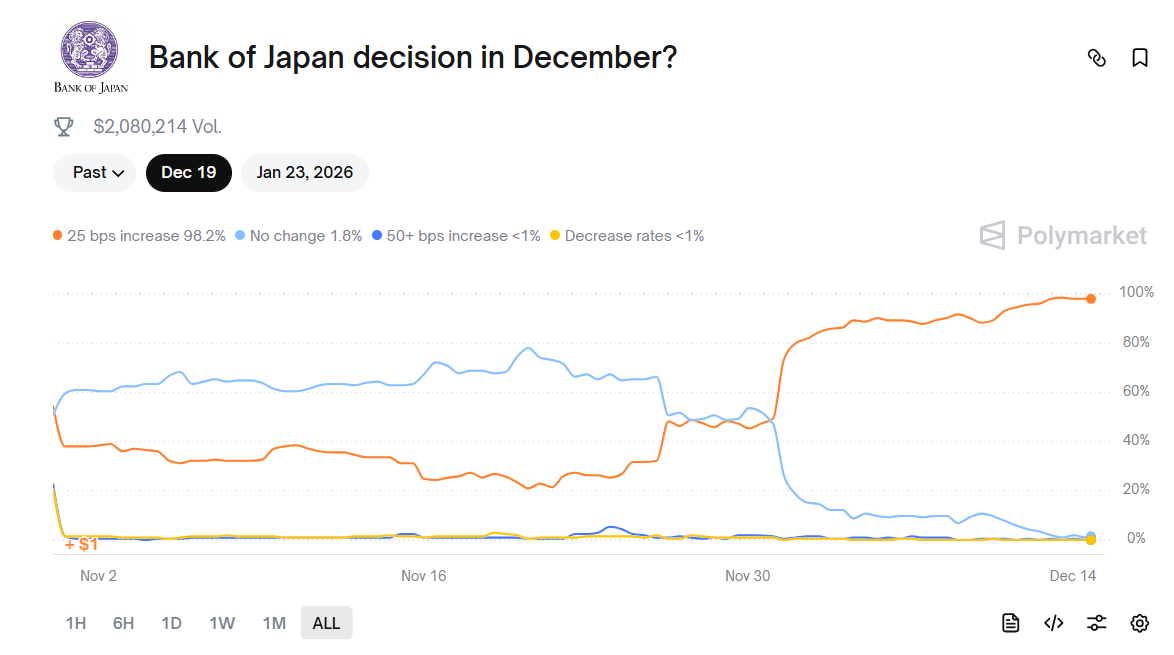

According to a Bloomberg chart shared by analyst Ted Pillows, the probability of a 25-basis-point rate hike at the BOJ’s December 18–19 meeting has climbed above 90%. Expectations surged following a series of hawkish comments from BOJ policymakers, as reported by Reuters.

Several analysts warn that if the BOJ raises rates to 0.75%, Bitcoin could retreat toward the $70,000 level. Historically, previous BOJ rate hikes have coincided with Bitcoin drawdowns of 20% to 25%.

The core explanation lies in the yen carry trade. As Japanese interest rates rise, borrowing yen becomes more expensive, prompting investors to reduce exposure to riskier assets, including cryptocurrencies.

However, long-term investors continue to accumulate during periods of volatility. Notably, Michael Saylor has signaled further Bitcoin purchases for Strategy, despite “extreme fear” dominating market sentiment.

Will Bitcoin See Further Selloffs After the BOJ Decision?

A move to 0.75% would mark Japan’s highest policy rate in 30 years, bringing it closer to estimates of a neutral monetary stance. Even so, BOJ officials are expected to emphasize that financial conditions will remain broadly accommodative.

Bitcoin traders will be closely watching December 19, as a decisive technical breakdown could accelerate downside momentum. Still, some strategists, including Tom Lee, believe that once volatility subsides, Bitcoin could rebound and reach a new all-time high (ATH) early next year.

On-chain data also point to growing bearish positioning among large traders. Ted Pillows reported that a whale recently opened an $89 million Bitcoin short position using 3x leverage. The same trader has reportedly generated more than $23 million in profits over the past two months.

Could Bitcoin Fall Below $80,000 This Year?

Prediction market data suggests traders are increasingly bracing for deeper losses. On Kalshi, contracts now indicate a 28% probability that Bitcoin falls below $80,000 before year-end.

At the time of writing, BTC is trading around $88,805 on CoinMarketCap, with sentiment remaining weak as crypto prices continue to be heavily influenced by macroeconomic developments. The outcome of the BOJ meeting is widely expected to set the tone for Bitcoin’s price trend through the remainder of the year.