Bitcoin, the world’s largest cryptocurrency, is enduring one of its worst years ever. Despite high hopes for “Uptober” — the month traditionally known for strong gains — investors are witnessing a disappointing “Floptober” instead.

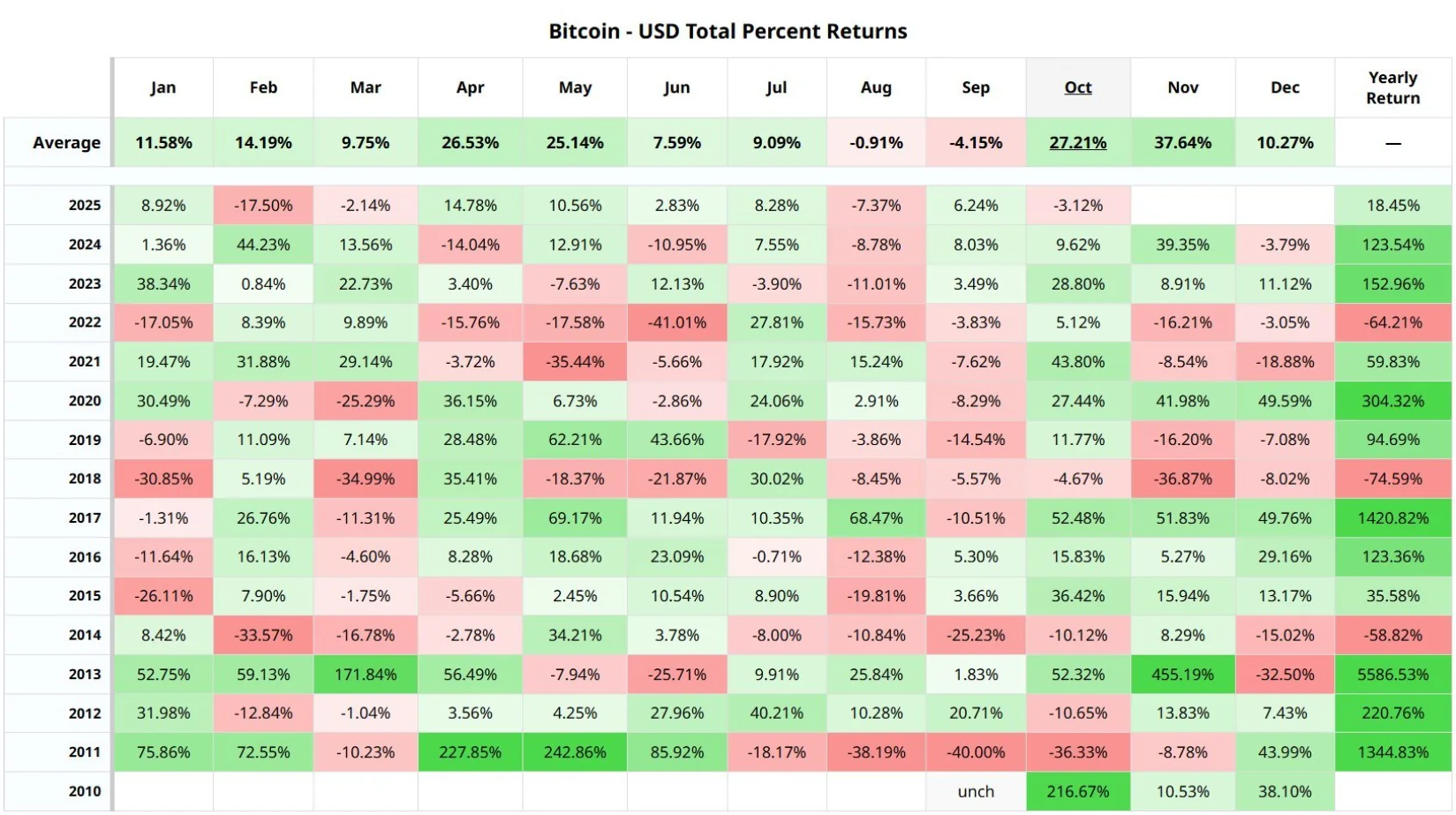

According to the latest data, Bitcoin’s year-to-date return stands at just 18.45%, making 2025 the fourth-worst year in its history. The figure is particularly discouraging given that the U.S. dollar is having its weakest year since 1973, plunging about 9% against a basket of major global currencies.

Historically, Bitcoin has only performed worse during severe crypto “winters” — in 2014 (-58.82%), 2018 (-74.59%), and 2022 (-64.21%). Its golden year was 2013, when the cryptocurrency skyrocketed 5,586%, a level of growth that now seems impossible for an asset valued at over $2.2 trillion.

Even more embarrassing is Bitcoin’s underperformance compared to gold and the S&P 500, despite its smaller market capitalization. Gold — the traditional safe-haven asset — is having its best year since 1979, soaring over 57% and recently breaking above $4,200 per ounce for the first time ever.

The collapse of “Uptober” has deepened investor disappointment. October has long been considered Bitcoin’s “lucky month,” often marked by powerful rallies. Indeed, Bitcoin hit an all-time high of $126,272 on October 6, sparking optimism about a new bullish cycle.

But that euphoria quickly evaporated. Bitcoin plunged 13% within days as escalating U.S.-China trade tensions rattled global markets, sending crypto prices sharply lower. If the trend continues, 2025 will mark Bitcoin’s first red October since 2018, when it was mired in one of the harshest bear markets on record.

Analysts warn that Bitcoin’s weak performance this year is a clear sign of fading momentum across the crypto landscape, while traditional assets like gold continue to shine. Once hailed as a digital revolution, Bitcoin’s “Uptober” has crumbled into a bitter “Floptober,” leaving investors trapped in a fading dream of revival.