Bitcoin’s surging valuation is luring traders and speculators back into the market, as indicated by on-chain data. In their recent newsletter, blockchain intelligence firm Glassnode pointed out the growing risk appetite within various segments of the Bitcoin market, encompassing both institutional buyers and short-term holders.

In the year’s initial months, Bitcoin has witnessed substantial capital inflows, propelling its realized cap by $30 billion to $460 billion—a mere 3% shy of its historical peak. Concurrently, the asset’s market price has soared by 29%, reaching $57,000.

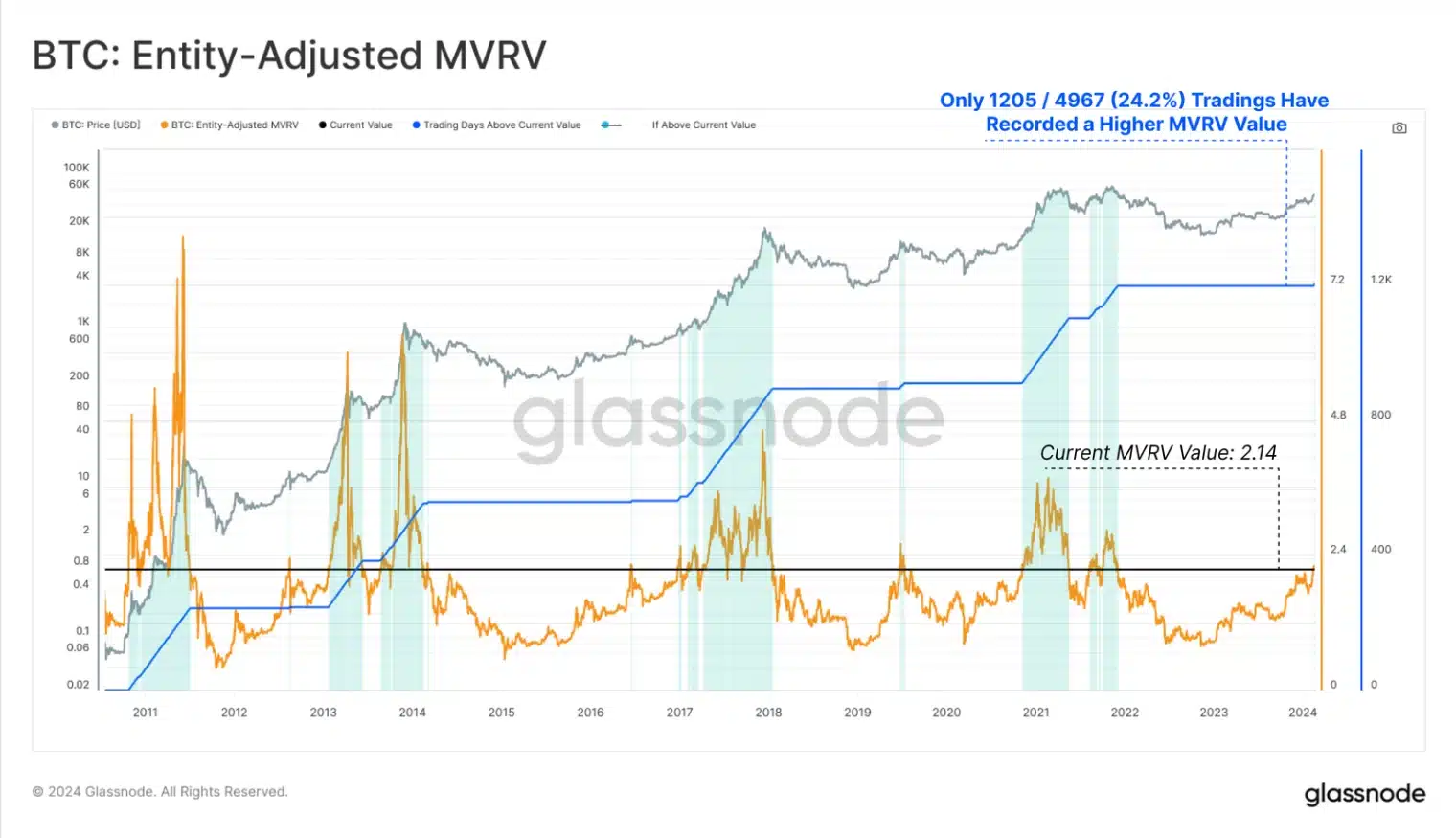

The term “realized cap” gauges the combined value of all Bitcoin, assessed according to the last time those coins were transacted. Employing the MVRV ratio to compare Bitcoin’s market cap, one can gauge the profitability of the average Bitcoin investor. Currently standing at 2.14, the ratio signifies a relatively high value, although not indicative of Bitcoin nearing its cyclical peak.

Glassnode observes, “As a consequence of this robust performance, the profitability of Bitcoin investors has notably improved, with the average investor now holding an unrealized profit of +120% per coin.”

Speculators Make a Comeback

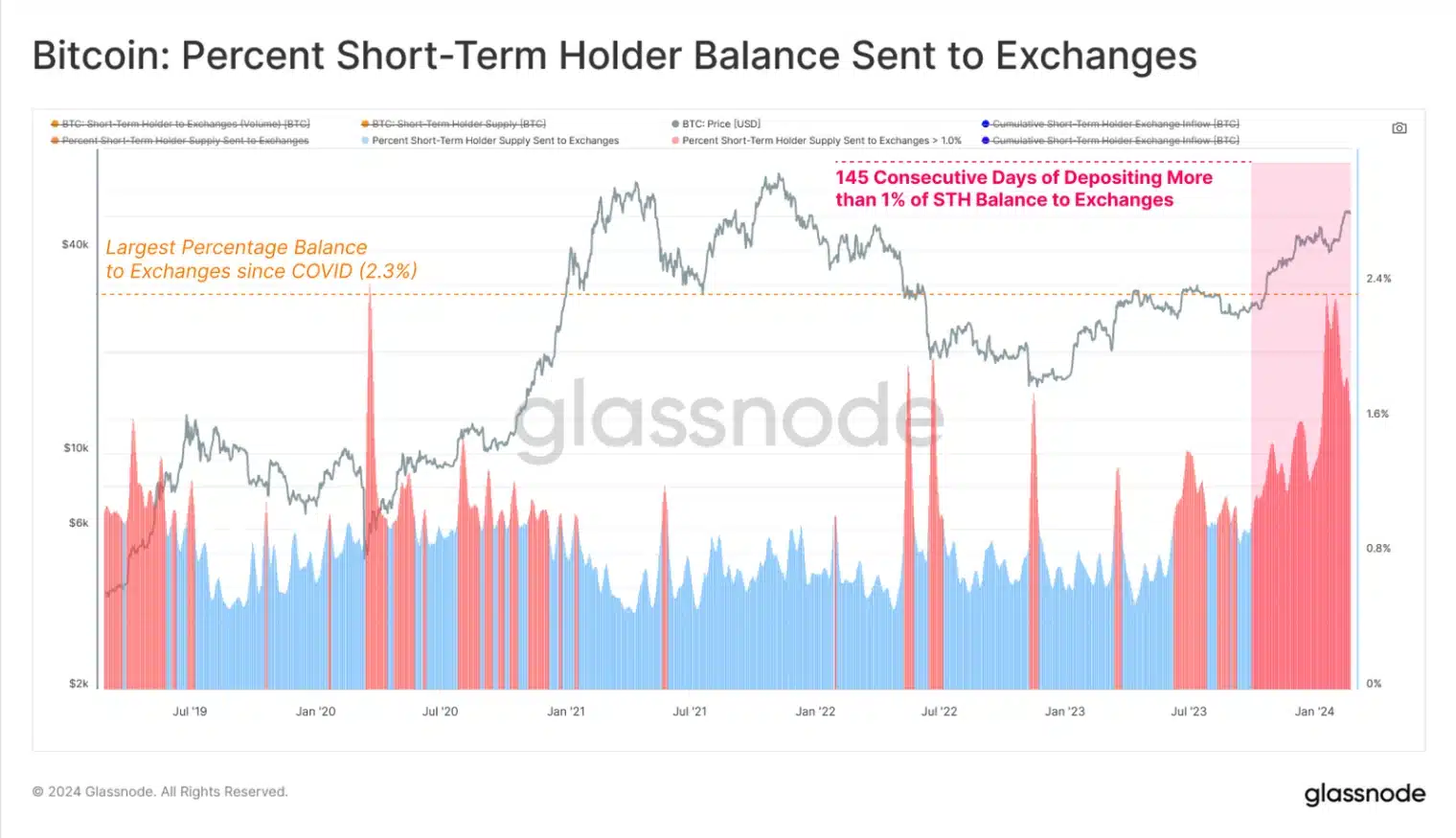

A surge in on-chain daily volume, reaching nearly $5.57 billion in recent weeks, has caught the attention of traders and speculators, marking a resurgence in interest, according to findings from Glassnode. The firm highlighted that the influx of exchange deposits, predominantly from short-term holders, emphasized the speculative nature of the current market dynamics.

Notably, since October 2023, short-term holders (STH) have been consistently depositing over 1% of their supply per day, reaching a peak of 2.36% during the recent speculation fueled by Exchange Traded Funds (ETFs). Glassnode characterized this as the most substantial relative deposit since the sell-off in March 2020.

Bitcoin ETFs have become a pivotal source of ongoing demand for BTC, absorbing over $6 billion since their launch on January 11. Glassnode underscored that these funds have introduced “a new degree of freedom for demand and speculation,” particularly among institutional buyers.

Related: Analyst Forecasts Bitcoin to Reach $100,000 by 2024

In addition to ETFs, open interest in Bitcoin futures and options has experienced significant increases in the past two months, reaching $20.5 billion and $17.8 billion, respectively. The latter achieved an all-time high of $20 billion in January, surpassing 2021 levels by a considerable margin.

Glassnode pointed out that much of the recent activity appears to be directional, with numerous traders betting against the prevailing uptrend, resulting in liquidations as a consequence.