Bitcoin Surges to $34,000 as BlackRock ETF Reemerges

The market had been abuzz with speculation surrounding the potential approval of Bitcoin ETFs, with particular focus on BlackRock and other applicants. This speculation fueled the most substantial two-day rally for Bitcoin in the past seven months.

However, this optimism encountered a setback when BlackRock’s iShares Bitcoin Trust, known as IBTC, was unexpectedly removed from the DTCC’s list of offerings. Whether this removal was due to a technical error or a premature listing, it caused a sharp drop in Bitcoin’s price.

The initial listing of IBTC had generated considerable excitement in the market, as it was seen as a step closer to the eventual launch of a cryptocurrency ETF and official endorsement.

However, the DTCC later clarified that an ETF’s presence on their website is a routine preparatory step and does not signify regulatory approval. Interestingly, the ETF had been listed on the site since August. Following this clarification, Bitcoin swiftly rebounded to the $34,000 level.

As per TradingView data, Bitcoin is currently trading at $34,116, having surged by 18.6% in the past week. Ethereum, the second-largest cryptocurrency, is priced at $1,792.29, reflecting a 14% increase during the same period. Notably, Solana has shown outstanding performance, with its price at $31.38, marking an impressive 29.8% rise over the past week.

Bitcoin’s dominance remains strong, standing at over 51%, according to CoinGecko’s data.

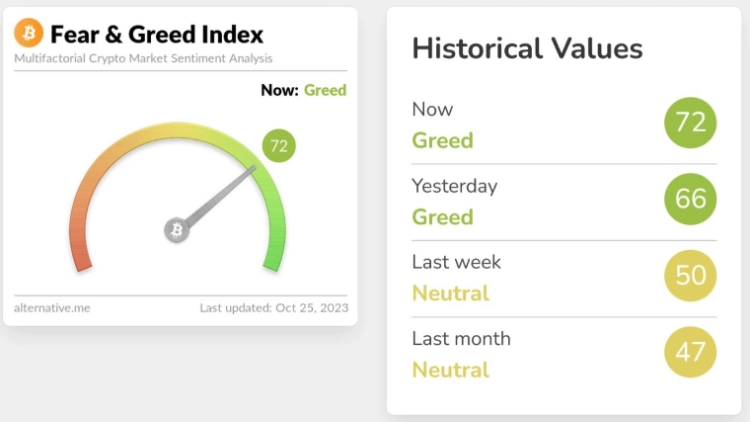

Crypto market sentiment has surged to its highest levels since Bitcoin’s record-breaking $69,000 high in mid-November 2021, as indicated by the Crypto Fear & Greed Index.

Currently sitting at 72 on a 100-point scale, the index firmly places the market in the “greed” category. This represents a noteworthy increase of six points since October 24, and a substantial 16-point climb from the “neutral” ranking observed on October 18.

This resurgence in market sentiment coincides with the growing anticipation of the United States Securities and Exchange Commission (SEC) potentially greenlighting BlackRock’s spot Bitcoin exchange-traded fund (ETF).

On October 24, Bitcoin experienced its most significant single-day rally in over a year, surging by 14% within the day, momentarily breaching the $35,000 price threshold.

The Crypto Fear & Greed Index derives its insights from six essential market performance indicators, with varying weights: volatility (25%), market momentum and volume (25%), social media sentiment (15%), surveys (15%), Bitcoin’s dominance (10%), and overall market trends (10%). These components are employed to gauge daily market sentiment.

The last time the index attained a score of 72 was on November 14, 2021, just four days after Bitcoin achieved its all-time high of $69,044 on November 10, 2021, as per data from CoinGecko.

>>> Bearish Camp Concedes as Bitcoin Enters ‘Anti-Gravity’ Phase

Conversely, the index reached its all-time low of 7 on June 16, 2022, following the collapse of Do Kwon’s Terra ecosystem. This unfortunate event precipitated a series of price-depressing consequences and led to significant setbacks, affecting entities such as hedge fund Three Arrows Capital and crypto lender Voyager Digital.

Amid the mounting enthusiasm for spot ETFs, Galaxy Digital, a prominent crypto investment firm, has made a bullish prediction. They anticipate that if the SEC approves the spot ETF, the price of Bitcoin could surge by more than 74% in the first year following the approval.