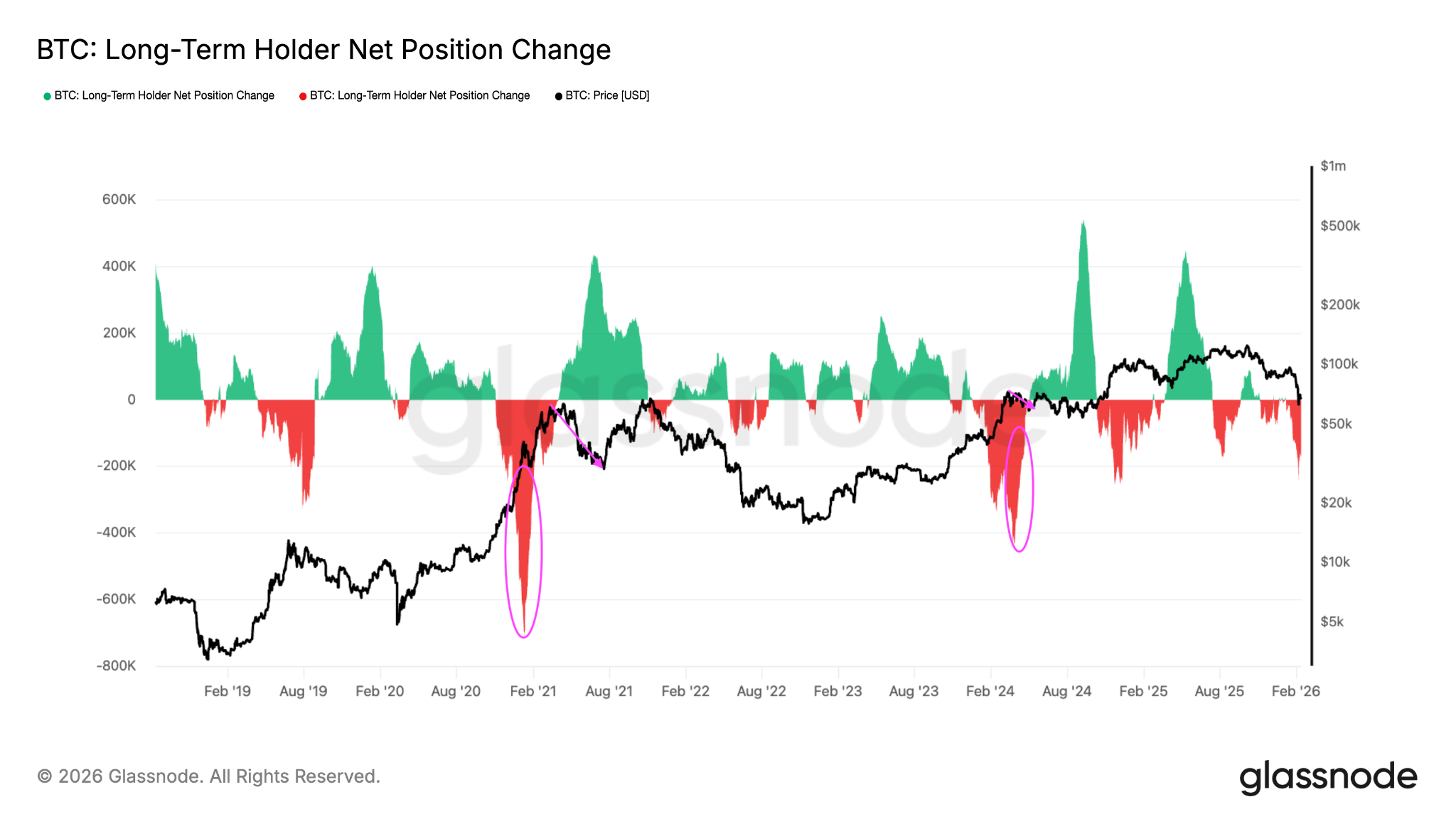

Selling Pressure From Long-Term Holders Persists

Since reaching its all-time high of $126,000, Bitcoin has declined roughly 46%, leaving a large portion of investors underwater. On-chain data shows that long-term holders (LTHs) are steadily reducing their exposure.

-

On Feb. 6, LTH-held Bitcoin dropped by 245,000 BTC within 30 days — the most aggressive distribution phase of the current cycle.

-

Since then, this cohort has continued selling an average of 170,000 BTC per day.

-

Similar spikes in LTH Net Position Change were observed during corrective phases in 2019 and mid-2021, preceding extended downtrends.

Meanwhile, Bitcoin’s 365-day MVRV Adaptive Z-Score has fallen to -2.66, reflecting intense sell-side pressure. Analysts note that while this confirms BTC remains deep in capitulation territory, it also suggests the market may be approaching a historical accumulation zone.

Another key signal is the Realized Profit/Loss Ratio, which is on the verge of dropping below 1 — a level historically associated with broad-based capitulation, where realized losses outweigh profit-taking across the market.

Analysts Expect Bitcoin to Bottom in Late 2026

Several market observers believe the downtrend is not yet over and that BTC could decline further before establishing a cyclical bottom.

-

Some projections place the ultimate bottom between $40,000 and $50,000.

-

The timing is expected between mid-September and late November 2026.

-

Previous bear cycles (2018 and 2022) saw bottoms form approximately 12 months after the market peak.

-

Bitcoin reached its all-time high of $126,000 on Oct. 2, 2025 — if history repeats, the bottom could emerge around October 2026.

-

Recent data shows Net Realized Loss hitting $13.6 billion, levels last recorded about five months before the 2022 bear market bottom.

Taken together, many analysts anticipate 2026 to be dominated by bearish conditions, with price forecasts suggesting a potential decline toward the $40,000 range.

At this stage, Bitcoin has yet to display a clear reversal signal. However, history shows that intense capitulation phases often lay the groundwork for long-term accumulation opportunities. The key question now is how much additional pressure the market must endure before reaching a definitive bottom.