Bitcoin unexpectedly plunged to $101,000, triggering a widespread sell-off across the crypto market. This decline is believed to stem from profit-taking by investors and the liquidation of leveraged long positions on major exchanges.

Despite the price drop, on-chain activity remains robust. On May 29 alone, over 556,000 new Bitcoin wallets were created — the highest number since December 2023. Additionally, on June 2, Bitcoin’s circulating volume reached more than 241,000 units, indicating a significant spike in transaction activity.

Although BTC has yet to break past the $105,000 mark, the increase in wallet creation and circulation highlights growing interest and demand. This could signal the early stages of a new bullish cycle, especially as the market remains relatively stable.

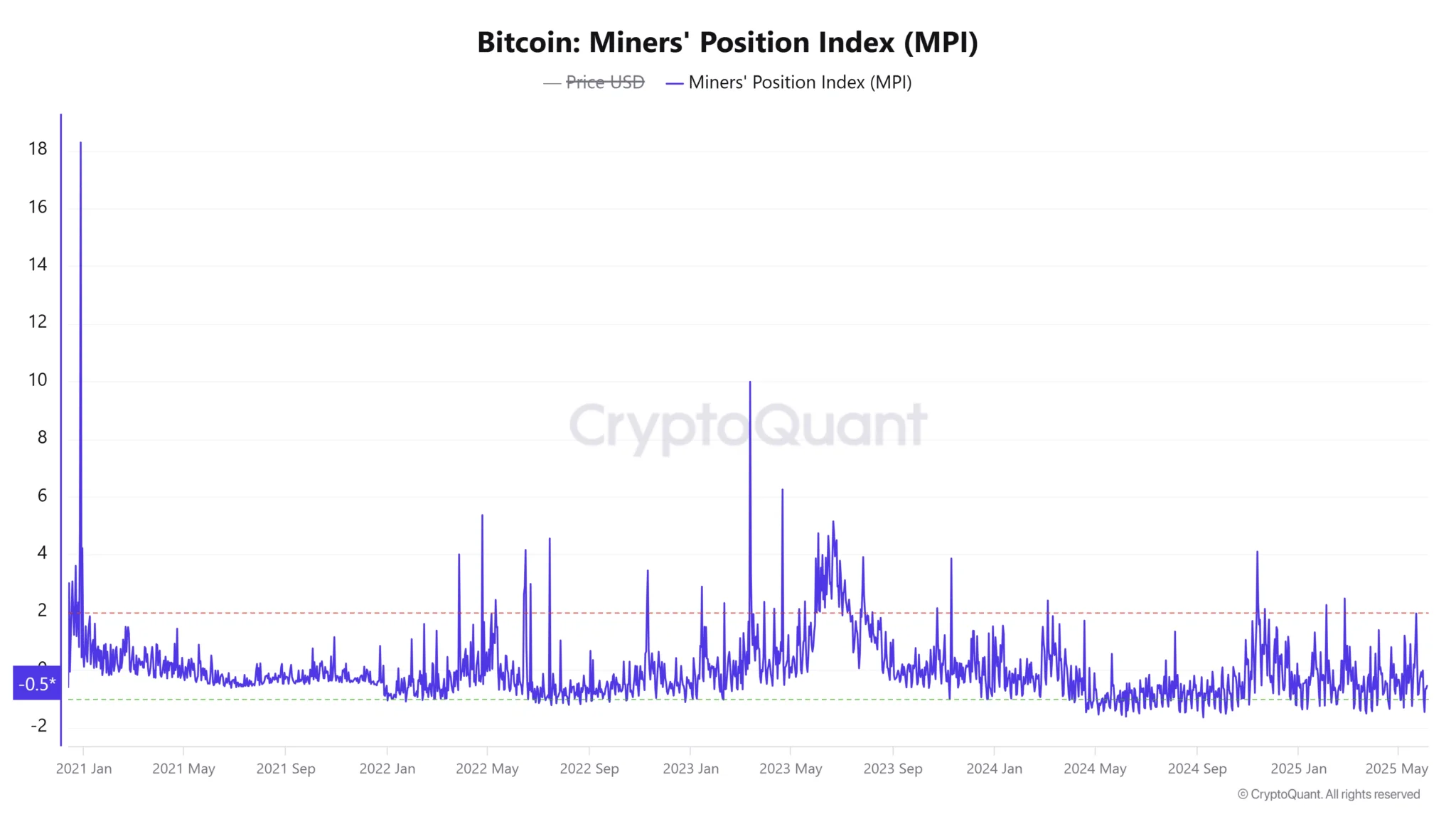

Meanwhile, selling pressure from miners appears minimal. The Miners’ Position Index (MPI), which tracks miners’ selling behavior, rose slightly but remained in negative territory (-0.55), indicating most miners continue to hold rather than sell — a sign of confidence in Bitcoin’s long-term value.

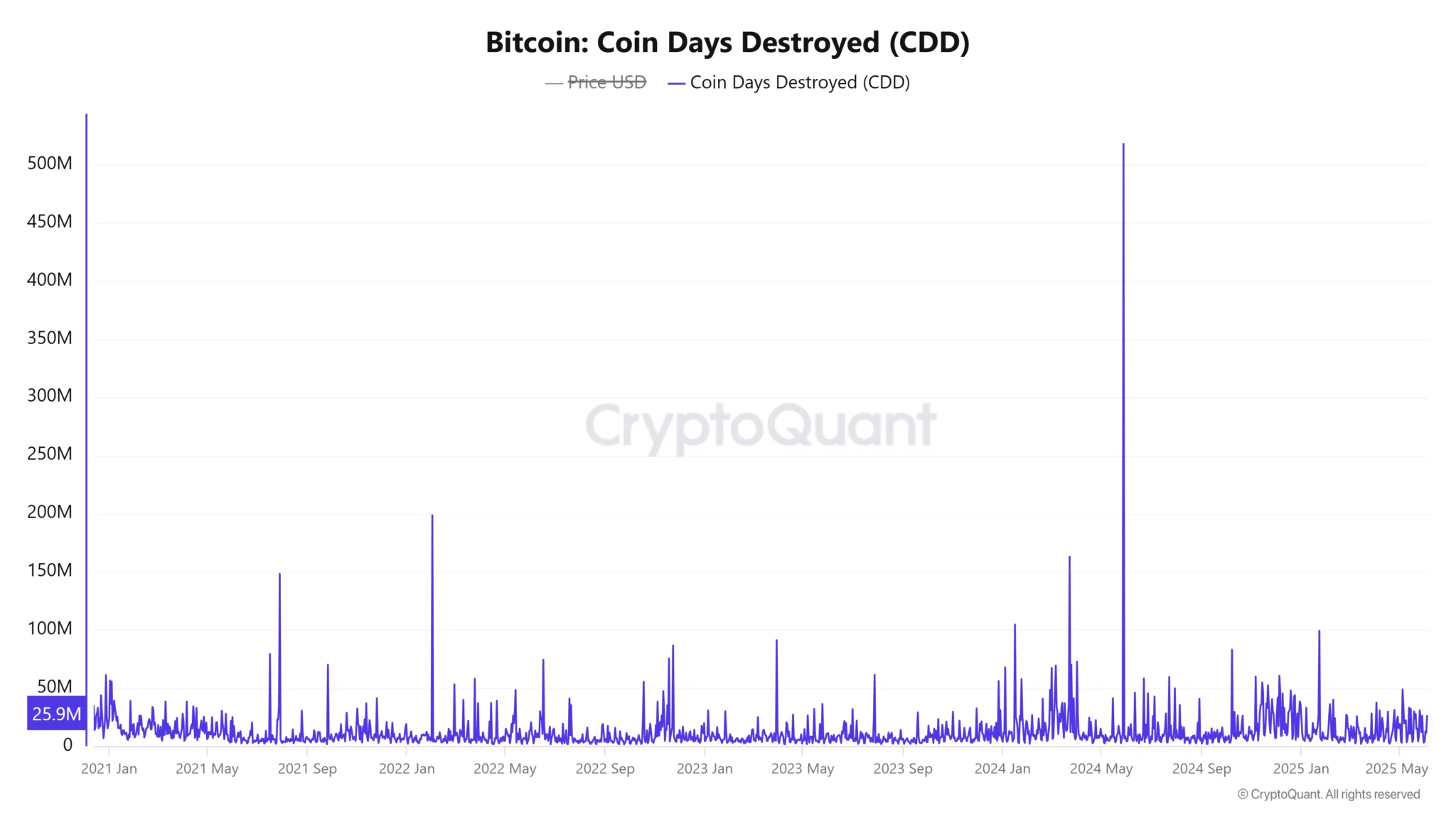

Long-term investors also show little intention to cash out. The Coin Days Destroyed (CDD) index — measuring the movement of long-dormant coins — only rose by 2.22%, suggesting that older BTC holdings are still largely inactive. This patience and conviction from long-term holders continues to provide crucial support for Bitcoin’s price.

Another key factor is scarcity. The Stock-to-Flow (S2F) ratio — which measures an asset’s scarcity by comparing existing supply to new issuance — surged by 300% to over 6.35 million. This sharp rise strengthens the narrative of Bitcoin as “digital gold,” particularly in the wake of reduced supply after the recent halving event.

Historically, strong rises in S2F have often preceded major bull runs. With growing network activity and tightening supply, investors have reasons to be optimistic about a potential new uptrend — especially if demand continues to rise.