Bitcoin Dominance at 54%, Highest in 2.5 Years Ahead of 2024 Halving

Now, Bitcoin’s market dominance has surged to 54%, its highest point in the past 30 months, signaling the cryptocurrency’s strengthening position as the 2024 halving event approaches.

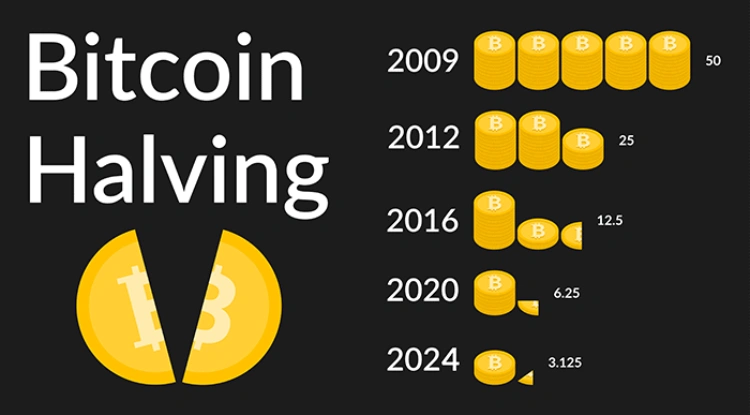

The Bitcoin halving is a significant event where the mining reward per block is halved, reducing the supply of Bitcoin amidst increasing demand and driving bullish price momentum. This event occurs every four years, and the upcoming 2024 halving will decrease the BTC mining reward from the current 6.25 BTC to 3.125 BTC.

With the total supply of Bitcoin capped at 21 million, each halving creates a supply-demand gap that limits the introduction of new BTC into the market.

Bitcoin market dominance measures Bitcoin’s market capitalization relative to the entire digital asset market, highlighting its strength. A market dominance of over 50% is considered highly bullish and represents the highest point since the last bull run in April.

Bitcoin’s market dominance started to rebound at the beginning of October, rising from below 49% to reach this new two-and-a-half-year high. Historically, October has been known as a bullish month for cryptocurrencies, earning the nickname “Uptober.”

This was evident in Bitcoin’s double-digit percentage surge over the past few weeks, taking BTC from just under $27,000 at the start of October to a new yearly high of $35,000.

In 2017, Bitcoin maintained a market dominance of over 80%, followed by Ethereum with a market dominance ranging from 10% to 17%. However, Bitcoin has seen a sharp decline in its market dominance over the years due to the proliferation of cryptocurrencies and the emergence of numerous new tokens during the 2021 bull run.

>>> Bitcoin Predicted to Rise to $45,000 with $14.4 Billion Inflows into ETFs

BTC Price Forecast for Q4 2023: Analyst Outlines Key Targets”

While past performance doesn’t guarantee future results, an analyst believes that Bitcoin (BTC) could be gearing up for a significant price surge in the coming months.

Bitcoin’s technical indicators are pointing toward a potential uptrend. BTC has not traded above $30,000 since July, and its spot price has not exceeded $32,000 since May 2022 when it was on a steep downward trajectory.

According to analyst Kempenaer, the next major resistance level for BTC is in the range of $47,000 to $48,000. He anticipates that Bitcoin will test this range before the end of the year. While historical performance is not a surefire predictor, Bitcoin’s price history lends support to Kempenaer’s projections.

Analysts at the crypto derivatives platform Deribit note that previous rallies, such as the recent breakout, have historically foreshadowed remarkable upward momentum.

The last time Bitcoin surpassed $32,000 on an upward trend was in July 2021, which was followed by a substantial price rally that led to Bitcoin’s all-time high of $69,000 in November 2021.

Several factors are currently bolstering BTC. The growing possibility of an SEC approval for a Bitcoin ETF product has sparked market excitement. A recent court ruling suggesting that the SEC’s rejection of a spot Bitcoin ETF application conflicts with its approvals of futures ETFs has emboldened BTC traders.

Additionally, the SEC’s more lenient stance toward Ripple Labs, along with its courtroom victories, has uplifted cryptocurrency markets. Furthermore, the high-profile FTX fraud trial has reinforced Bitcoin’s appeal as a decentralized blockchain, free from the influence of any single leader. This is evident in the increasing Bitcoin dominance metric as the leading cryptocurrency surges.

Beyond these favorable conditions, markets are following a multi-year Bitcoin market cycle. The upcoming halving in the spring will halve new BTC supplies for the next four years. Furthermore, markets are anticipating lower interest rates from major central banks in the near future.

As we approach the winter season in the northern hemisphere, strong tailwinds and positive technical indicators are thawing the long crypto winter.