Why Could the $113,000–$114,000 Range Spark a Breakout?

The ongoing rally is largely driven by the rising number of short positions. A significant volume of these shorts is concentrated around the $113,000–$114,000 zone — precisely where Bitcoin is now approaching.

This accumulation of leverage creates ideal conditions for a classic “short squeeze”: as the price reaches this level, forced liquidation of short positions may trigger aggressive buying pressure, pushing BTC even higher.

However, with open interest already heavily concentrated in this area, any breakout may be short-lived — potentially marking a temporary top in the current bullish cycle.

Real Demand Still Underpins the Market

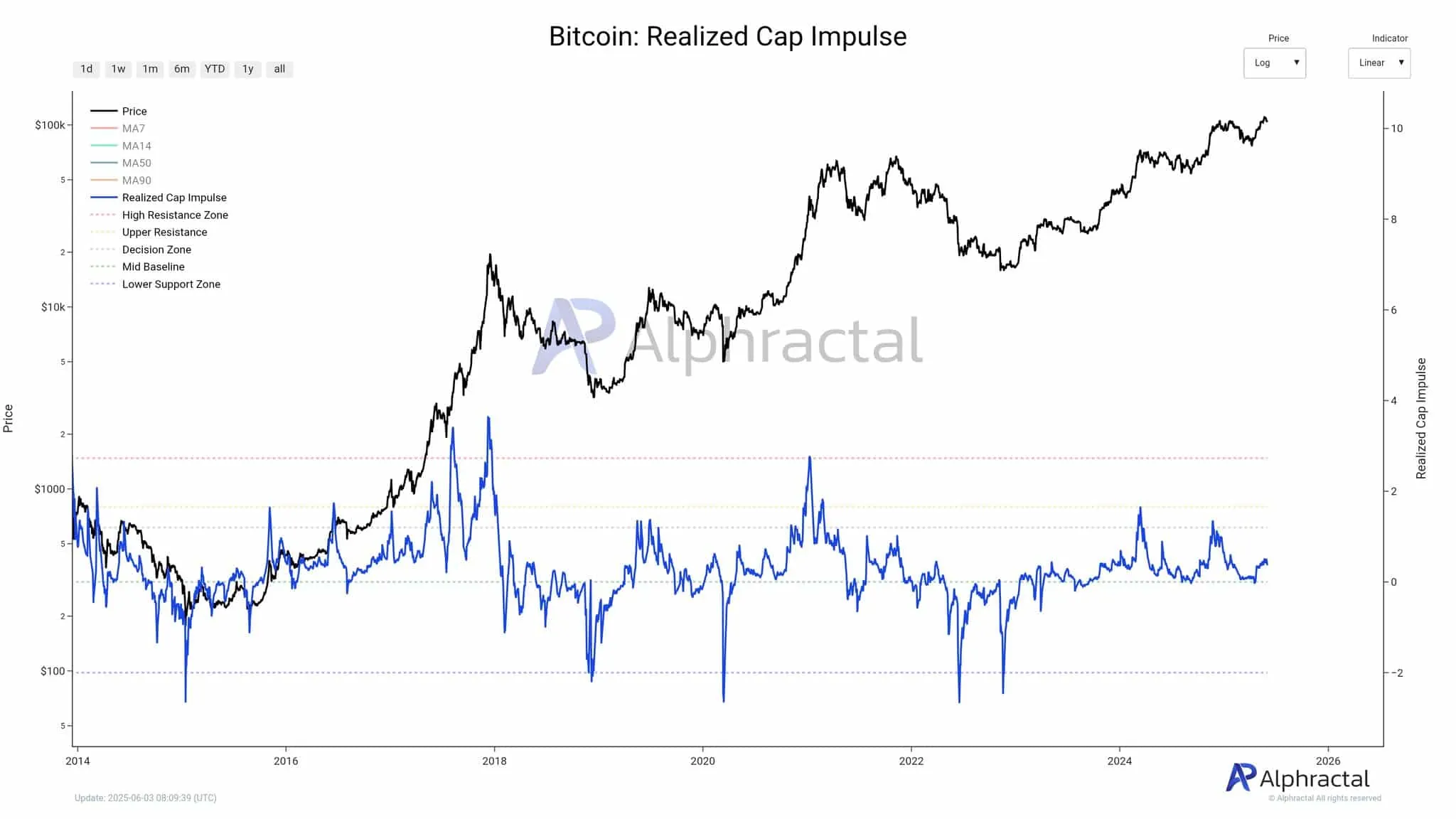

Despite price volatility and rising leverage, Bitcoin’s on-chain indicators remain structurally sound. Price momentum is holding above key support zones, indicating that real demand continues to support the market.

Historically, the market only enters a prolonged downtrend when these indicators fall below critical support. For now, accumulation behavior dominates, rather than distribution.

Moreover, Bitcoin’s realized value is still trending upward, reinforcing the view that this rally isn’t merely speculative but is supported by genuine capital inflows.

This suggests Bitcoin’s price may continue rising in the coming months — potentially until at least the fourth quarter of this year.

Bitcoin: Countdown to a New Cycle?

While short-term indicators remain positive, long-term momentum in realized capitalization is flashing caution. This metric is nearing historically significant resistance levels — thresholds that have previously appeared just before deep, extended downturns.

This could indicate we are witnessing the final stage of capital inflows before the market shifts into a new cycle.

If this scenario unfolds, the peak of this rally may occur around October. After that, Bitcoin could enter a prolonged bearish cycle — possibly lasting up to a year and ending by late 2026.