Bitcoin is edging closer to the $120,000 milestone, fueled by three key forces: massive net withdrawals from centralized exchanges, surging inflows into spot Bitcoin ETFs, and its growing role as a financial hedge.

Since the weekend, Bitcoin has traded within a tight 2.3% range as markets await the Federal Reserve’s interest rate decision, set for Wednesday. While the direct impact of a rate cut remains uncertain, these three drivers continue to reinforce BTC’s bullish momentum.

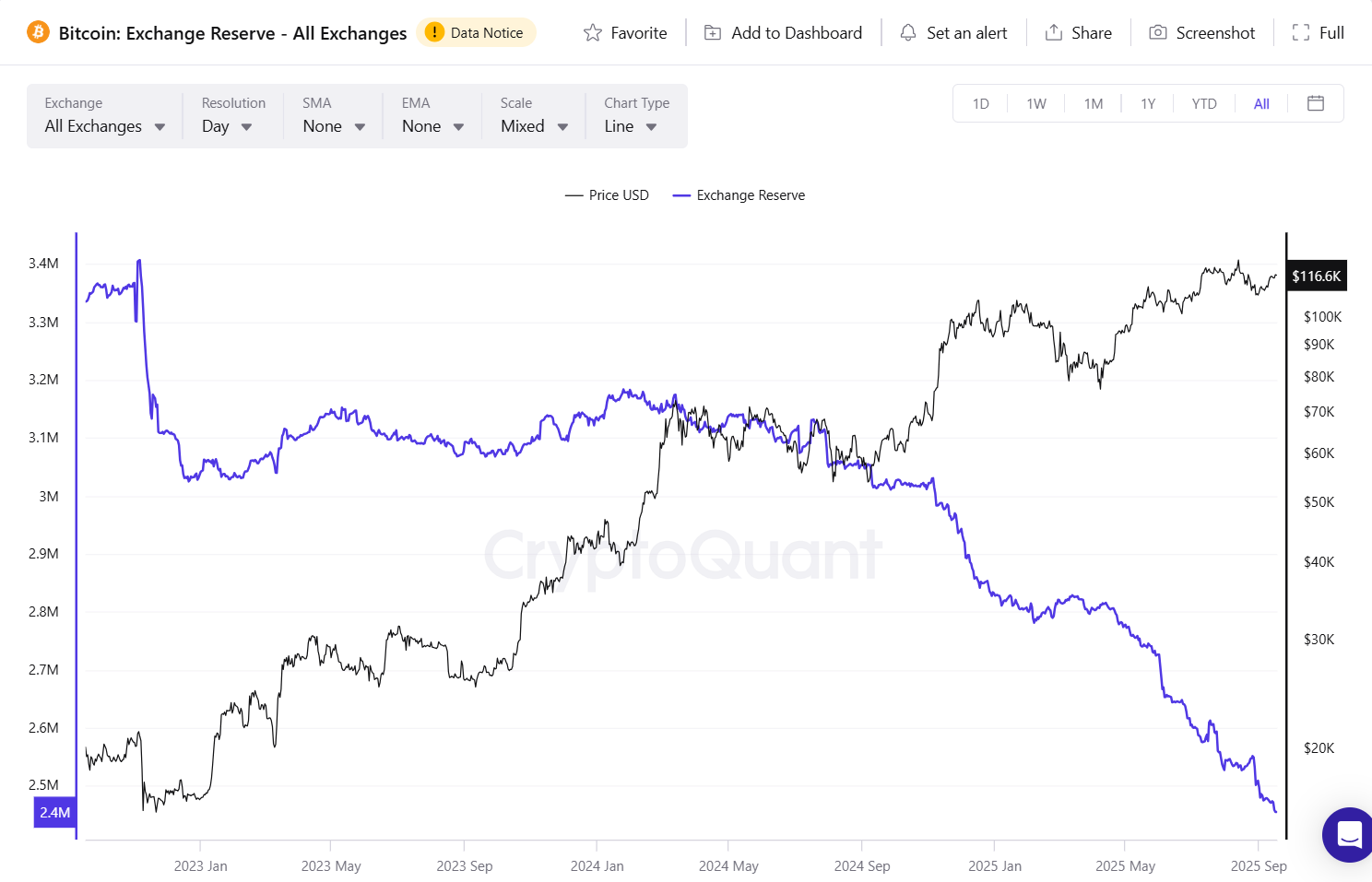

Shrinking Liquidity Strengthens Price Support

According to Glassnode, 44,000 BTC were withdrawn from exchanges in September alone, reversing July’s strong net inflows. The sharp decline in exchange balances has squeezed immediate liquidity, limiting selling pressure around the $116,000 level — a crucial base supporting Bitcoin’s strength.

ETFs Drive Demand Beyond New Supply

Some analysts argue that the 2.96 million BTC still held on exchanges is enough to absorb buying pressure. However, much of this supply isn’t actively listed for trading, as many investors leave coins on exchanges either to avoid self-custody or to benefit from yield and fee incentives.

Meanwhile, demand from Bitcoin ETFs is soaring. In the U.S. alone, spot Bitcoin ETFs recorded $2.2 billion in net inflows over just five days, with daily purchases exceeding the number of newly mined coins by a factor of 10. Combined with gold’s 11% rally since August, this trend is boosting investor confidence that Bitcoin could break past $120,000 as early as this week.

Currently, bond markets are pricing in a 96% probability that the Federal Reserve will lower rates from 4.5% to 4.25%. This suggests Bitcoin may only see a muted reaction to Wednesday’s announcement. Instead, the spotlight will be on Fed Chair Jerome Powell’s press conference, which could clarify whether further cuts are on the horizon. If inflation remains a significant concern, Bitcoin’s path to $120,000 may face some resistance.