After setting a new all-time high at $123,000, Bitcoin (BTC) quickly faced a sharp correction, dropping to as low as $115,700. However, the decline was short-lived as BTC rebounded and is now stabilizing near its current price levels.

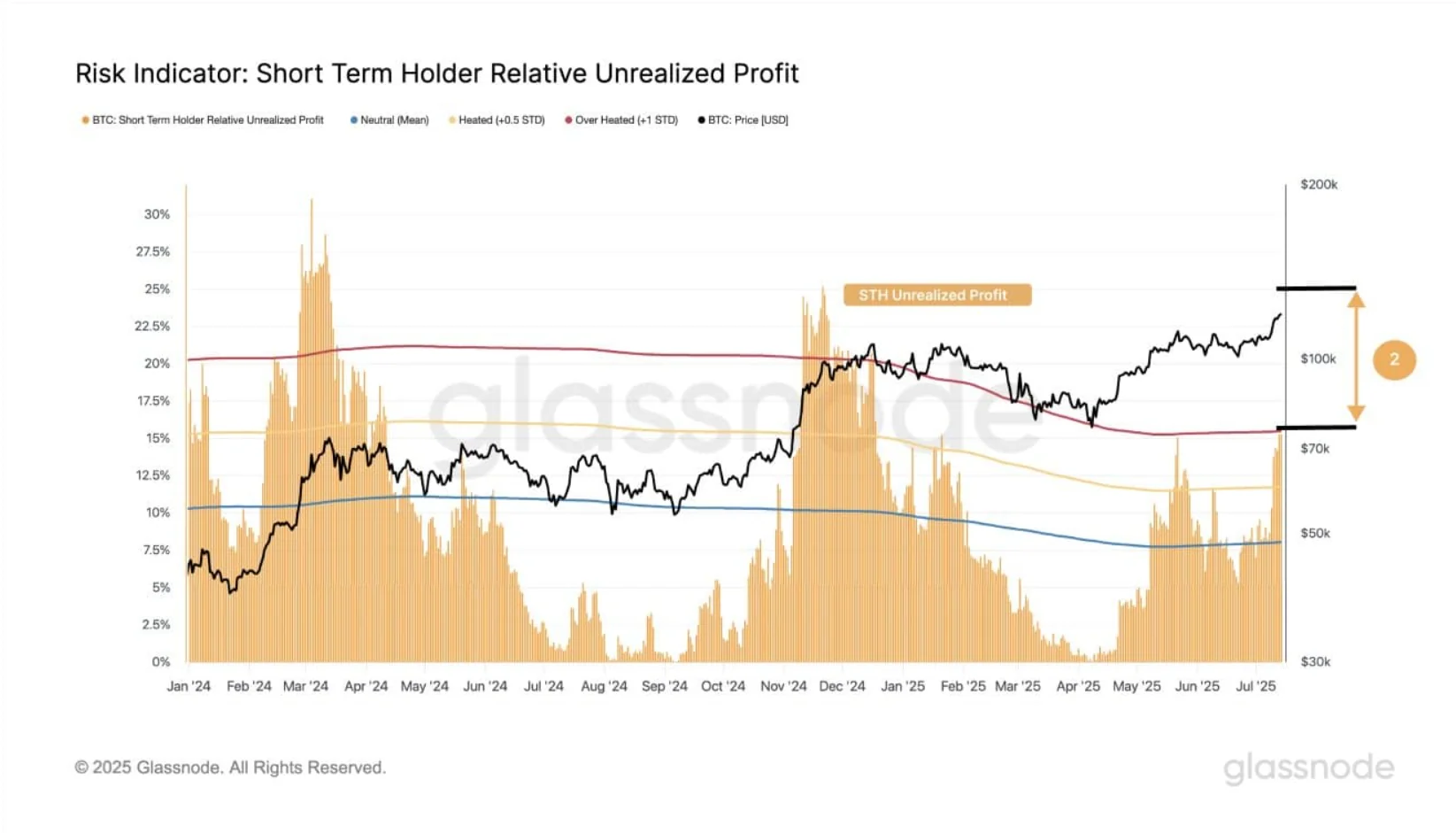

According to on-chain analysts, this appears to be just a short-term correction within a larger uptrend. Data from the Unrealized Profit metric for short-term holders (STH) suggests that BTC could still climb toward $136,000. On the flip side, in a bearish scenario, the price might return to the accumulation zone around $101,000.

Has Bitcoin Really Peaked Yet?

Despite recently hitting a record high, several indicators suggest Bitcoin hasn’t reached its true peak. One key metric is the Relative Unrealized Profit for short-term holders, which divides the market into three zones: neutral (blue), hot (yellow), and overheated (red).

Historically, local tops often appear when this metric enters the “hot” zone — as seen in January and April 2024. Currently, according to data from Glassnode, the index remains below the “hot” zone, implying that BTC still has room to grow.

In addition, the VWAP (Volume Weighted Average Price) continues to support the bullish trend, with BTC prices staying above the mid-term VWAP line — another positive signal for further upside.

How Many Days Until Bitcoin Peaks?

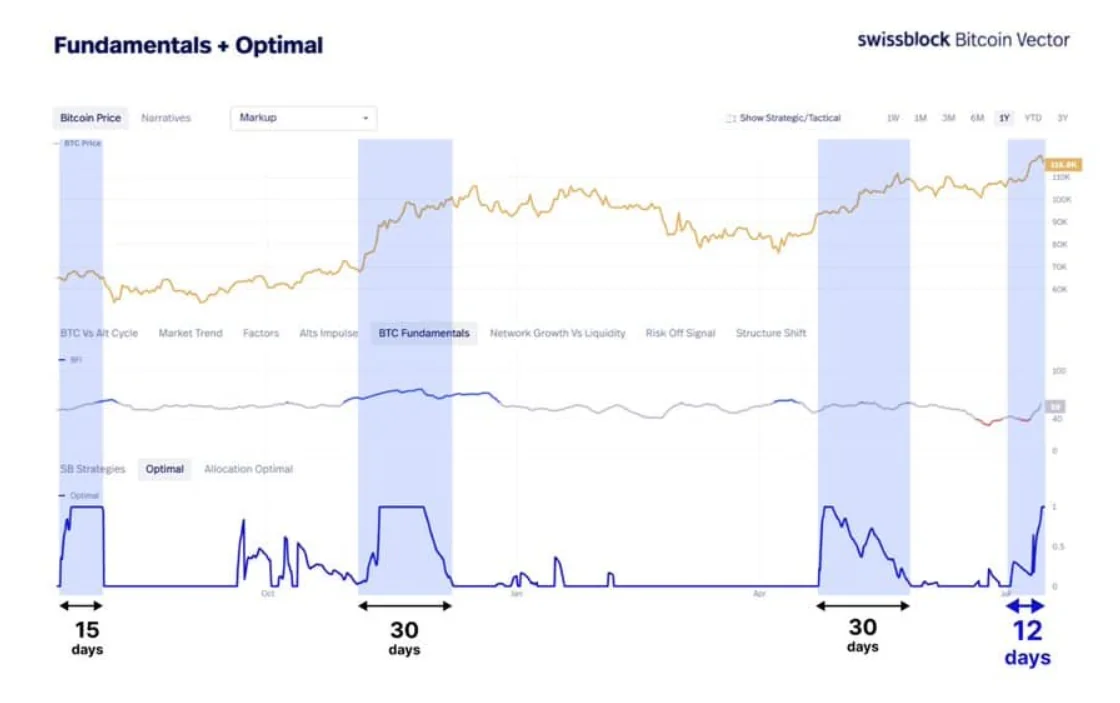

Based on the Optimal Signal indicator from Bitcoin Vector, Bitcoin is currently in day 12 of its ongoing bullish expansion cycle. In previous cycles, rallies typically lasted between 15 and 30 days. If history repeats, BTC could have another 3 to 18 days of upward momentum before entering a correction phase.

Bullish scenario: If the rally continues, BTC could surge to $136,000 — corresponding to the +2 standard deviation band in Glassnode’s short-term holder cost basis model. This level is often considered an “overheated” zone, potentially signaling a local top.

Bearish scenario: If BTC fails to maintain momentum, it could revisit a key support zone between $101,000 and $109,000. Should this zone break down, prices may decline further toward the $93,000–$97,000 range, temporarily pushing Bitcoin below the $100,000 mark.