MVRV Drops Below Long-Term Benchmark – Cycle Weakening Evident

Bitcoin’s MVRV ratio has fallen beneath the 365-day moving average, a signal often tied to weakening market cycles and extended corrections.

Since peaking at 2.77 in March 2024, the ratio has consistently formed lower highs, highlighting fading momentum after BTC’s record $124,400 high.

This breakdown below the long-term benchmark strengthens the risk of a prolonged market cooldown. However, institutional demand and wider BTC adoption remain key factors that complicate the current cycle compared to previous ones.

Can $110K Hold After Trendline Break?

The latest pullback dragged BTC to around $110,600, breaking below a key ascending trendline.

This move signals fragility in the bullish structure, with support resting at $108,800. If selling pressure intensifies, a deeper slide toward $100K is increasingly plausible.

Meanwhile, the RSI sits at 40.27 – close to oversold territory, underscoring fragile sentiment. That said, history shows multiple rebounds from similar levels, suggesting buyers could still defend this zone. The coming sessions will be critical in determining whether Bitcoin stabilizes or continues its decline.

Spot Selling Pressure Builds – Correction Risk Extends

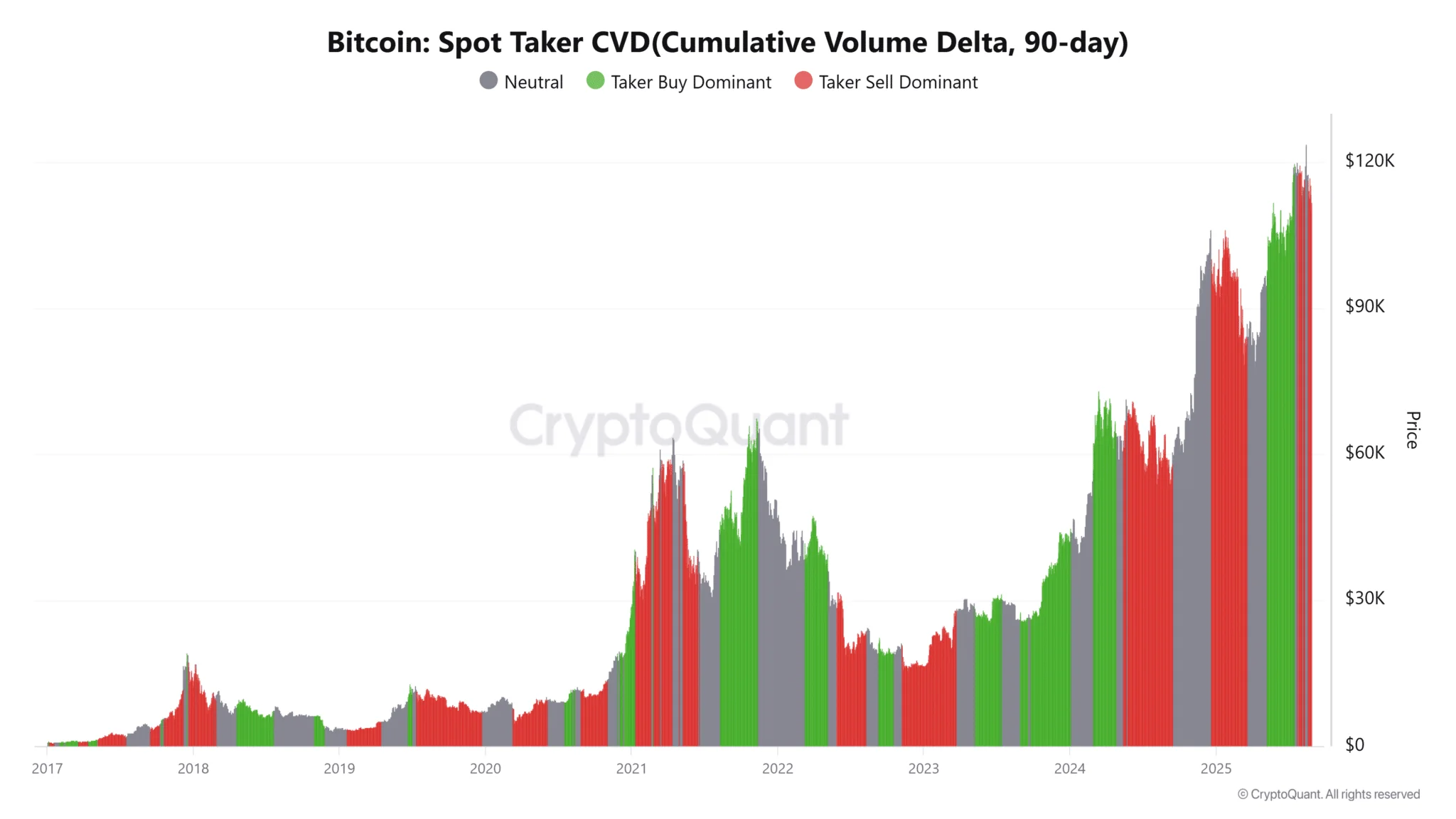

Spot Taker CVD data over the past 90 days revealed alternating control between buyers and sellers, but recent sessions have tilted toward sell-side dominance.

This has kept pressure on Spot markets and limited the chances of swift bullish reversals. When Spot flows lean heavily toward selling, rallies tend to be rejected quickly.

Even so, ETF and institutional inflows remain supportive, leaving the short-term outlook split between bearish pressure and underlying demand strength.

Binance data shows 64.55% of positions are Longs versus 35.45% Shorts, giving a Long/Short Ratio of 1.82 – a significant imbalance in favor of bullish traders.

This reflects strong conviction among leveraged accounts. However, such lopsided positioning often raises the risk of sudden liquidation cascades if prices dip further. Overconfidence in volatile conditions could accelerate declines when market stress builds.