The cryptocurrency market is entering a critical phase as Bitcoin [BTC] continues to be the focal point of an intense battle between bullish and bearish forces. Investor sentiment remains neutral, reflecting caution amid unpredictable short-term movements.

According to analysis, this moment could mark a pivotal turning point. A breakout from the current stalemate could lead to a significant move—either a strong rally or a sharp correction—providing ideal conditions for traders to capitalize on the next wave of volatility.

As Q2 comes to a close, Bitcoin has staged an impressive rebound from its multi-month low near $98,000. Market sentiment has gradually improved as macroeconomic concerns like inflation and geopolitical tensions begin to ease, prompting previously bearish investors to reassess their strategies.

In the derivatives market, the proportion of long positions at risk of liquidation has dropped sharply—from over 80% last week to around 58% currently. This suggests that the market has undergone a major leverage flush-out, potentially laying the groundwork for short-term stability.

However, as BTC approaches the $110,000 threshold, selling pressure is starting to re-emerge. The current price range of $106,000–$108,000 has become a key defensive zone for bears. Whether Bitcoin breaks above or falls below this range could determine the market’s next major direction.

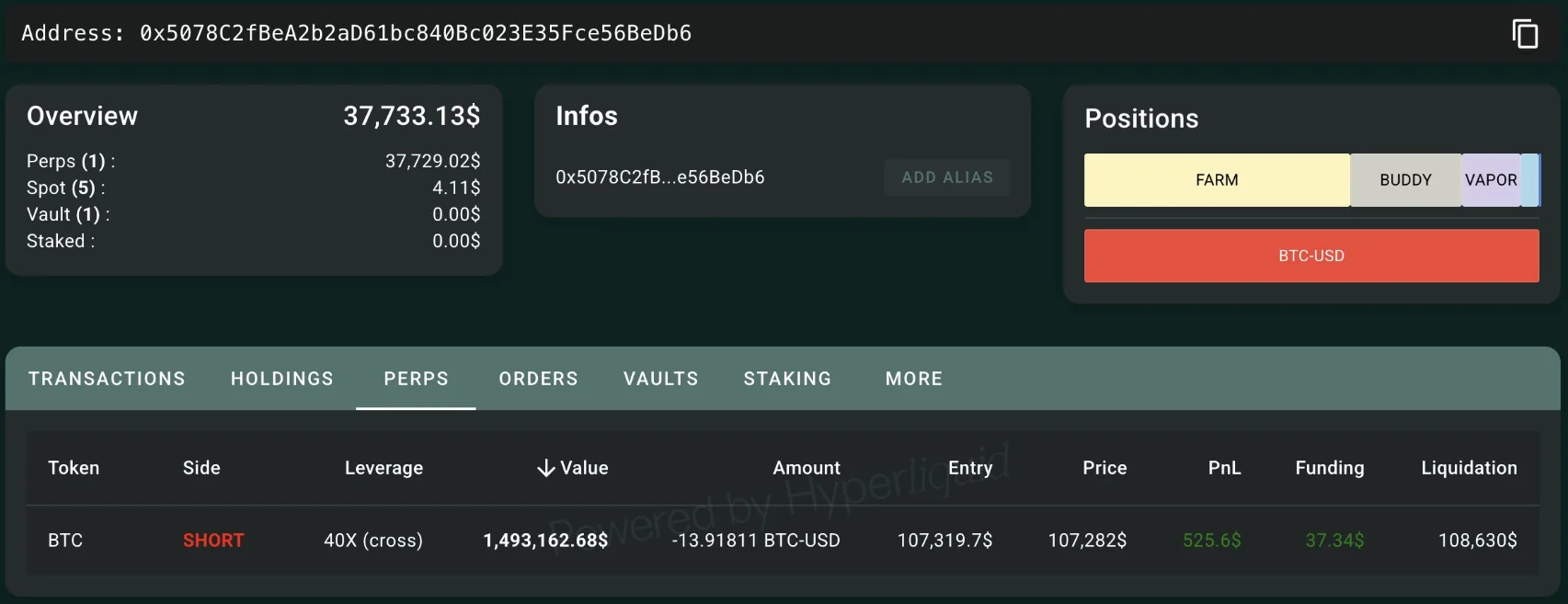

Of particular interest is trader James Wynn, known for his high-leverage BTC positions that have often led to liquidations. This time, he’s back with a bold 40x short worth $1.49 million, betting on a pullback from the $108,630 level. Given his track record, Wynn’s move is seen as a risky gamble but one that could have significant psychological impact on market sentiment.

Regardless of whether his bet plays out, Wynn’s positioning is stirring the waters—adding a layer of uncertainty and speculation to an already tense Bitcoin landscape.