As the trading week nears its close, Bitcoin investors are closely monitoring key price levels. Liquidity pressure is mounting, raising concerns over a potential large-scale market shake-up.

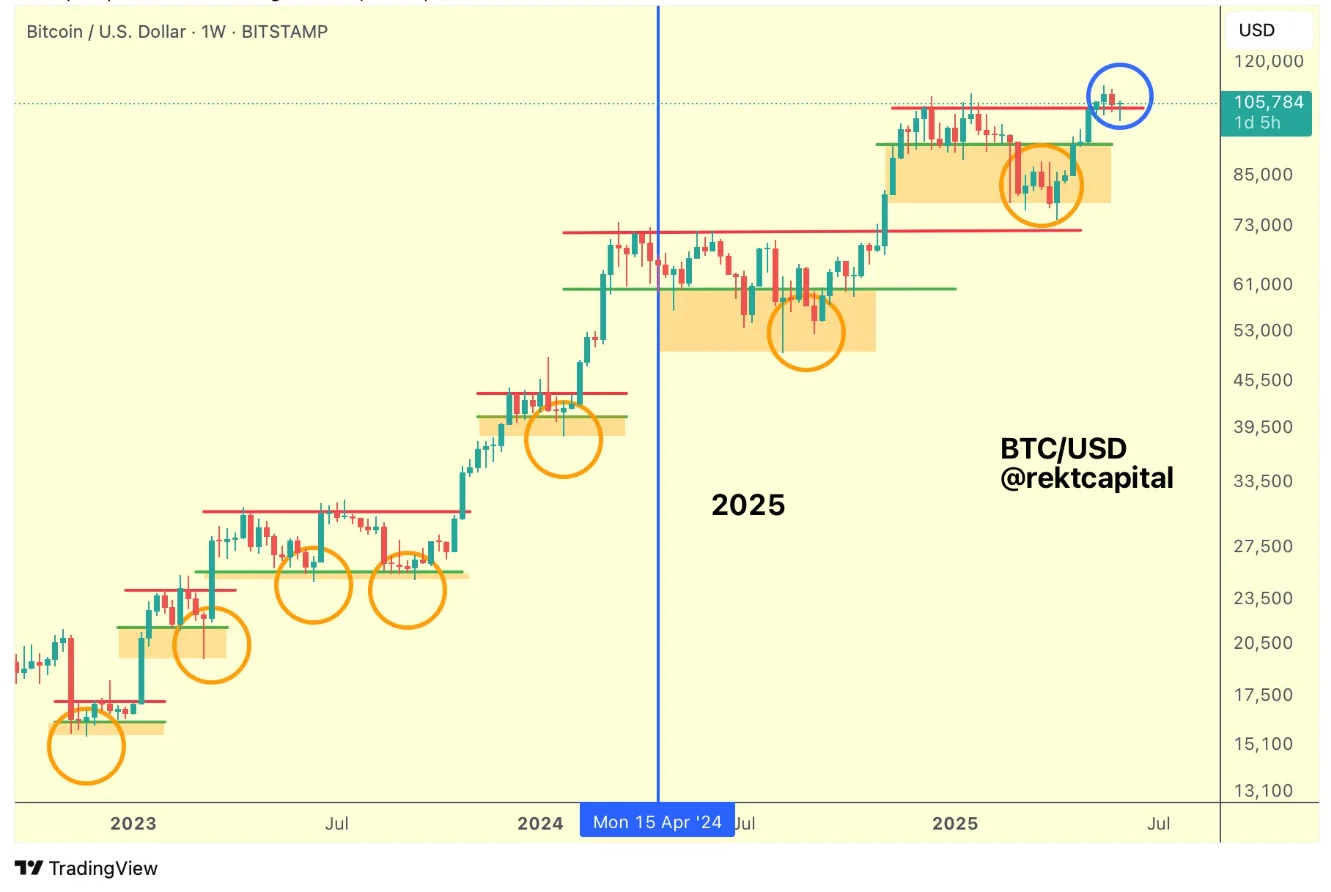

As of June 8, Bitcoin remained stable around the $105,500 mark — a positive signal following a recent correction. Data from TradingView shows that the BTC/USD pair is gradually recovering, consolidating its upward momentum after hitting a low of $100,500 on June 5.

The current price action suggests that Bitcoin is approaching its weekly opening level, drawing attention from traders betting on a continued bullish trend.

Well-known analyst

shared on platform X: “On the daily chart, Bitcoin is showing signs of breaking out of the two-week downtrend. In fact, it has turned that trendline into support. A close and successful retest around $106,600 would be an even stronger confirmation of a bullish continuation.”

Another bullish signal came as Bitcoin closed a daily candle above the 10-day Simple Moving Average (SMA 10), according to trader SuperBro — a key condition to “invalidate the bearish scenario.”

Meanwhile, trader Cas Abbe analyzed order book data to predict the market’s next move. With spot price hovering between clusters of buy and sell orders, he suggested a “magnet-style move” could be underway to sweep liquidity from both sides.

Writing on X, Abbe noted: “Current liquidation clusters indicate upside potential. If BTC rises 10% from the current price zone, around $15.11 billion in short positions would be liquidated. On the flip side, if it drops 10%, about $9.58 billion in long positions could be wiped out.”

Abbe also pointed out that negative funding rates over the weekend indicate large short positions accumulating — a signal that Bitcoin may be gearing up for a major move next week, potentially pushing the price past the $109,000–$110,000 range.