Traders and analysts are identifying a series of bullish signals for Bitcoin, fueling expectations that BTC could regain strong upside momentum and return to six-figure prices in 2026. Notably, technical patterns suggest a potential year-end “bear trap,” alongside a breakout setup that could push Bitcoin toward the $107,000 level in the near term.

Bitcoin is entering the final week of the year down roughly 30% from its all-time high of $126,000, recorded on October 6. This has sparked a key debate among investors: Has BTC already topped, or is this simply a corrective phase before a new bullish cycle heading into 2026?

Multiple Bullish Signals Are Emerging

According to analyst James Bull, Bitcoin’s 2.6% pullback from the $90,000 level earlier this week could represent a classic “Christmas bear trap.” A bear trap occurs when price briefly breaks below a key support level, triggering sell-offs and stop-loss orders, only to reverse sharply higher and trap short sellers.

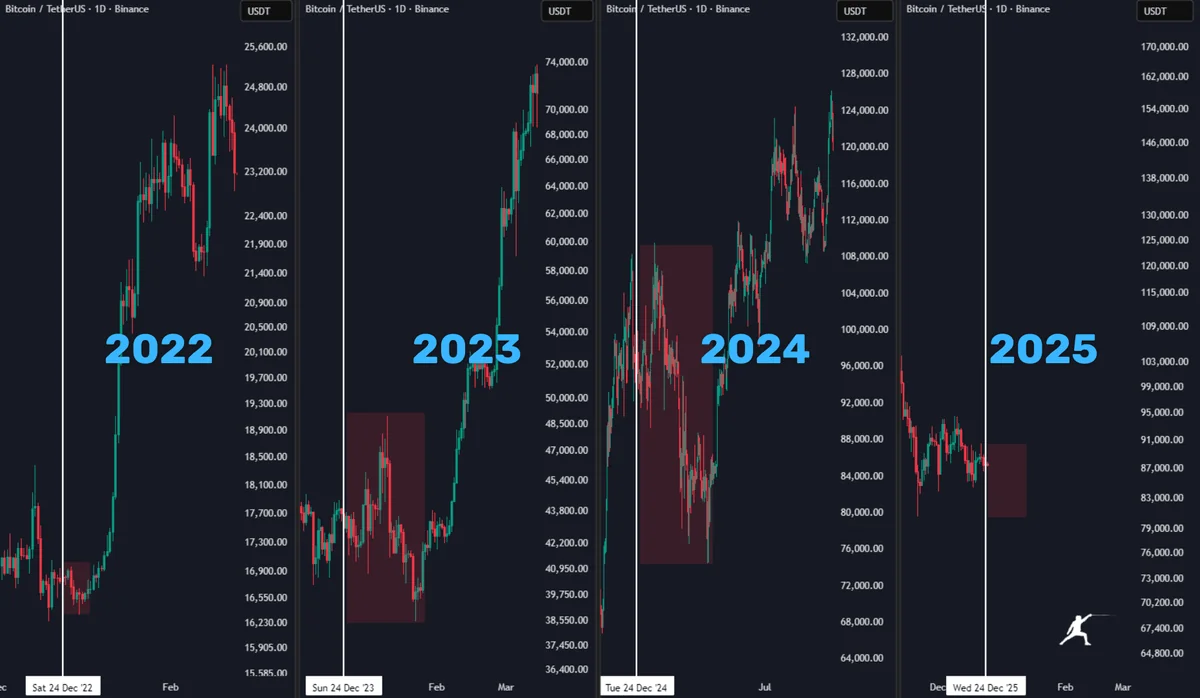

James Bull noted that Bitcoin has displayed a similar pattern over the past several years, often dipping in late December before staging a strong rebound in January. He cited the end of 2024 as a recent example, when BTC fell 8.5% between December 26 and December 31, before rallying 12.5% during the first week of 2025.

Supporting this view, analyst The ₿itcoin Therapist suggested that if the traditional four-year Bitcoin cycle is indeed breaking down, BTC could set a new all-time high as early as Q1 2026—potentially creating what he called “the greatest bear trap in history.”

James Bull added that the weakening relevance of the four-year cycle may signal the end of the old retail-driven boom-and-bust pattern. Instead, Bitcoin’s market structure is evolving, driven by rising institutional participation through spot ETFs and corporate treasury adoption. Combined with macroeconomic tailwinds such as interest rate cuts and increased liquidity, these factors could propel Bitcoin to new highs in 2026.

From a longer-term perspective, Citi Group analysts have set a 12-month base-case target of $143,000 for Bitcoin, primarily driven by renewed spot ETF demand. In a bullish scenario, Citi’s price target rises to $189,000.

ETF Flows Improve as Selling Pressure Eases

Regarding spot Bitcoin ETF flows, James Bull noted that outflows have declined sharply—from around -1,600 BTC on November 21 to levels now approaching zero. A similar setup earlier this year preceded a 33% rally that sent Bitcoin to $112,000 on May 22.

“This doesn’t guarantee a return to all-time highs,” Bull said, “but it’s a strong signal.”

At the same time, selling pressure from long-term holders appears to be easing, further strengthening the case for a potential relief rally in January 2025.

Symmetrical Triangle Targets $107,000

Data from TradingView shows BTC/USD consolidating within a symmetrical triangle on the daily chart. To confirm a bullish continuation, Bitcoin needs to close above the upper trendline of the pattern, near the $90,000 level.

If a breakout occurs, the measured target of the formation points to approximately $107,400—representing a potential 22% gain from current price levels.

“Bitcoin is forming a symmetrical triangle pattern,” analyst Dami-Defi said in a recent post on X. “If price breaks above the upper trendline and holds, we’re likely looking at a bullish breakout toward higher resistance levels around $94,000, followed by the $106,000 zone.”