Bitcoin remains in a consolidative phase above the $28,400 mark, with the potential to reach $32,000 if the current uptrend persists.

This consolidation follows a false report claiming that the Securities and Exchange Commission had approved BlackRock’s spot Bitcoin exchange-traded fund application, which sparked a surge in cryptocurrency prices.

Simultaneously, stock markets faced downward pressure due to stronger-than-expected retail sales data, raising concerns about potential interest rate hikes by the Federal Reserve.

Throughout the day, Bitcoin traded within a range of $28,082 to $28,645, with the latest trading price at $28,525, based on data from TradingView. Kitco’s senior technical analyst, Jim Wyckoff, reported that October Bitcoin futures prices trended higher in early U.S. trading on Tuesday.

He noted that Bitcoin bulls had regained a near-term technical advantage, restarting an uptrend, and indicating that the path of least resistance for prices was now sideways to higher in the near term.

Analysts at MN Trading also expressed confidence in Bitcoin’s ongoing uptrend, pointing out that it was forming higher lows. They noted that as long as these higher lows held, the price was likely to move toward the $32,000 mark. However, they advised caution, emphasizing the importance of taking profits along the way, given the relatively high price target.

Their analysis, released prior to Monday’s price surge, correctly identified $28,700 as a key resistance level, which has proven to be the case as Bitcoin has struggled to surpass this level since the initial spike on Monday. For those not yet in long positions, the 4-hour fair value gap (FVG) was suggested as a favorable entry point.

Michaël van de Poppe, founder of MN Trading, reiterated this perspective on Twitter, predicting a pullback into the $27,300 to $27,700 range. In the broader cryptocurrency market, the top 200 tokens displayed mixed performance, with some gaining and others losing value.

Positively surprised that #Bitcoin is currently above $28,000 after the debacle of yesterday.

Still expecting it to be ‘Buy the Dip’ season, through which I assume that, if we reach $27,300/$27,700 you’d be a buyer. pic.twitter.com/NRORmqGrl6

— Michaël van de Poppe (@CryptoMichNL) October 17, 2023

Notable gainers included Band Protocol (BAND) with a 39.35% increase, Stratis (STRAX) up by 34.2%, and Tellor (TRB) rising by 11.11%. In contrast, Rocket Pool recorded a 5.13% loss, and Alexar (AXL) declined by 3.17%.

The total cryptocurrency market capitalization now stands at $1.09 trillion, with Bitcoin maintaining a dominance rate of 51.2%.

Bitcoin has reached a critical historical on-chain metric

Bitcoin has reached a critical historical on-chain metric, and its ability to sustain this position may determine the onset of a bullish trend.

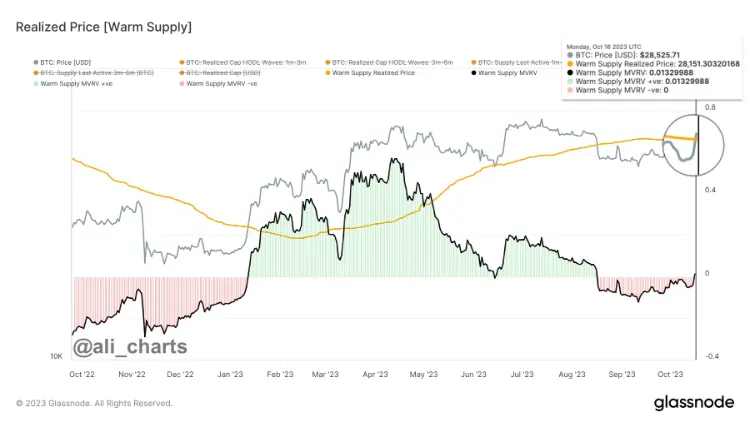

This metric is the “Warm Supply” Realized Price. To clarify, the “realized price” denotes the average investor’s cost basis or buying price in the Bitcoin market.

When the spot price of Bitcoin is trading above this metric, it indicates that holders are currently in a profitable position, which is a positive signal. Conversely, when Bitcoin’s spot price is below this indicator, it suggests that losses are prevalent in the market.

In this context, the realized price is specifically applied to a specific segment of the supply, known as the “warm supply.” This category, defined by on-chain analytics firm Glassnode, comprises coins that were last moved on the network between one week and six months ago.

This segment is less liquid than the “hot supply,” which includes coins that are frequently involved in transactions and are often in motion.

The warm supply is a critical focus because it provides insights into investor behavior. Unlike the hot supply, which is frequently traded for various reasons and can obscure data about typical traders, the warm supply reflects a more stable and clearer picture of how investors are managing their holdings.

>>> Bitcoin Could Surge to $45,000 After Spot ETF Approval

A chart depicting the trend in the Bitcoin realized price for the warm supply over the past year shows that Bitcoin’s realized price for this segment of the supply is currently trading at approximately $28,151. This means that the recent surge in the spot price has pushed Bitcoin above this critical level, signifying that the holders of this supply have returned to a profitable state.

Typically, when investors who were previously at a loss break even due to a surge in the asset’s price, they may consider selling to prevent any potential future losses if the price drops again.

This selling at the break-even point can act as resistance to Bitcoin’s upward movement. Therefore, the fact that Bitcoin has surpassed this level with its recent rally is considered a positive sign.

The analyst in the post notes that if Bitcoin can maintain its position above this level, it could potentially herald the beginning of a new uptrend for the cryptocurrency, which would be an encouraging development for Bitcoin investors.