Bitcoin has surged past $90,000, while Ethereum trades above $3,000. However, on-chain data reveals a divided market, with strong selling pressure coexisting alongside massive outflows from exchanges.

Key Highlights:

-

Rising exchange inflows: On November 21, large Bitcoin deposits accounted for 45% of total inflows, equivalent to 7,000 BTC, according to CryptoQuant.

-

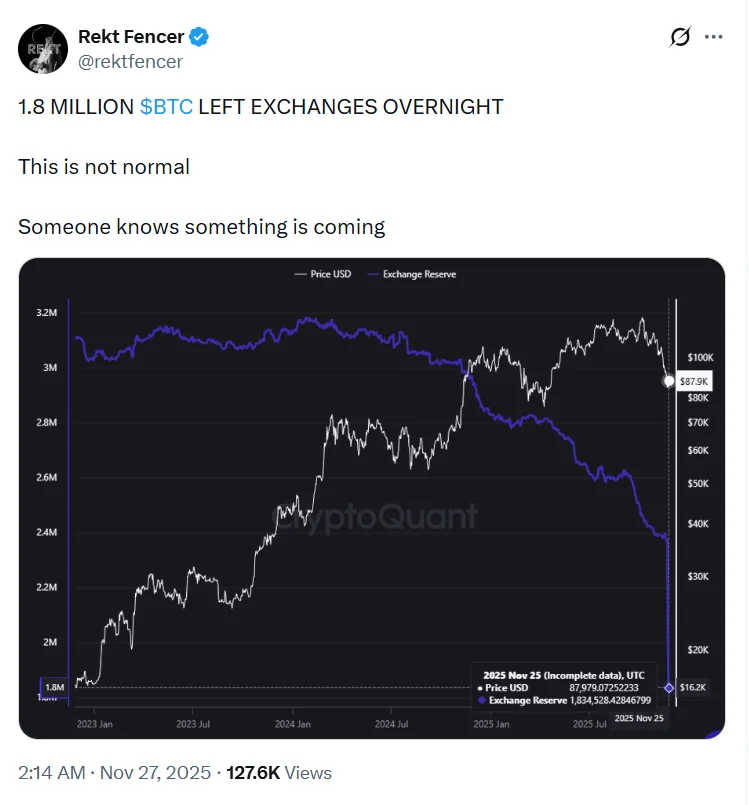

Massive withdrawals: Approximately 1.8 million BTC were withdrawn in a single night, fueling speculation about institutional portfolio adjustments.

-

Record stablecoin reserves: Binance holds $51.1 billion in stablecoins, signaling traders are preparing for heightened market volatility.

Price recovery masks complex exchange activity

-

Bitcoin trades at $90,418, up 3.12% in the past 24 hours, after peaking at $126,080 on October 6, 2025. Ethereum also rose 1.74% to $3,023.74 following its August peak of $4,946.05.

-

Trading volumes remain high: Bitcoin’s 24-hour volume reached $69.56 billion, Ethereum $21.27 billion.

-

On-chain data shows different market participants taking opposing actions, meaning price alone doesn’t capture the full market picture.

Rising inflows indicate selling pressure

-

Large Bitcoin deposits (100 BTC or more) now make up 45% of total inflows, suggesting whales may be adjusting portfolios or liquidating positions.

-

BTC and ETH inflows this week totaled $40 billion, led by Binance and Coinbase.

-

CryptoQuant notes that while some trends could reflect technical factors, the overall pattern points to real selling pressure.

Massive outflows hint at accumulation

-

1.8 million BTC left exchanges in one night, equivalent to $162 billion, sparking speculation about long-term institutional accumulation.

-

Exchange reserves dropped to roughly 1.83 million BTC, historically a bullish signal.

-

The scale of outflows far exceeds normal daily activity, likely reflecting coordinated moves by major players.

Record stablecoin reserves signal market tension

-

Binance’s $51.1 billion stablecoin reserve indicates traders are positioning for buying opportunities or hedging against price swings.

-

Ethereum has mirrored Bitcoin’s movements, facing both increased inflows and active trading, reflecting ongoing market engagement alongside potential selling pressure.