On Tuesday, Bitcoin surpassed $126,000 for the first time in history but quickly retreated by about 4% shortly after. Despite this short-term pullback, the broader trend shows an unusually calm period — a pattern that has often preceded major price swings in the past.

Not Yet a Cycle Top for Bitcoin

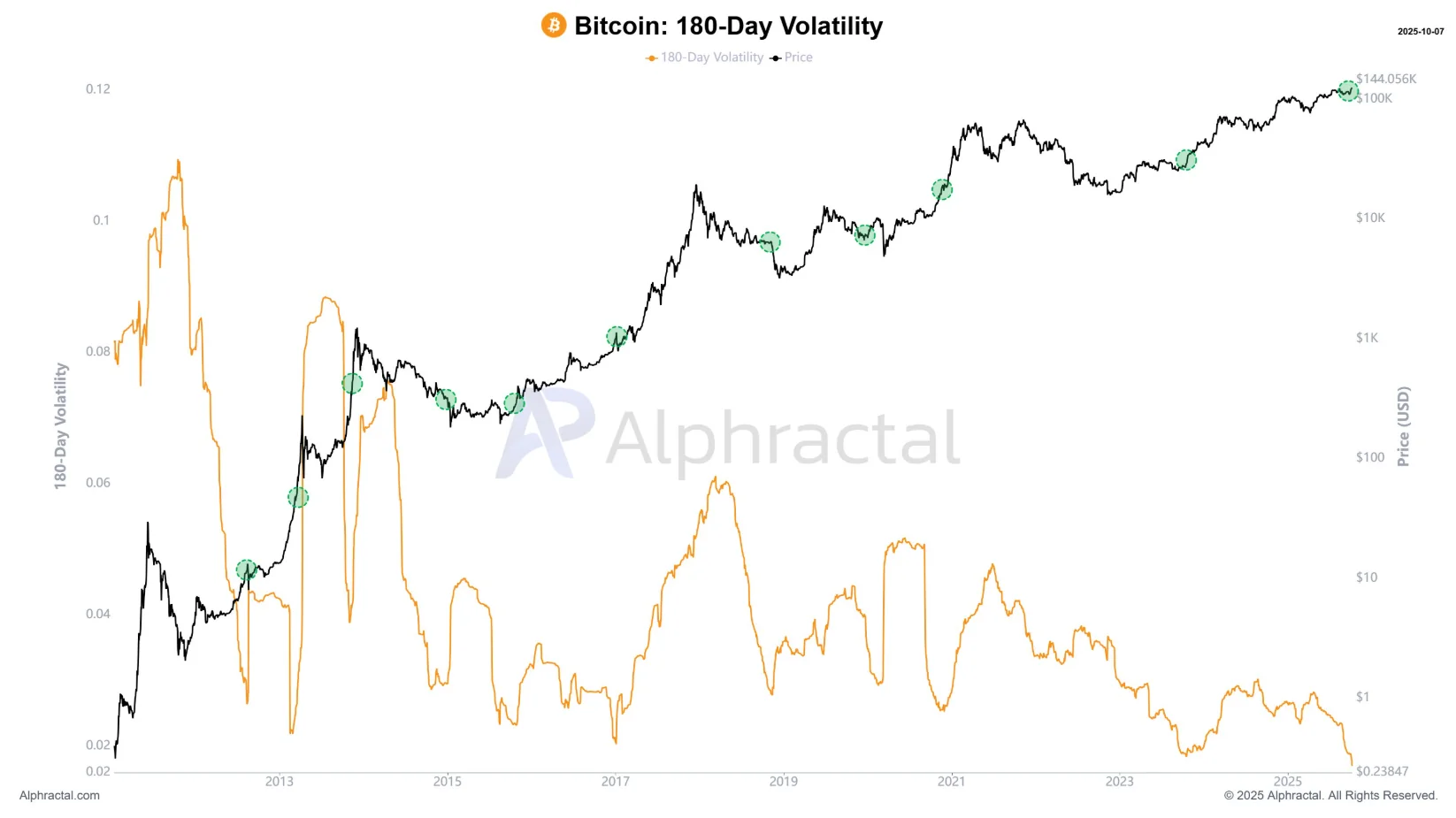

According to analytics platform Alphractal, Bitcoin’s 180-day volatility has fallen to its lowest level ever recorded. This metric, which measures the standard deviation of daily returns, suggests that the market is entering an exceptionally stable phase. Historically, such periods of low volatility have often paved the way for large upward moves.

Crypto analyst Mr. Wall Street also believes Bitcoin is gearing up for its next major rally, not entering a top phase. After surging 16% from $108,000 to $126,000 in just ten days, he argues that BTC is currently consolidating within a bullish structure rather than weakening.

One key factor he highlights is strong accumulation by major institutional investors. Reports indicate that BlackRock purchased $1.2 billion worth of Bitcoin this week and $3.3 billion the week prior. According to him, such large-scale buying activity will likely absorb market liquidity, forcing short sellers to capitulate, which could further fuel Bitcoin’s next leg up.

From a technical perspective, he expects Bitcoin to retest the 4-hour EMA200 before staging a decisive breakout, mirroring the setup that preceded the rally to $110,000. On the macro side, he points to weakening U.S. economic data and a more dovish Federal Reserve, both of which could depress the U.S. dollar and drive additional capital inflows into Bitcoin.

Selling Pressure Rapidly Fading

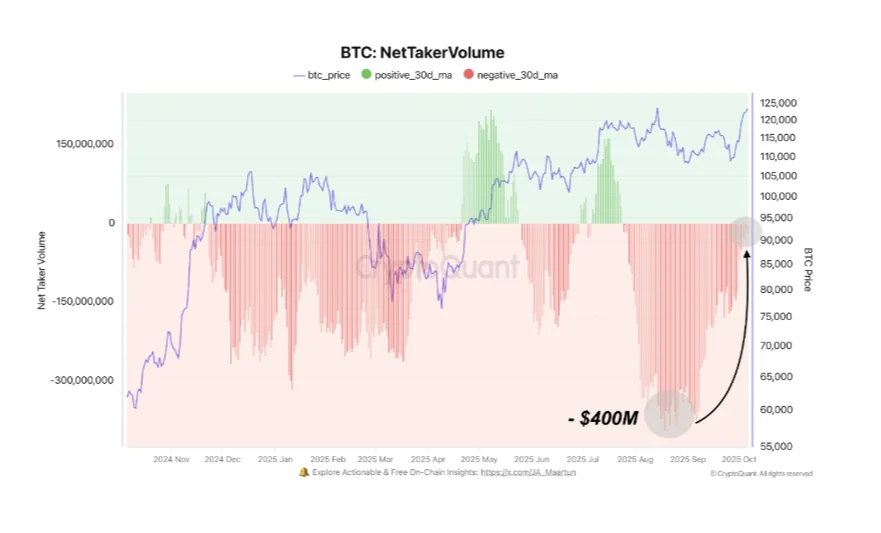

Data from the Bitcoin derivatives market also indicate that bearish momentum is waning.

The Net Taker Volume — a metric comparing the size of buy and sell orders across derivatives platforms — has rebounded from an extreme low of -$400 million to a neutral range.

This shift marks a critical change in trader behavior, showing that bearish sentiment is weakening after months of dominance. In previous cycles, similar recoveries in Net Taker Volume have often coincided with periods of renewed bullish momentum, where derivatives activity helped reinforce price strength.

A comparable setup was observed after the April correction, which later led to a fresh rally. Currently, Bitcoin’s medium-term outlook appears more stable, as buying and selling forces are reaching equilibrium, setting the stage for the next major breakout.