Whales Buy In, Miners Cut Back on Selling

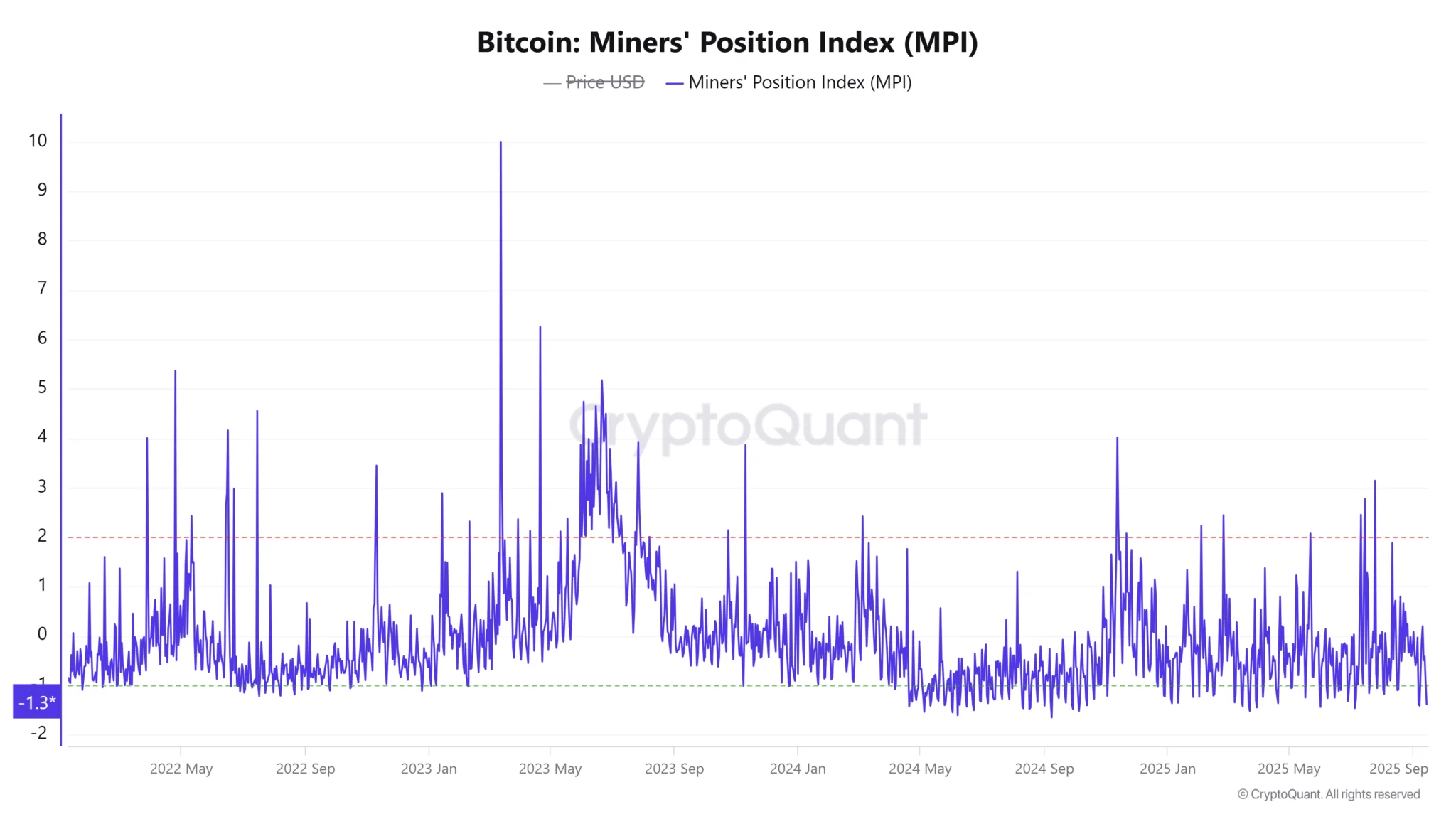

Large-scale purchases from whales drove the Scarcity Index higher, while the Miners’ Position Index (MPI) dropped more than 44% in just 24 hours. This reflects a sharp decline in miner outflows, suggesting that miners are holding onto their BTC instead of moving it to exchanges — a move often linked to confidence in future price appreciation.

However, miner restraint alone does not guarantee a price rally, as liquidity and valuation factors must also align to sustain momentum.

Warning Signs from the NVT Ratio

Even as supply tightens, the Network Value to Transaction (NVT) Ratio jumped nearly 29% to 50.5 — a level that warns BTC’s price growth is outpacing real network activity.

A high NVT often signals overvaluation risks, raising concerns about whether the current rally can be sustained.

Exchange Outflows Point to Accumulation

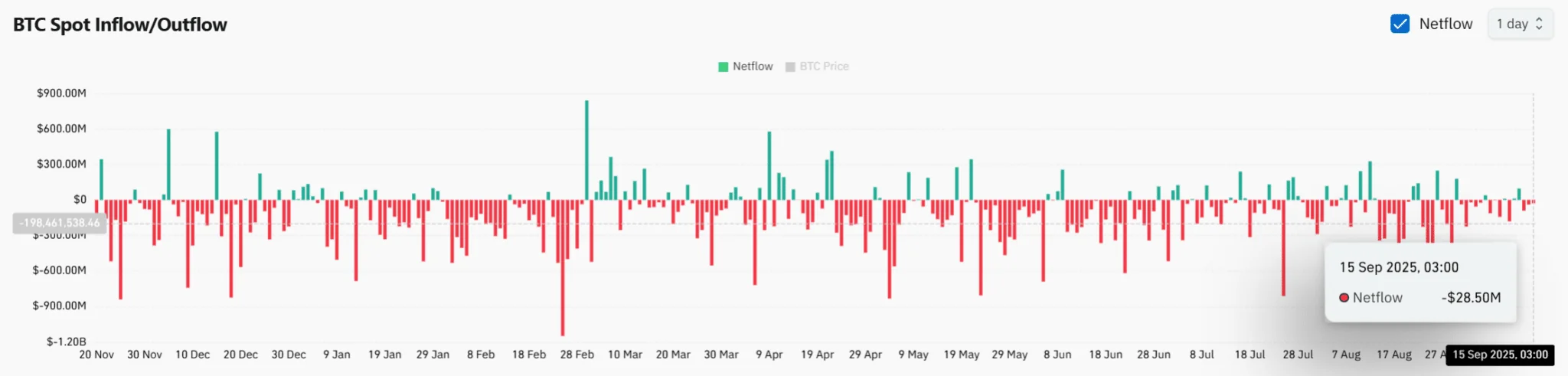

Spot exchange flow data showed about $28.5 million worth of BTC withdrawn, reinforcing the broader trend of investors moving assets into cold storage for long-term holding. This reduction in exchange liquidity can fuel price strength if demand persists.

Still, the scale of these outflows has fluctuated, leaving questions about whether accumulation momentum will remain strong.

Market at a Crossroads

Taken together, the Scarcity Index spike, falling miner outflows, and consistent withdrawals all signal strong bullish undercurrents for Bitcoin’s price.

Yet, the sharp rise in the NVT Ratio sounds a cautionary note that the market may already be overheating.

Bitcoin now stands at a critical juncture: it could either break higher on tightening supply, or face a sharp correction if profit-taking pressures mount.