As of now, Bitcoin’s price has dropped by 1.48%, settling at $102,156. While retail interest is clearly on the rise, BTC’s upward momentum appears to have temporarily stalled. The key question remains: Is this new wave of retail investors strong enough to sustain bullish pressure and drive Bitcoin back to its all-time highs?

Retail Traders Warming Up Again

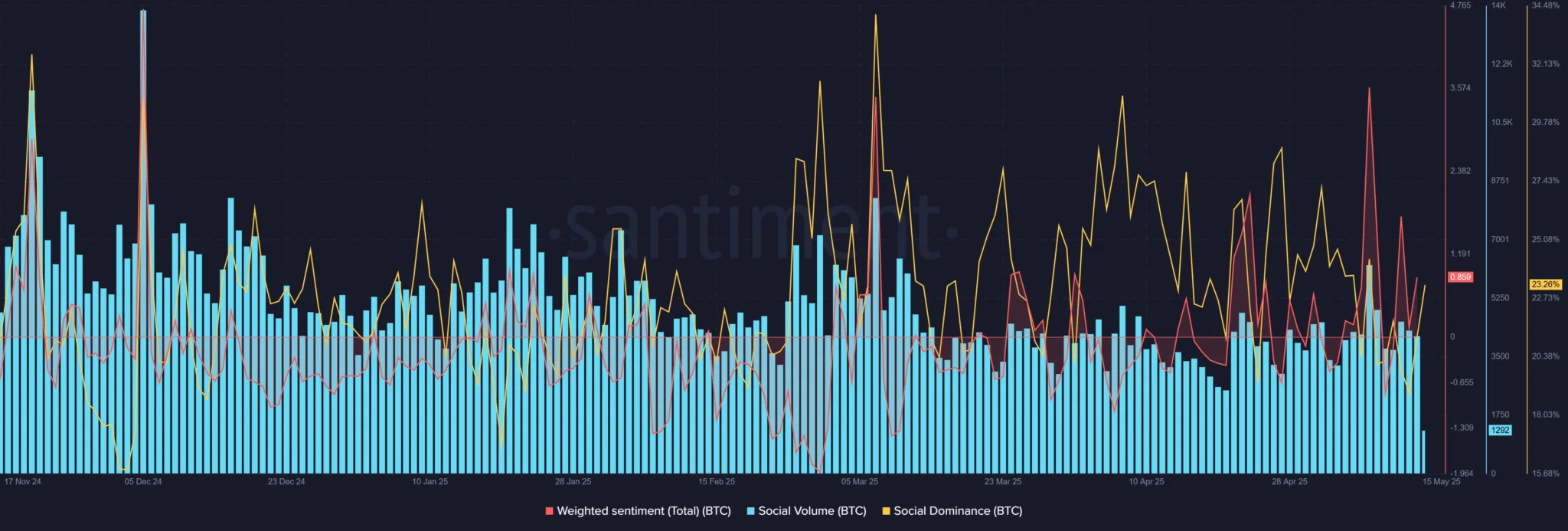

Retail activity is picking up significantly, breathing new life into the market. Social media chatter surrounding Bitcoin has soared to 1,292 mentions, while BTC’s social dominance has climbed to 23.26%—affirming that Bitcoin remains the market’s focal point.

Notably, the Weighted Sentiment indicator has turned positive, reaching 0.859—suggesting growing confidence and optimism across the community. However, retail enthusiasm alone may not be sufficient if institutional players continue to stay on the sidelines.

Are the Whales Holding Back?

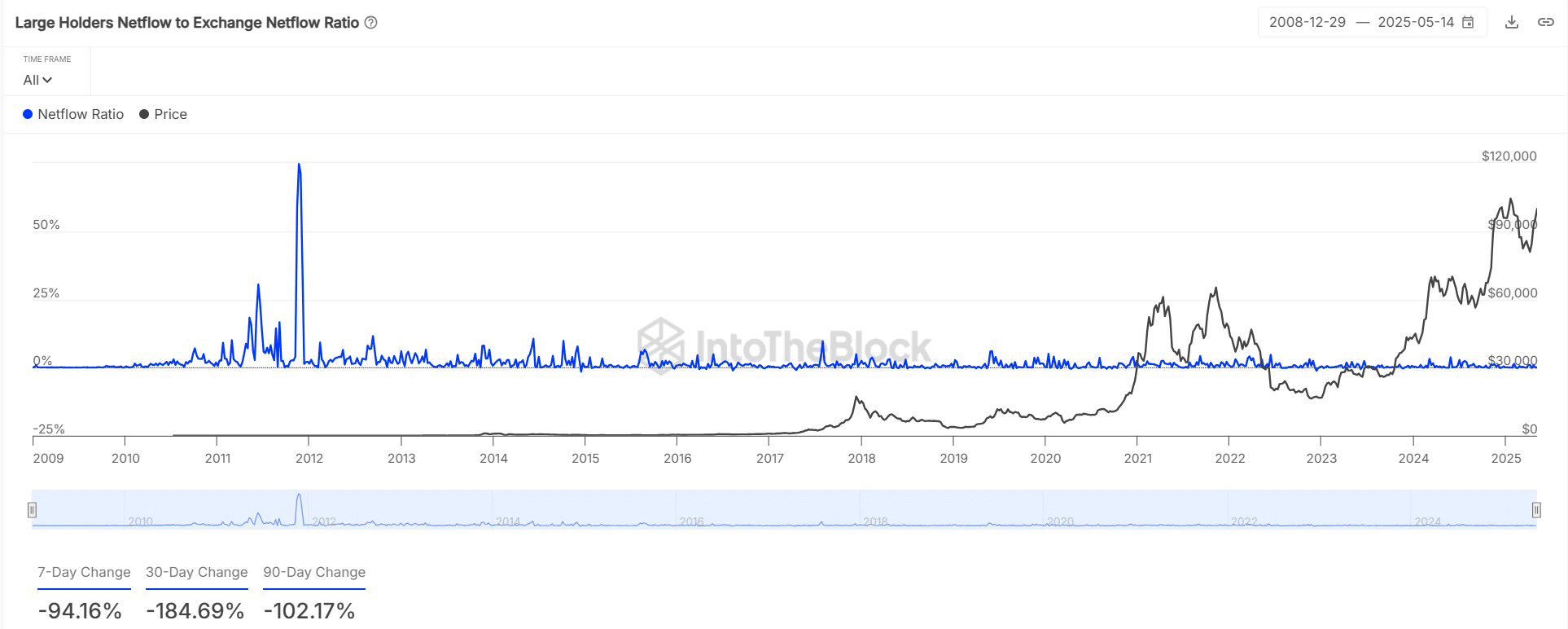

While retail investors are showing renewed enthusiasm, major BTC holders—commonly referred to as “whales”—seem to be more cautious. Net inflows to exchanges have plummeted by 94.16% over the past seven days, indicating that large holders are transferring less BTC to exchanges, typically a sign of accumulation or anticipation of a market correction.

Over a 30-day period, this figure has dropped even more sharply—by as much as 184.69%—highlighting a growing divergence in strategy between large and small investors.

Stablecoin Imbalance and Distribution Risks

Although retail momentum is gaining strength, the lack of active participation from institutional players remains a significant hurdle to sustaining a strong short-term rally.

Another red flag comes from the stablecoin ratio on exchanges, which has risen to 5.3—well above the warning threshold of 5.0. This means the amount of BTC held on exchanges is increasing faster than the inflow of stablecoins, suggesting potential selling pressure on the horizon.

Historically, such spikes in this metric have often coincided with short-term distribution phases. The last time it reached a similar level was in late January, just before a sharp market correction.

If stablecoin inflows do not pick up soon, the risk of mounting sell-side pressure could become more pronounced—something traders should keep a close eye on in the coming days.