Massive ETH Exodus from Binance Sparks Speculation

An Ethereum whale is making waves with substantial withdrawals from Binance, causing ripples of speculation in the crypto community. These significant transactions hint at a surge in market engagement.

Recent analysis from Lookonchain has shed light on an Ethereum whale’s active removal of ETH from the Binance exchange. Etherscan data reveals withdrawals of 8,968 ETH on November 4th and an additional 8,618 ETH on November 5th. In just two days, the total withdrawal surpassed 17,316 ETH, equating to nearly $32 million at the time of writing.

This smart whale withdrew another 8,618 $ETH ($16M) from #Binance 4 hours ago.

The whale deposited 31.8M $USDT to #Binance and withdrew 17,316 $ETH, the buying price is ~$1,836.https://t.co/OLrmsm7kAi pic.twitter.com/WHvgeaR5At

— Lookonchain (@lookonchain) November 5, 2023

Analyzing Ethereum’s Exchange Supply

AMBCrypto’s examination of Ethereum’s exchange supply indicates a recent decrease in assets held on these platforms. The decline began around October 23rd, with the supply dropping from over 10.7 million to approximately 10.6 million ETH. This reduction suggests growing confidence in a sustained price uptrend and a desire to accumulate holdings.

As of now, the Supply on Exchanges remains at approximately 10.6 million ETH, but it is inching closer to the 10.7 million mark. Moreover, Glassnode’s Exchange Netflow chart, as reviewed by AMBCrypto, consistently shows outflows surpassing inflows, underscoring the significant withdrawals from various exchanges and the strong shift of ETH away from these platforms.

Whale Activity on the Rise

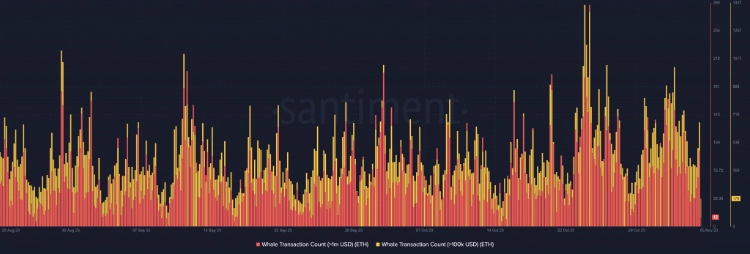

Santiment’s data reveals a surge in Ethereum whale activity, particularly in transactions exceeding $100,000 and $1 million. Transactions exceeding $100,000 have spiked to a total of 179, signifying a substantial increase in this category of whale activity in recent times.

Furthermore, the $1 million transaction category has recorded approximately 12 transactions at the time of this report, indicating a high level of engagement and increased activity among Ethereum whales.

The massive ETH exodus from Binance and the broader trend of decreased supply on exchanges signal a potential bullish sentiment in the Ethereum market, with large players making significant moves and taking a more active role in the ongoing crypto landscape.

Related: 6 AI Chatbots Provide Updated Bitcoin Forecasts for Year-End

Bitcoin and Ethereum Outshine Gold in Remarkable Year

In a year filled with uncertainty, Bitcoin (BTC) and Ethereum (ETH) have emerged as star performers, significantly outpacing the growth of gold. This remarkable trend challenges conventional notions of wealth preservation and security in the market.

Bitcoin, as the pioneer in the digital asset space, has experienced a meteoric rise, boasting a staggering 93% increase in value when compared to gold. Ethereum has not lagged far behind, with a solid 39% gain in terms of this precious metal’s value.

The performance of these digital assets serves as a potent message to traditional investors, indicating a shift in wealth storage dynamics and the exciting potential of digital currencies.

Unprecedented Resilience in the World of Digital Safe Havens

When evaluating the trajectories of Bitcoin and Ethereum, it’s essential to acknowledge the scale of their growth, especially when contrasted with the longstanding benchmark of gold.

Bitcoin, in particular, has surged by over 30% in recent weeks, partly driven by the anticipation surrounding several Bitcoin ETF proposals awaiting SEC approval. This prevailing optimism extends throughout the digital asset landscape, standing in stark contrast to the gradual progress and occasional sharp declines witnessed in traditional commodities.

It’s crucial to emphasize that Bitcoin’s valuation surge is not a one-way street. While Ethereum is following suit, it is doing so at a slightly more measured pace. Nonetheless, it’s worth noting that Ethereum’s valuation relative to Bitcoin has been on a steady decline for over 470 days and counting.

The ETH/BTC ratio is echoing trends observed in mid-2022, once again nearing the 0.052 mark, reinforcing Bitcoin’s dominant position in the cryptocurrency domain.

Investor Confidence on the Rise

Taking a closer look at Ethereum’s price models, the current trading price of $1,800 stands at a remarkable 22% above the Realized Price. The Realized Price, which reflects the average cost basis of all coins based on their most recent transactions, suggests that Ethereum holders are indeed profiting, albeit modestly.

Though the exuberant peaks of a bull market may be distant memories, this positive development is a reassuring note in the ever-evolving market dynamics. The MVRV Ratio, which compares the current price to the realized price, offers valuable insights into the ebb and flow of investor sentiment.

Monitoring Market Momentum with the MVRV Ratio

The MVRV Ratio, in comparison to its 180-day moving average, serves as a valuable indicator of the market’s current momentum. Despite Ethereum’s strong year-to-date performance, this signal suggests that the market is still on the path to recovery after grappling with the bearish influence of the previous year.

Bitcoin’s Dominance Versus Altseason Enthusiasm

When we expand our perspective to encompass the entire altcoin market, a substantial increase in valuation becomes apparent, with a noticeable 21.3% upswing. This surge in the altcoin market underscores a cascading effect, wherein an upsurge in Bitcoin’s dominance often leads to gains in the fiat currency valuation of altcoins.

Nevertheless, Bitcoin’s increasing dominance casts a shadow over this expansion, as it now commands over 53% of the total digital asset market value. This marks a notable climb from the cyclical low of 38% observed in late 2022.

Comparing the year-to-date growth of Bitcoin to that of the altcoin market reveals an intriguing narrative: Bitcoin’s market capitalization has surged by an impressive 110%, outpacing altcoins, which have experienced a commendable but relatively modest 37% increase.

This paints a nuanced picture of a market where altcoins shine in comparison to traditional assets like gold in terms of fiat currency gains, yet they remain overshadowed by Bitcoin’s dominant influence.

Market Dynamics and Perspectives

In 2023, the digital asset landscape has undeniably entered an upward trajectory, with industry heavyweights Bitcoin and Ethereum exhibiting remarkable resilience in the face of market volatility. This newfound strength is a testament to robust investor support and a substantial influx of capital.

The altcoin market has witnessed its most significant valuation surge since the previous market cycle’s peak, aided by the development of the Altcoin Indicator and favorable market sentiment. However, it’s crucial to contextualize this performance within the broader digital asset ecosystem.

Bitcoin, the unstoppable force, continues its ascent, leaving a profound impact on the altcoin sector. It exemplifies a dynamic in which, despite altcoins making gains, they consistently lag behind Bitcoin’s historic surge.

In light of these developments, it becomes increasingly evident that Bitcoin and Ethereum are not only outperforming traditional safe-haven assets like gold but are also reshaping the very foundations of investment strategies and market dominance in the digital age.