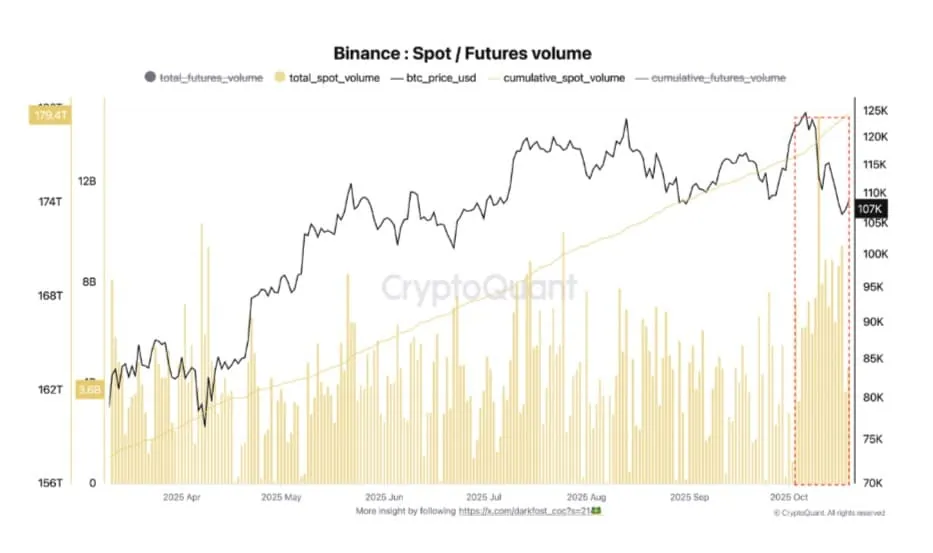

The crypto market is witnessing an intriguing shift as Binance’s Spot Bitcoin trading volume has surged to $5–10 billion per day since October 10, 2025, reflecting investors’ move away from futures trading after a wave of massive liquidations.

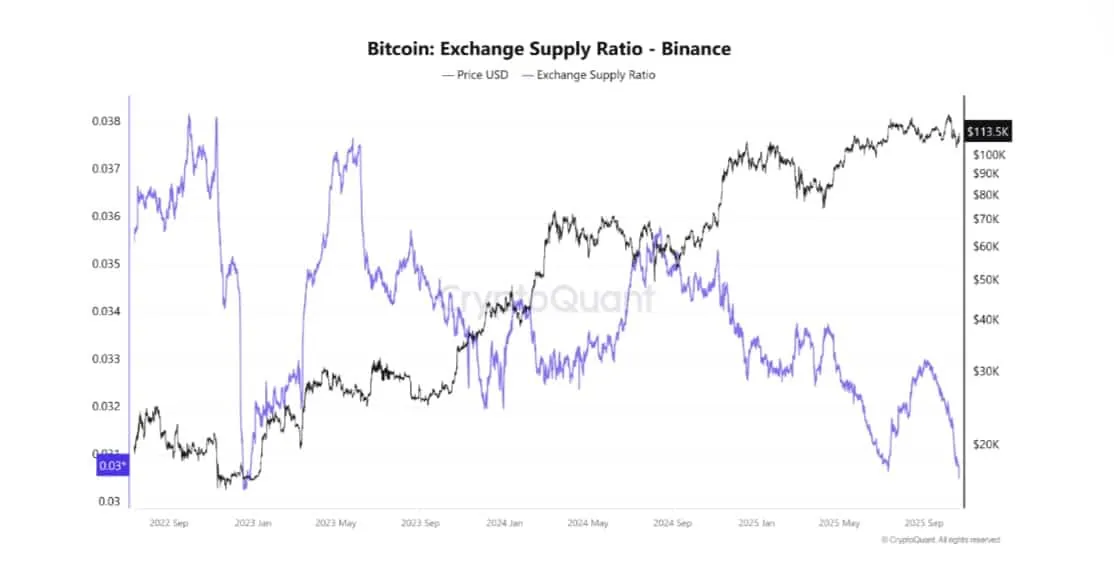

This trend, coupled with Bitcoin’s Exchange Supply Ratio (ESR) dropping to 0.03, its lowest level since mid-2022, signals reduced selling pressure and a return to accumulation among holders.

Clear Signs of Recovery

-

Spot trading volume on Binance has jumped from an average of $3–5 billion in September to $5–10 billion daily following the October 11 liquidation event.

-

Bitcoin’s ESR on Binance has fallen to 0.03, marking the lowest point in over two years, indicating a sharp decline in short-term supply available for sale.

-

Whale activity remains mixed: the Exchange Whale Ratio has reached 0.556, a monthly high, even as overall interest in the spot market continues to grow.

Cautious Yet Positive Market Sentiment

According to CryptoQuant, the drop in ESR typically signals a shift toward accumulation among major holders, especially during late-stage market cycles. As short-term supply decreases, selling pressure tends to ease, creating a more stable environment for Bitcoin and paving the way for a potential bullish phase.

Historically, periods of rising spot accumulation have often preceded strong Bitcoin recoveries. While BTC is currently trading around $107,716, down over 4% for the week, the combination of growing spot activity and declining exchange supply could mark the early stage of a sustainable rebound.

The shift from leveraged futures to the spot market reflects a more cautious but constructive investor mindset, setting a solid foundation for Bitcoin’s next growth cycle if accumulation continues.