Bitcoin extended its decline by 2% over the past 24 hours, slipping below $108,000 on Friday. According to data from CryptoQuant, the primary driver behind this latest drop is strong selling pressure led by Binance.

However, the firm’s analysts emphasized that this represents only a temporary pullback, not the end of the broader bull cycle.

Bears Dominate the Short Term

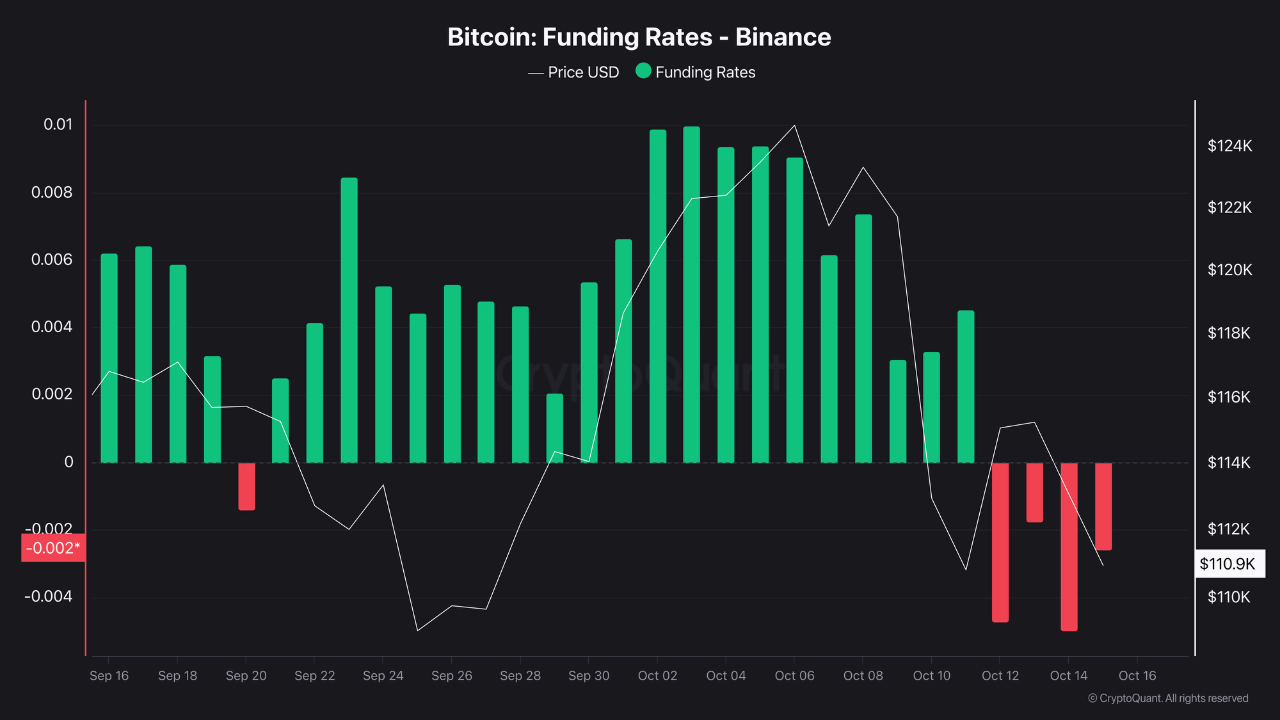

Three key indicators — Coinbase Premium, Funding Rate, and Taker Buy/Sell Ratio — together illustrate the market’s current behavior. Although U.S. buying activity remains solid, reflected in a positive Coinbase Premium, Bitcoin’s price continues to weaken, suggesting that Binance-led selling is overpowering U.S. demand.

Notably, Binance’s Funding Rate has stayed negative for four consecutive days, while most other exchanges report positive rates — signaling that futures traders on Binance are betting on further short-term downside.

Additionally, the Taker Buy/Sell Ratio has fallen to its lowest level in over a year, showing that aggressive selling is dominating market flows.

According to CryptoQuant, while Binance’s influence is clearly shaping near-term price action, this appears to be a cyclical correction rather than a structural breakdown.

Bitcoin’s on-chain fundamentals — including network activity, trading volume, and long-term holder accumulation — remain strong. Thus, although volatility may persist in the short term, the broader bullish trend is still intact.

‘Uptober’ — The Hope for a Comeback

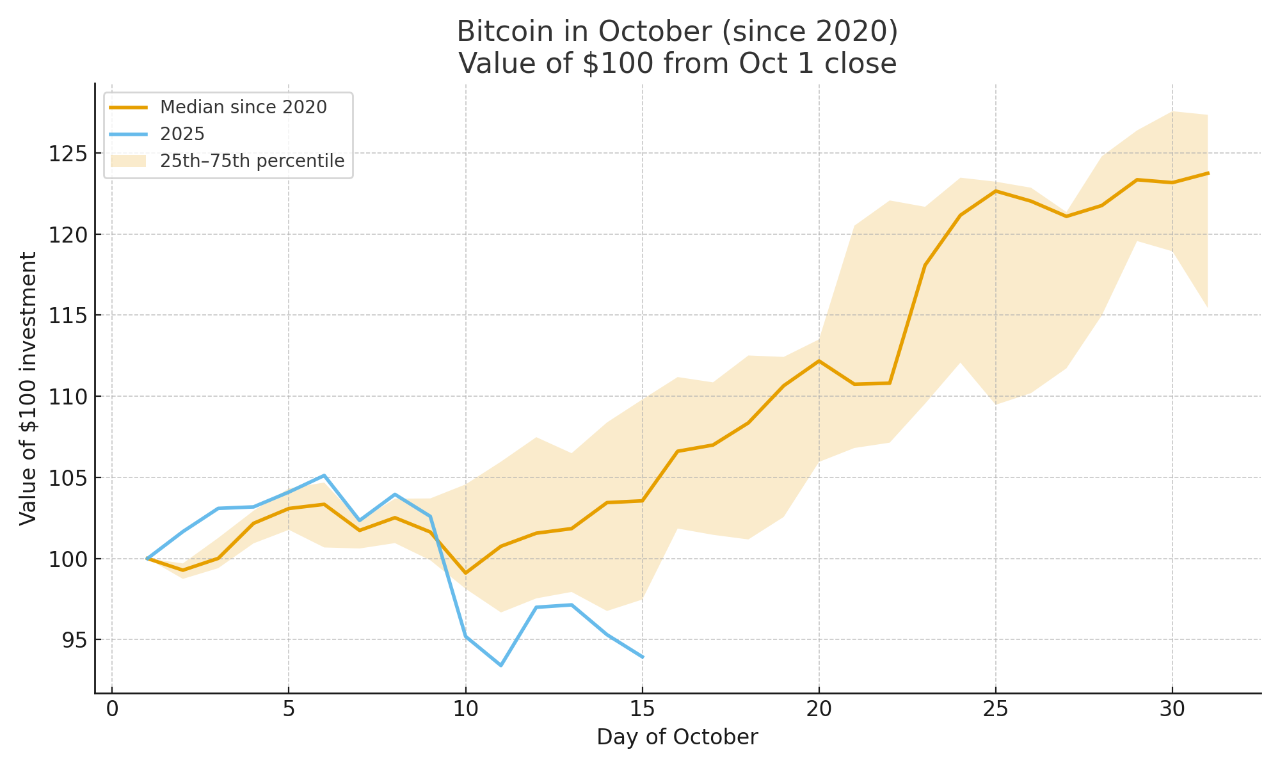

CryptoQuant suggests that Bitcoin may soon regain momentum as the second half of October begins — a period historically favorable for crypto markets. Historical data shows that since 2020, a $100 investment in Bitcoin at the start of October typically grows to around $120–$125 by month’s end, a remarkably consistent pattern.

This trend stems from a 0.5–1% decline in Bitcoin exchange reserves during late October, as investors withdraw BTC into cold wallets or long-term storage. The resulting supply contraction tightens market liquidity, making prices more sensitive to renewed buying pressure.

At the same time, stablecoin issuance tends to increase, signaling new capital entering the market. The combination of reduced supply and rising demand often triggers strong late-month rallies — a phenomenon widely known as the “Uptober effect.”

If history repeats itself, Bitcoin could soon stage a powerful rebound in the coming weeks, marking the beginning of a fresh rally after a tense period of correction.