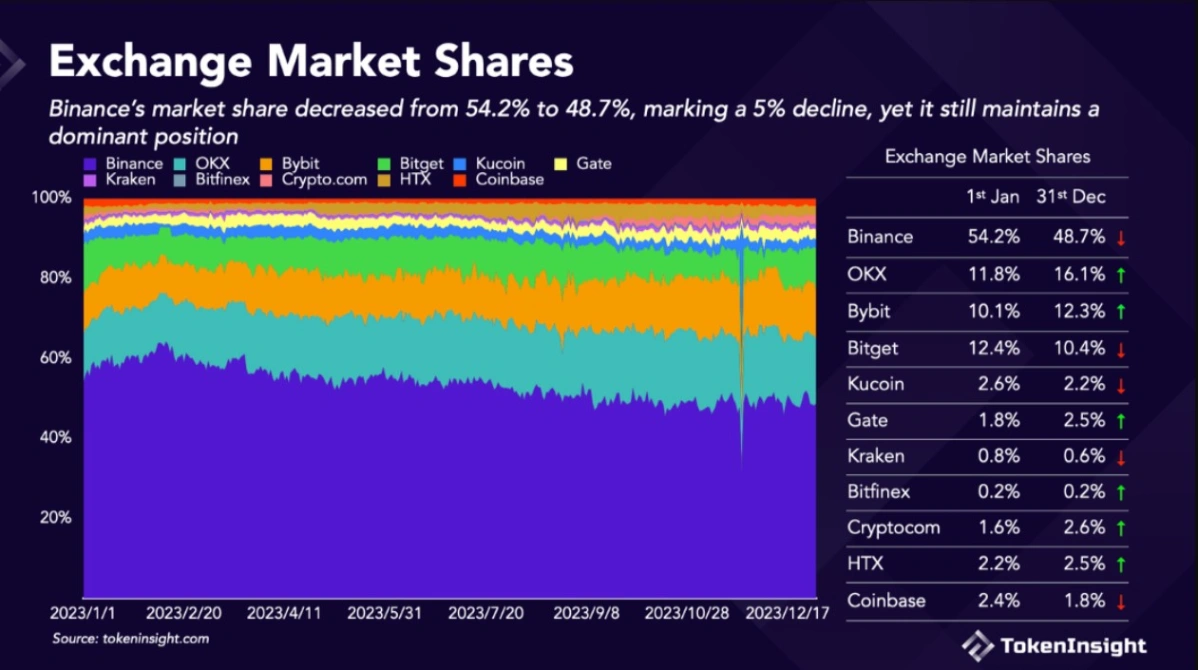

Binance Dominance Wavers: Competitors Gain Ground

The recent dip in Binance’s market share is attributed to the conclusion of its popular zero-fee Bitcoin promotion, emphasizing that while promotional campaigns may provide temporary boosts, market fundamentals ultimately dictate outcomes, according to analysts.

Although legal challenges are not explicitly outlined, they likely contributed to this shift. Following the departure of Changpeng Zhao, Binance’s dynamic leader, the market share temporarily dropped to 32%. However, a swift recovery propelled it back above 45% by year-end, highlighting the exchange’s adaptability.

This competitive landscape is evolving, with OKX securing the second spot with a 16% market share, fueled by strategic partnerships and an innovative platform, marking a 4% gain from the previous year. Bybit closely followed at 12%, capturing a 2.2% share, signaling an intensifying battle for crypto exchange supremacy in the foreseeable future.

Simultaneously, Coinbase staged a notable comeback, surpassing pre-2023 levels despite a mid-year trading volume slump. This resilience suggests a renewed focus on customer experience and regulatory compliance, positioning Coinbase for potential growth and a larger market share in the future.

Gate.io Emerges as Token Leader Amid Crypto Evolution

Beyond the fierce competition for market share, Gate.io has quietly ascended as the king of tokens. Listing an impressive 362 new tokens, totaling over 1,871, the exchange has attracted enthusiasts seeking alternative crypto ventures. This strategic move underscores the expanding diversity of the crypto landscape and the potential for niche exchanges to establish their own realms.

Related: Binance Predicts 7 Crypto Market-Impacting Events in 2024

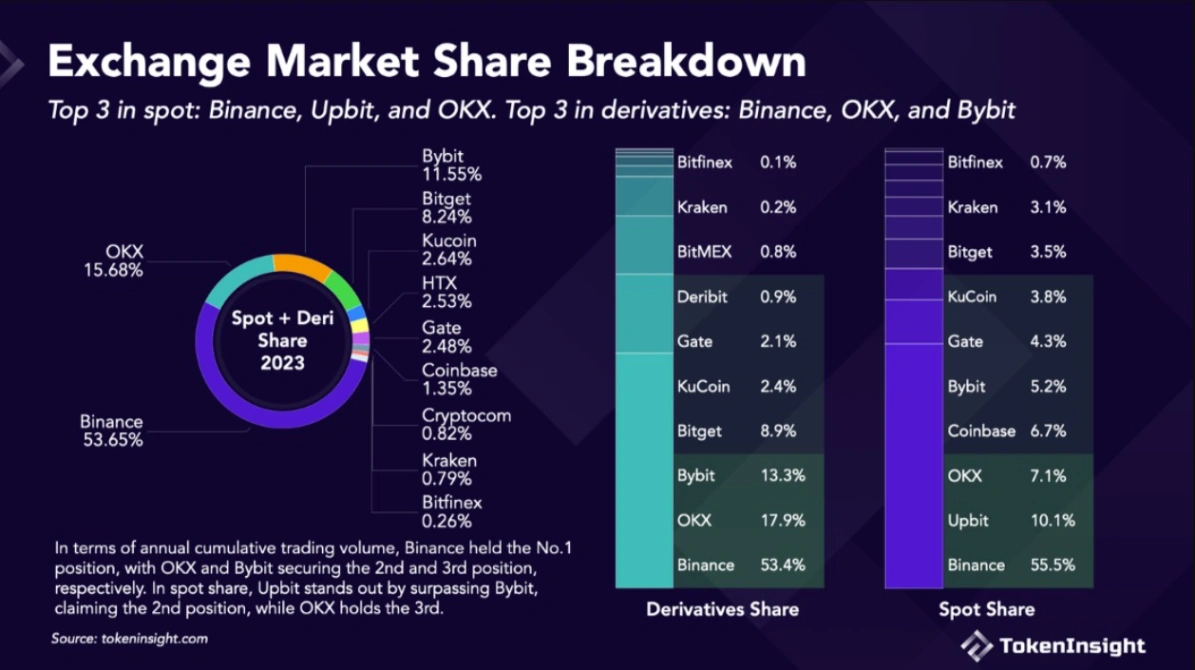

Derivatives Market Surges: Exchanges Navigate Evolutionary Pressures

The derivatives market has undergone a significant transformation, with open interest across the top 10 exchanges soaring by 60%, reaching a staggering $35 billion by the end of the year. Bitfinex, Kraken, Deribit, and Bybit have spearheaded this surge, each experiencing over 100% growth. This trend reflects a growing interest in leveraged crypto trading among investors, introducing an additional layer of complexity to the already dynamic exchange landscape.

Dethronements and Comebacks: Crypto Exchange Dynamics in 2023

The year 2023 witnessed a series of dethronements and comebacks for crypto exchanges. While Binance remains a dominant force, its grip on the crown has loosened. The ascent of ambitious rivals, the flourishing derivatives market, and the diversification of the token landscape depict a rapidly evolving environment. The adaptation and maneuvers of these industry powerhouses in the coming years promise a riveting chapter in the unfolding story of cryptocurrency.