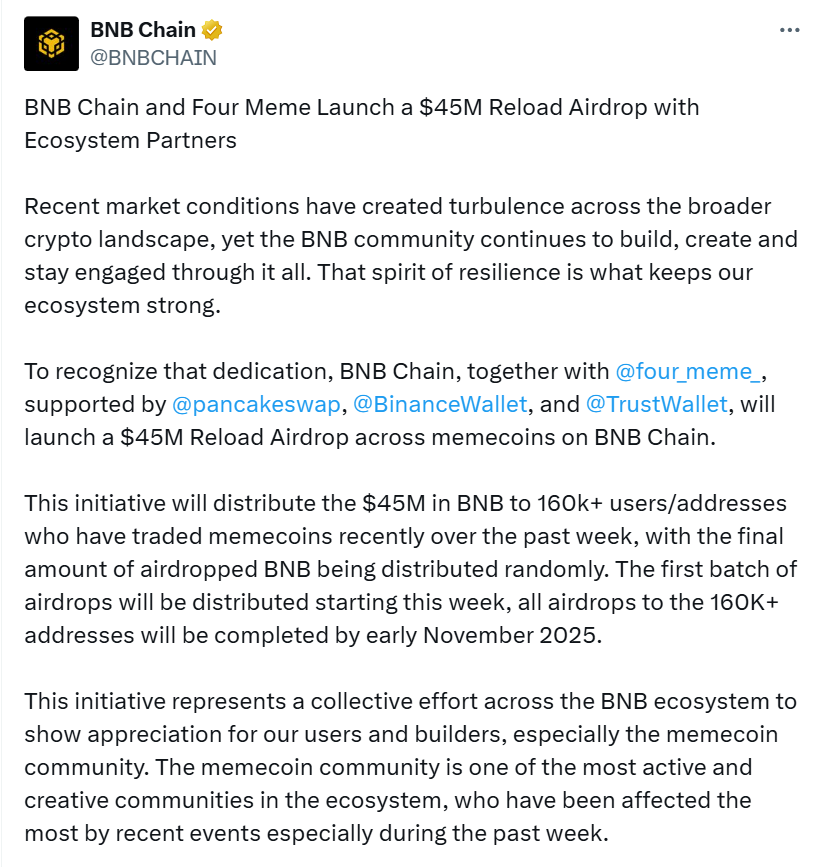

BNB Chain – the blockchain network within the Binance ecosystem – has announced a “Reload Airdrop” worth $45 million to compensate over 160,000 memecoin traders who suffered heavy losses during last week’s dramatic market crash. The move marks Binance’s largest-ever user relief initiative, following a staggering $20 billion market wipeout in just one day.

According to the announcement, the airdrop will roll out this week and be completed by early November. Eligible users will receive BNB tokens distributed randomly through ecosystem partners such as Four Meme, PancakeSwap, Binance Wallet, and Trust Wallet.

Originally developed by Binance and now maintained by a decentralized community, BNB Chain powers the ecosystem’s native BNB token and supports a wide range of DeFi, gaming, and digital asset applications.

Market Meltdown and Binance at the Center of the Storm

The airdrop follows the market’s historic $20 billion liquidation last Friday — the largest single-day loss in crypto history. The crash was triggered by a Truth Social post from former U.S. President Donald Trump, threatening 100% tariffs on Chinese imports, which sent shockwaves across global markets.

Amid the chaos, several Binance users reported system glitches that prevented them from closing positions. A trader known as SleeperShadow wrote on X that Binance “shut down their system during a major market crash,” leaving him “unable to close” his futures trades.

Another issue involved Ethena Labs’ synthetic stablecoin USDe, which dropped to $0.65 on Binance while remaining near its $1 peg on other exchanges. Guy Young, founder of Ethena Labs, explained that Binance relied on internal oracle data from its own order book — where liquidity was thinner — rather than external price feeds.

Adding to the turmoil, altcoins such as IoTex, Enjin, and Cosmos appeared to crash to zero on Binance, even though their prices remained stable elsewhere.

Binance Responds with Record-Breaking Relief Package

Amid mounting criticism, Binance issued an official statement on Sunday, assuring users that its core futures systems remained fully operational throughout the market volatility. The exchange clarified that the brief collapses in spot prices were caused by old limit orders being triggered during periods of thin liquidity, while the “zero price” glitch resulted from a decimal display error, not from tokens actually crashing.

Binance further noted that forced liquidations on its platform represented only a small portion of total market activity, implying that the extreme volatility stemmed from broader market conditions, not internal failures.

However, the exchange acknowledged that the depegging of USDe, BNSOL, and WBETH led to the liquidation of some collateralized positions. To compensate affected users, Binance has already covered $283 million in losses, and now, with the $45 million airdrop, the exchange is taking another major step to restore confidence amid the market chaos.