According to Binance’s announcement on October 14, the relief package will distribute $300 million worth of token vouchers, valued between $4 and $6,000, to eligible users. To qualify, traders must have experienced forced liquidations in futures or margin positions between 00:00 UTC on Oct. 10 and 23:59 UTC on Oct. 11, with a minimum loss of $50 that accounts for at least 30% of their total net assets, based on a snapshot taken on Oct. 9. The exchange stated that distribution will be completed within 96 hours.

In addition, Binance will establish a $100 million low-interest loan fund aimed at supporting institutional and ecosystem participants impacted by the market turmoil, with the goal of “easing liquidity pressures.”

While reaffirming that it does not bear legal responsibility for users’ trading losses, Binance said the initiative seeks to “rebuild confidence across the industry” after a brutal sell-off that rattled the crypto world.

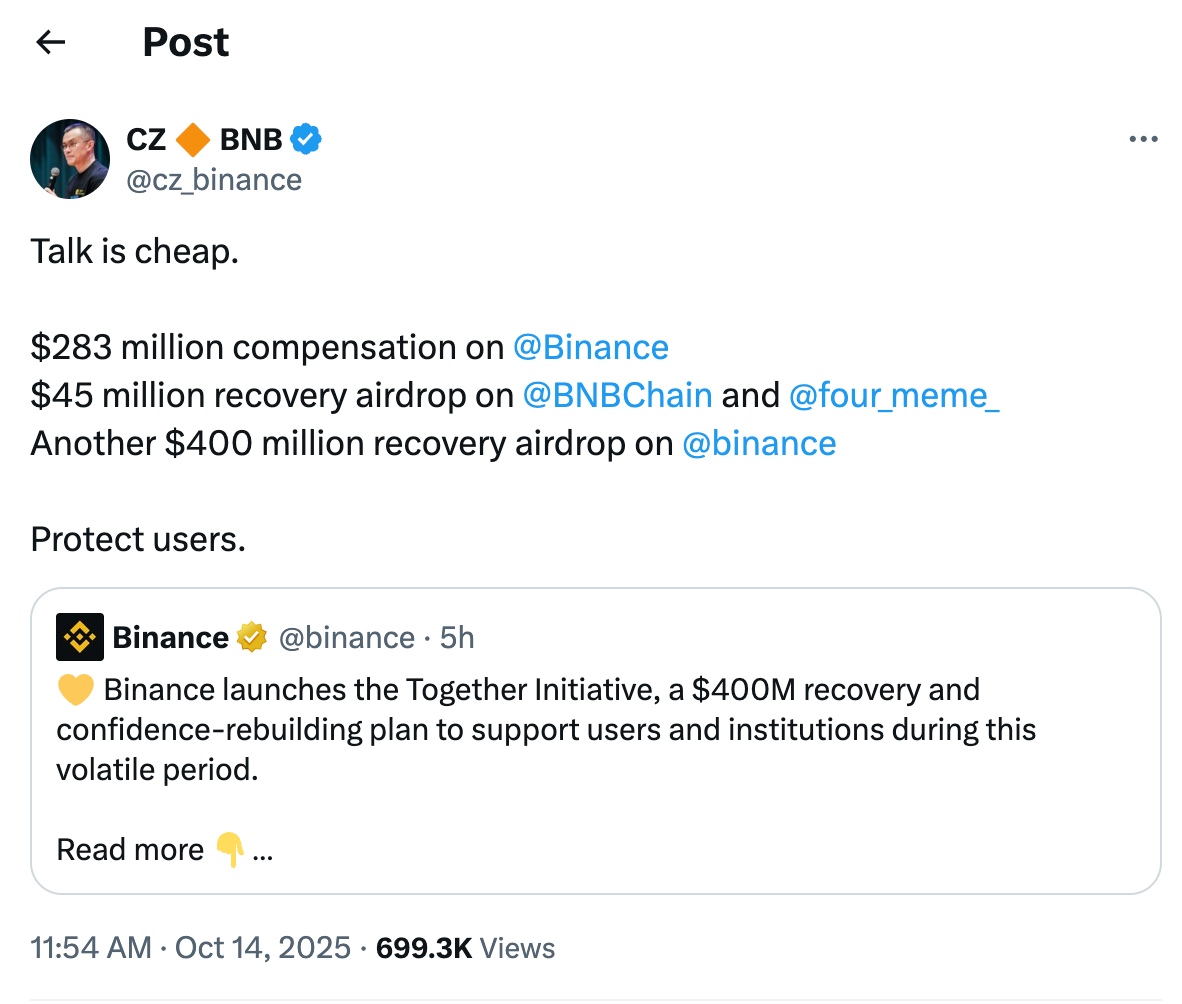

Earlier this week, BNB Chain — Binance’s blockchain network — had already launched a $45 million “Reload Airdrop” to compensate memecoin traders hit hardest by Friday’s crash.

The chaos was triggered by U.S. President Donald Trump’s announcement of 100% tariffs on Chinese imports, which sent shockwaves through global markets. Within just 24 hours, over $19 billion in leveraged positions were liquidated, marking the largest single liquidation event in crypto history.

Binance has since faced heavy criticism from users. Some traders reported technical glitches that prevented them from closing positions, while others pointed to pricing discrepancies in stablecoins. Several altcoins — including Enjin, Cosmos, and IoTeX — even temporarily showed prices of $0 due to faulty oracle data. However, Binance insisted that its core futures systems functioned normally throughout the volatility.

To date, Binance and BNB Chain have announced a combined $728 million in recovery measures, including $45 million in airdrops, $283 million in post-crash compensation, and the newly launched $400 million relief fund.

Still, the community remains divided. Some praised Binance for taking swift action to restore market confidence, while others dismissed the effort as “too little, too late.”

User LeveragedDegen wrote on X: “A $4,000–$6,000 voucher for users who lost everything is kind of a joke.” Meanwhile, Curb.sol accused Binance of being directly responsible for the $400 billion in liquidations, blaming mispriced internal oracles, and urged: “Everyone needs to get their funds off Binance immediately.”