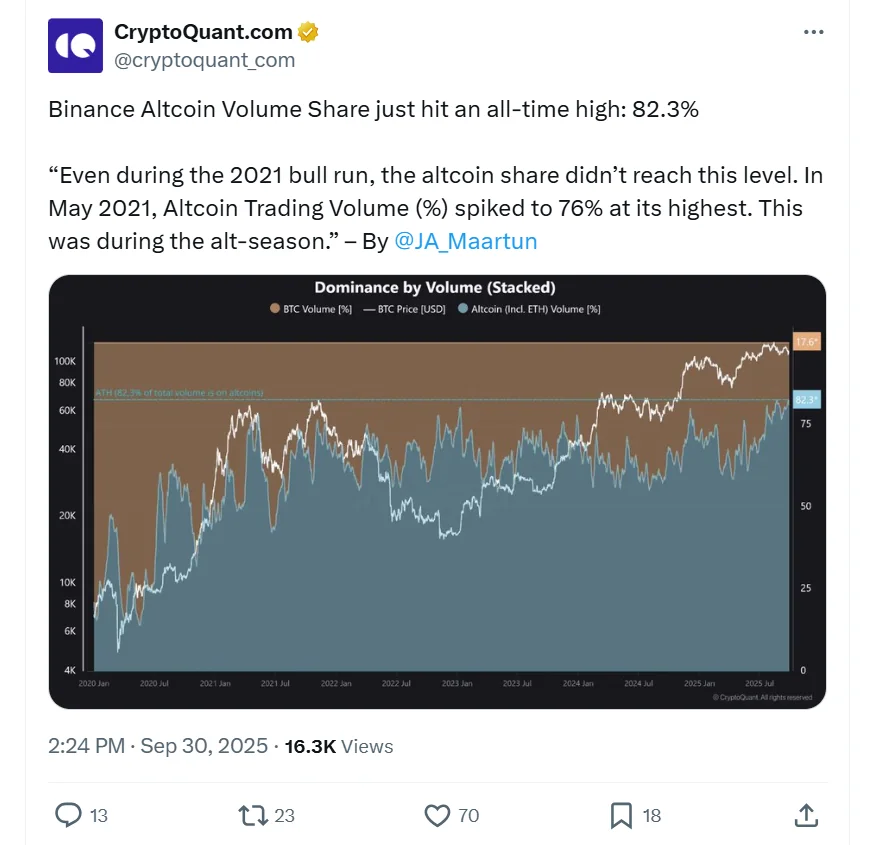

Altcoin trading volume on Binance has reached a new all-time high, accounting for 82.3% of the global altcoin market share, surpassing the previous peak of 76% during the 2021 altcoin season. According to a CryptoQuant analysis, the milestone signals a growing investor preference for non-Bitcoin assets.

Altcoins Outshine Bitcoin

Market data shows capital on Binance is increasingly flowing into altcoins. Tokens such as XPL, ASTR, SOL, ETH, and PUMP have all posted strong gains since July. Notably, ASTR surged more than 250% in just one week following its listing on September 18.

JA Maartum, a CryptoQuant analyst, commented: “Altcoins have never dominated the market like they do now, not even during previous bull runs.” He noted that the current 82.3% share far exceeds the 2021 record.

According to the CMC Altcoin Season Index, altcoin dominance has reached 62%, reflecting a familiar pattern: Bitcoin rallies attract fresh capital, but investors quickly shift toward smaller, riskier tokens in pursuit of higher returns.

The Coins Leading the Surge

The top performers in this rally include:

-

MYX: up over 13,200% in the past 90 days.

-

MemeCore (M): up over 3,100%.

-

Aster: up over 2,000%.

The Altcoin Season Index officially marks an “altseason” once at least 75% of the top 100 altcoins outperform Bitcoin over a 90-day period.

Institutional Capital Powers the Rally

A major driving force behind the rally is institutional inflows. In August alone, Ether ETFs attracted nearly $4 billion, while Solana and XRP ETFs received more than $1 billion over the past year. The SEC’s recent adjustment of ETF regulations has paved the way for over 90 new applications, most of which involve Solana and XRP.

At the same time, market sentiment and online activity are amplifying momentum. Rising valuations of Solana ecosystem tokens and memecoins like Dogecoin and Pudgy Penguins have sparked surges in online searches and discussions. Google Trends data shows altcoin-related searches hit a record high on August 13, matching the peak in May 2021.

The Bigger Picture

According to Forbes, expectations of Federal Reserve rate cuts in 2025 are boosting liquidity, supporting risk-on assets like altcoins. The current total market cap of altcoins stands at $1.65 trillion.

On Binance Futures, more than 52% of positions are long, with over $10 billion in open interest for Bitcoin, compared to about $7 billion for Ethereum. Despite the explosive growth of altcoins, Bitcoin remains the dominant force in the broader market.