Users in the European Economic Area (EEA) can still hold non-MiCA-compliant tokens, including Tether’s USDt, and trade them through perpetual contracts.

Cryptocurrency exchange Binance has officially discontinued spot trading pairs with Tether’s USDt in the EEA to comply with the Markets in Crypto-Assets Regulation (MiCA).

According to Cointelegraph, Binance has delisted spot trading pairs with multiple non-MiCA-compliant tokens in the EEA, following a plan announced in early March.

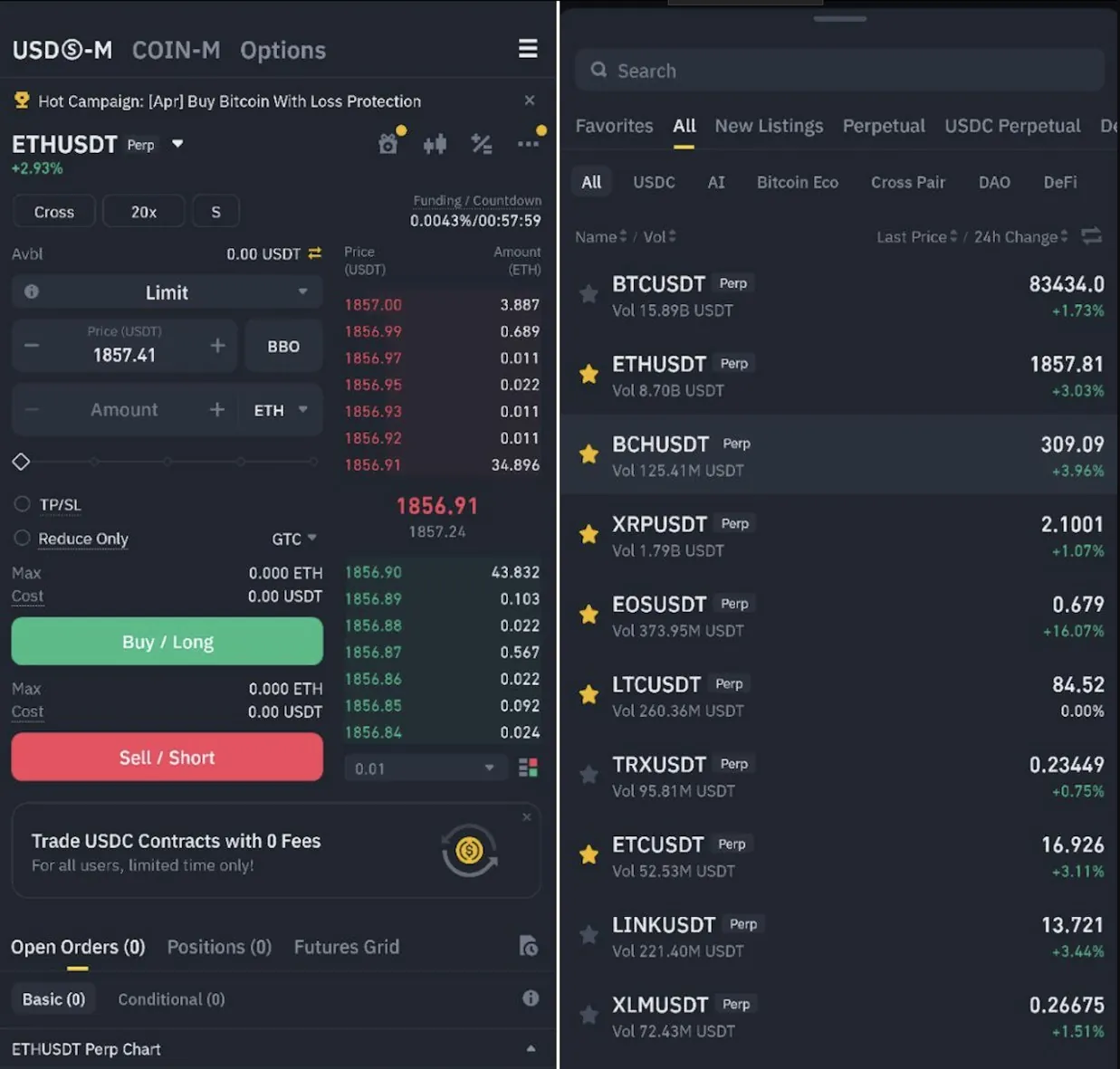

Although spot trading pairs with USDt have been delisted, EEA users can still hold the affected tokens and trade them via perpetual contracts.

Previously, Binance announced that spot trading pairs for non-MiCA-compliant tokens would be delisted by March 31, in accordance with local requirements to remove such tokens by the end of Q1 2025.

Other Exchanges in the EEA Also Delisting Tokens

Binance is not the only exchange implementing such changes to comply with MiCA regulations.

Kraken announced its plan to delist spot trading pairs with USDT in the EEA as early as February. According to a notice on Kraken’s website, USDT has been restricted to sell-only mode in the EEA since March 24. As of now, EEA users cannot purchase the affected tokens on the platform.

Aside from USDT, Binance has also delisted spot trading pairs for several other non-MiCA-compliant tokens, including Dai, FDUSD, TrueUSD, Pax Dollar, Anchored Euro (AEUR), TerraUSD (UST), TerraClassicUSD, and PAX Gold.

Meanwhile, Kraken’s delisting roadmap in the EEA only covers five tokens: USDT, PayPal USD (PYUSD), Tether EURt (EURT), TrueUSD, and TerraClassicUSD.

ESMA Does Not Prohibit Custody of Non-MiCA-Compliant Tokens

Binance and Kraken’s decision to continue offering custody services for non-MiCA-compliant tokens aligns with guidance from MiCA compliance supervisors.

On March 5, a spokesperson for the European Securities and Markets Authority (ESMA) told Cointelegraph that custody and transfer services for stablecoins that do not comply with MiCA do not violate the new European cryptocurrency laws.

However, the same regulator previously advised European crypto asset service providers to halt all transactions involving the affected tokens after March 31, causing some confusion regarding MiCA compliance requirements.