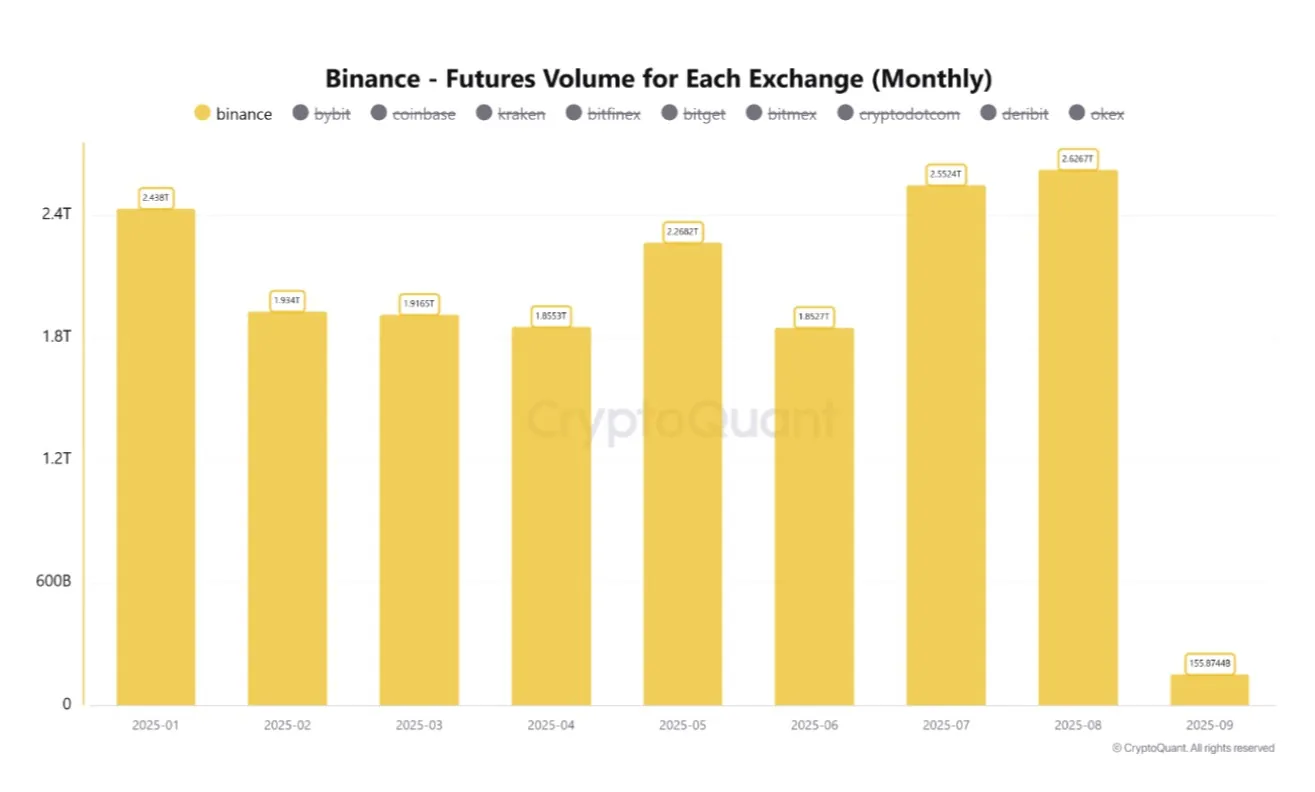

In August, Binance achieved a historic milestone as its futures trading volume surged to $2.626 trillion – the highest monthly figure in 2025 so far, surpassing July’s $2.552 trillion. The surge highlights a strong comeback from both institutional investors and retail traders.

Institutional Capital Returns

According to CryptoQuant data, Binance’s remarkable growth was fueled by extreme Bitcoin volatility in August – with sharp rallies followed by swift corrections. These conditions provided fertile ground for short-term speculators while also drawing hedge funds and institutional players back into the market.

Notably, open interest on Binance spiked alongside trading volume, indicating that growth was not merely the result of liquidations but also driven by the buildup of new positions. This aligns with the broader market trend where traders increasingly shifted from spot to derivatives, leveraging contracts to maximize short-term gains amid slowing spot activity on other exchanges.

Records Come with Risks

Despite the record figures, CryptoQuant cautioned that periods of high momentum in futures markets often precede corrections. For sustainable growth, derivatives trading must be supported by strong spot activity and steady liquidity flows, particularly from stablecoins and exchange reserves.

With August’s performance, Binance is evolving beyond a trading platform into a “strategic playground” for institutions. If this momentum carries into September, the market could witness either a powerful rally fueled by derivatives activity or a sharp pullback if liquidity proves insufficient.

Bitcoin Faces a September Turning Point

Bitcoin saw a turbulent week, surging to $113,350 before retreating to near $110,600, with a brief dip below $107,500 before bouncing back toward weekly highs.

Market attention is now centered on the mid-September FOMC meeting, where a potential Fed rate cut could shift momentum. Analysts remain divided: will September 2025 extend the bearish trend, or mark the beginning of a bullish reversal?