Entering 2024 with a surge in crypto activity, Binance Futures is rolling out a substantial $170,000 USDC reward initiative to support its traders. This promotional endeavor aims to spotlight the newly introduced USDC-margined perpetual contracts. The exchange initiated USDC-denominated markets for BTC, ETH, BNB, SOL, and XRP on January 4th.

Traders on Binance Futures depositing USDC can participate in sharing 125,000 USDC in rewards. This opportunity is open to both regular users and those on VIP tiers 1-3, requiring only a minimum deposit of 100 USDC. Users meeting this criterion will receive a trading fee rebate voucher.

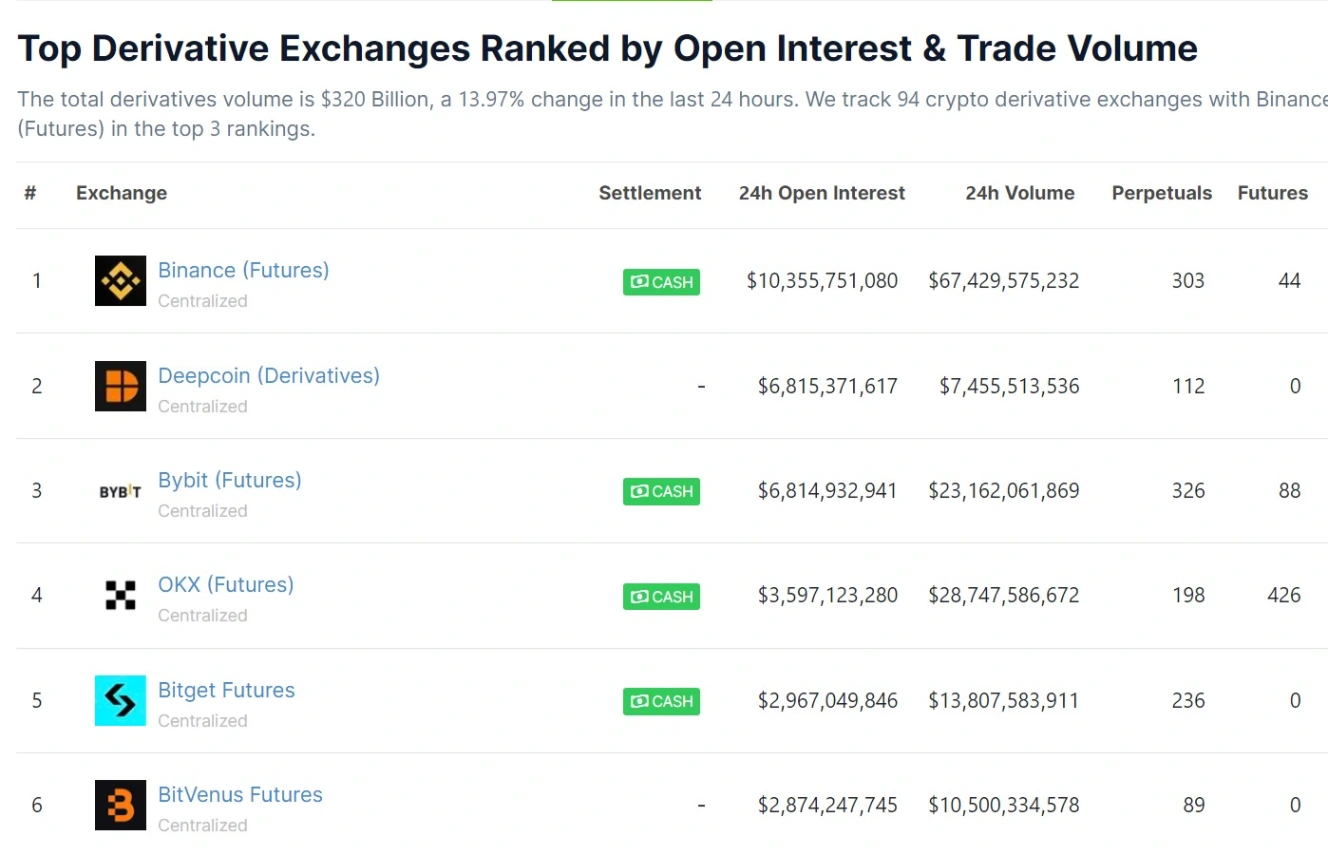

Expanding on its success as the leading crypto derivatives exchange with a daily volume of $60 billion, Binance Futures anticipates a boost in demand for its new USDC-margined perpetual contracts through this promotion. While BTC remains dominant in the futures market, especially during ETF seasons, other coins, notably SOL, have seen increased volume. Solana’s rise against ETH in the latter half of 2023 has contributed to this trend.

In the realm of derivatives exchanges, perpetual swaps with the top crypto assets by market cap continue to thrive due to their liquidity, global accessibility, and resilience to manipulation, making them a less volatile choice for traders.

Binance Futures: Doubling Down on USDC Rewards

In tandem with the ongoing $125,000 USDC promotion, Binance Futures introduces an additional campaign offering an extra $45,000 USDC. Traders engaging with a minimum of 1,000 USDC are eligible to share the rewards pool, capped at 45,000 USDC for 6,000 qualifying participants, with adjusted thresholds for fewer participants.

Crypto futures continue to outpace spot trading in market share, captivating both retail and professional traders, particularly in perpetual contracts. Beyond the allure of substantial returns through leveraged trading during significant market moves, the popularity of futures can be attributed to various factors.

The convenience of holding stablecoins like USDC as the underlying asset provides traders with a risk-mitigating option during inactive positions, shielding them from market fluctuations. Dollar-denominated perpetual swaps offer a streamlined trading experience, facilitating profit-making and secure positioning in stable assets between opportunities.

Related: SEC Accused of Market Manipulation Due to Misleading Post

The surge in Bitcoin futures volume surpassed $1 trillion in December, with January poised to exceed this impressive figure, highlighting the sustained momentum in the crypto futures market.