The world’s largest cryptocurrency exchange, Binance, has sent shockwaves through the crypto community after announcing the delisting of three altcoins: Flamingo (FLM), Kadena (KDA), and Perpetual Protocol (PERP).

The decision immediately sparked intense market volatility, causing all three tokens to fluctuate sharply — yet, in a surprising twist, FLM surged by double digits, defying the usual post-delisting selloff trend.

Delisting Details and Timeline

According to Binance’s official announcement:

-

Spot trading for FLM, KDA, and PERP will end at 03:00 UTC on November 12, 2025.

-

Deposits made after 03:00 UTC on November 13, 2025 will not be credited.

-

Withdrawals will become unavailable starting January 12, 2026.

Binance stated:

“All trade orders will be automatically removed once trading ceases for the respective pairs.”

Several other Binance services will also be affected:

-

Copy Trading will end on November 5, 2025

-

Margin Trading will conclude on November 4, 2025, with borrowing suspended from October 30, 2025

-

Mining Pool services will stop on November 4, 2025

-

Convert services will be disabled after November 6, 2025

Meanwhile, futures contracts linked to FLM, KDA, and PERP will remain available but may face additional risk management measures.

Why Binance Made This Controversial Move

Binance explained that the delisting is part of its periodic review process, which evaluates listed projects based on multiple factors:

-

Team commitment and project development

-

Trading activity and liquidity

-

Network security and transparency

-

Regulatory and compliance considerations

The exchange emphasized:

“When a coin or token no longer meets Binance’s high standards, or when the market landscape changes, we conduct an in-depth review and may delist it. Our top priority is protecting users while adapting to evolving market conditions.”

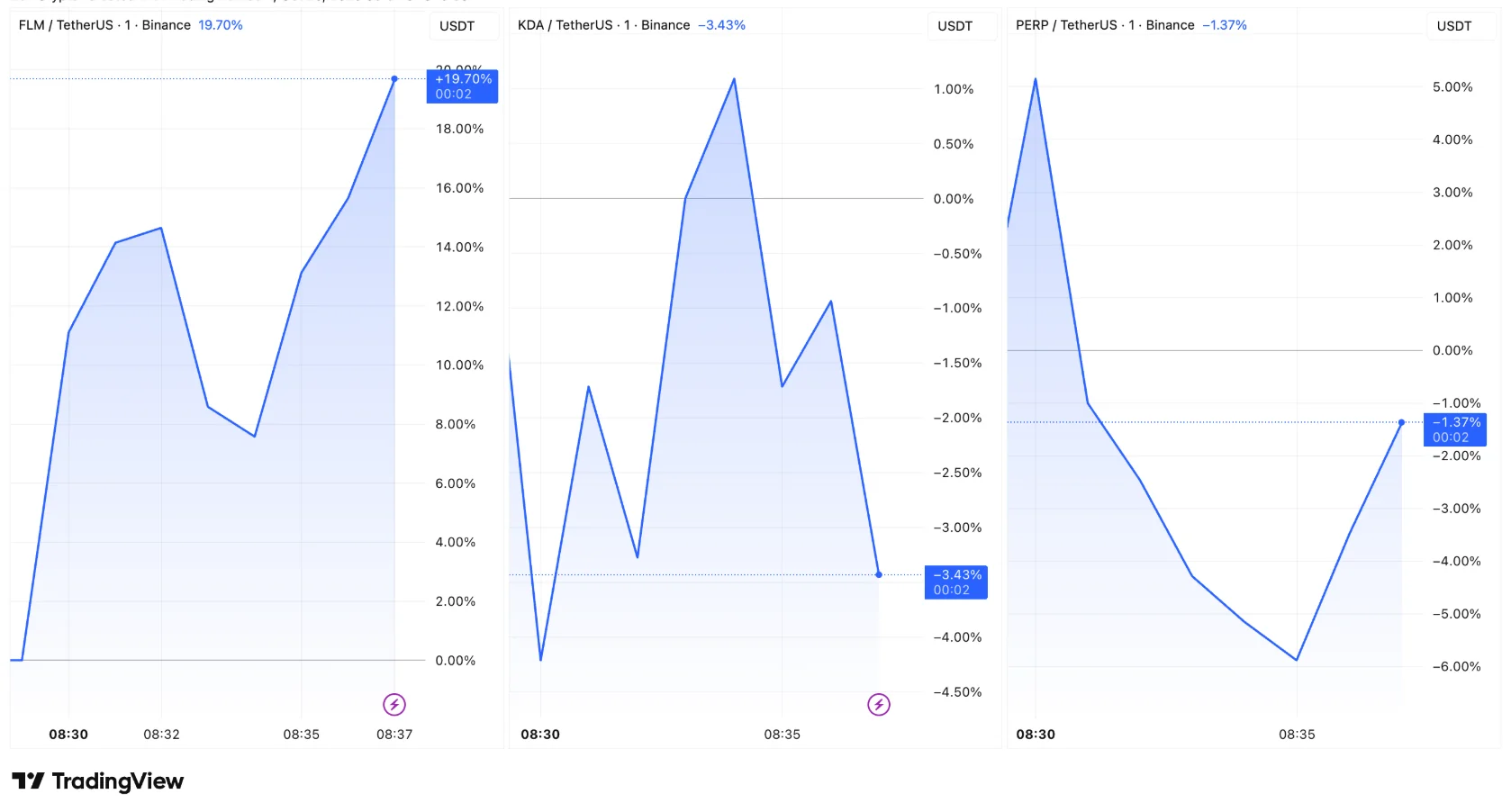

Market Reactions: FLM Breaks the Pattern

Following the announcement, the three tokens reacted in dramatically different ways:

-

KDA plunged 3.43%, extending its ongoing decline after the Kadena organization’s recent market withdrawal.

-

PERP slipped 1.37%, weighed down by bearish sentiment.

-

FLM, however, skyrocketed 19.7%, stunning traders worldwide.

This unusual rally echoed the case of Alpaca Finance (ALPACA), which soared 71% after being delisted by Binance earlier this year — an event that raised market manipulation concerns among analysts.

One market observer warned:

“Binance will delist FLM on Nov 12, yet the token just spiked. Big pumps often mean big risk.”

Conclusion

The contrasting reactions of FLM, KDA, and PERP reveal the unpredictable dynamics of the crypto market.

While KDA and PERP followed the typical post-delisting downtrend, FLM’s explosive rally tells a different story — one driven by speculation, emotion, and high risk.

Once again, Binance proves that a single move by this crypto giant can send shockwaves across the entire altcoin landscape.