Binance CEO Changpeng Zhao (CZ) has outlined the exchange’s future plans and addressed crucial concerns during the Binance Blockchain Week Istanbul event. In a comprehensive video conference, CZ emphasized three pivotal aspects: the commitment to DeFi Wallet development, a dedication to regulatory compliance, and the growing significance of Turkey in the cryptocurrency industry.

CZ’s discourse delved into the challenges faced by Binance, including financial setbacks and reputational damage. In response, Binance has undertaken a recovery mission, prioritizing the rebuilding of trust and compliance with evolving global regulations. CZ underscored the importance of these initiatives in maintaining Binance’s position as a reliable and compliant cryptocurrency exchange.

A notable highlight of CZ’s address was the recognition of the Binance Web3 Wallet as a crucial step toward enhancing cryptocurrency adoption. He stressed its role as a secure and user-friendly platform, designed to make cryptocurrency management accessible globally. This commitment aligns with Binance’s broader strategy to diversify its product offerings and improve the overall user experience.

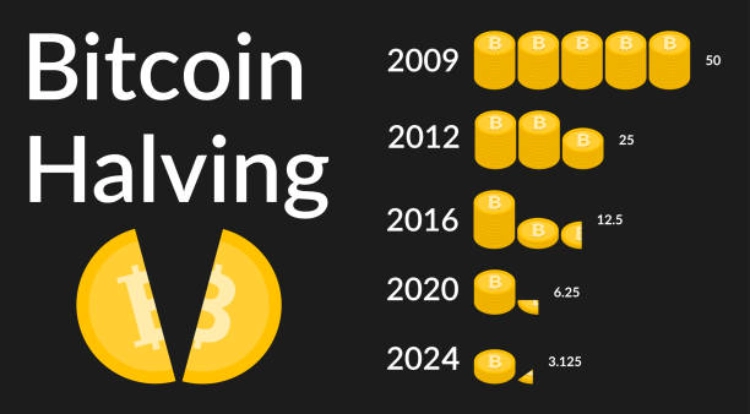

Looking ahead, CZ expressed optimism about the potential approval of Spot Bitcoin ETFs, foreseeing their positive impact on the cryptocurrency market. He also cautioned against unrealistic expectations surrounding the 2024 Bitcoin halving, urging investors to maintain a balanced perspective and avoid succumbing to Fear, Uncertainty, and Doubt (FUD).

Beyond internal developments, CZ emphasized the growing importance of Turkey in the cryptocurrency industry. Turkey has emerged as a key player, with a rising number of enthusiasts and blockchain startups. CZ’s acknowledgment of Turkey’s role signifies its potential to shape the future trajectory of the cryptocurrency market.

Related: The Remarkable Applications of Blockchain in Life

In a significant market development, a report from blockchain analytics firm 0xScope revealed a decline in Binance’s spot trading market share to 40% in late 2023, down from 62% a year earlier. The report attributes this decline to Binance’s listing strategy, causing downturns in the value of newly listed coins. Meanwhile, South Korean exchange Upbit experienced substantial growth, increasing its spot market share from 5% to 15.3% during the same period.

Despite the decline in spot trading market share, Binance remains the leader in overall cryptocurrency trading, encompassing both spot and derivatives. However, the report highlights increased competition from exchanges like OKX, Bybit, Bitget, and MEXC Global. Binance’s overall market share stood at 51.2% in October 2023, indicating a notable decrease compared to its dominance in previous years.

The report suggests a shifting landscape in the cryptocurrency exchange industry, where emerging players and second-tier exchanges pose challenges to established giants like Binance. The dynamic nature of the market, coupled with evolving user preferences, underscores the need for continuous adaptation and innovation in the competitive cryptocurrency exchange landscape.