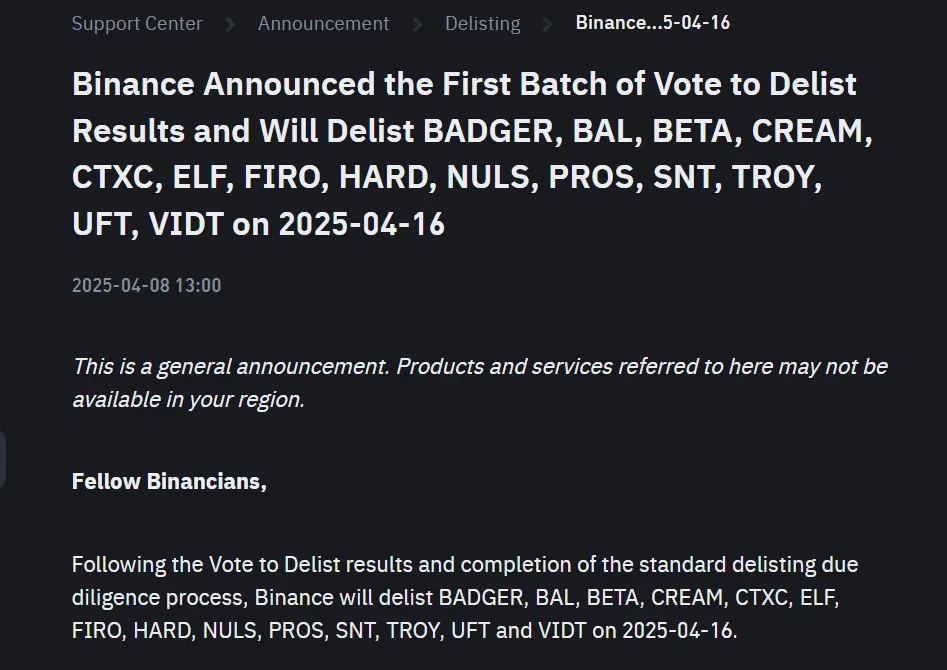

Binance to Delist 14 Altcoins

The announcement was made early Tuesday morning (Asia time), stating that the exchange will officially delist and cease all spot trading for the listed tokens starting at 03:00 (UTC) on April 16, 2025.

The tokens set to be delisted are: BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT, and VIDT.

Binance explained that this decision was based on a comprehensive evaluation of various factors, including the level of project development activity, trading volume, liquidity, and compliance with standards.

Notably, this time Binance implemented a community voting mechanism to decide on token listings and delistings. A total of 103,942 votes were cast by 24,141 participants, but only 93,680 were deemed valid after filtering out ineligible entries.

Immediately after the announcement, all 14 altcoins experienced a steep decline, with most recording double-digit losses. This outcome was not unexpected, as delisting announcements typically trigger panic selling. A similar case occurred when Binance previously delisted three tokens — AKRO, BLZ, and WRX — which also saw significant price drops.

What Should Binance Users Do?

Binance has advised that all open trade orders will be automatically canceled once trading ceases for each affected pair. Additionally, any trading bots associated with the delisted spot pairs will be terminated at the time of delisting.

Therefore, users are urged to adjust or disable their trading bots in advance to avoid unnecessary losses.

Furthermore, after the delisting takes effect, any remaining balances in these tokens will either be automatically sold at market price or moved to the Spot Account if they are unsellable. These tokens will also no longer display their market value in users’ accounts.

Binance also confirmed that deposits of these tokens will no longer be credited after the delisting time. Withdrawals will be disabled after 03:00 UTC on June 9, 2025.

In an effort to support users, Binance stated:

“Delisted tokens may be converted into stablecoins on behalf of users after 03:00 UTC on June 10, 2025.”

Community Reactions

While Binance’s move to engage the community in listing decisions is viewed as a more democratic and transparent approach, it has also faced some criticism. Concerns have been raised regarding the fairness of the process, with some speculating that Binance may show favoritism towards tokens on the Binance Smart Chain (BSC).