According to the latest report from analysts Gautam Chhugani and Mahika Sapra, a new Bitcoin bull cycle is underway, fueled by strong capital inflows into newly launched Bitcoin exchange-traded funds (ETFs) eyes, along with a strong expansion in mining capacity and historic mining revenues.

The analysts note that Bitcoin miners remain “attractive buying targets for equity investors looking to participate in the crypto cycle”, and have revised their estimates for the Cryptocurrency mining stocks.

They noted that they observed a hashrate decrease of 7% following Bitcoin’s upcoming halving, compared to a 15% decrease they had previously predicted. Hashrate is an index of the computing power underpinning the Bitcoin network, as miners compete to find new blocks.

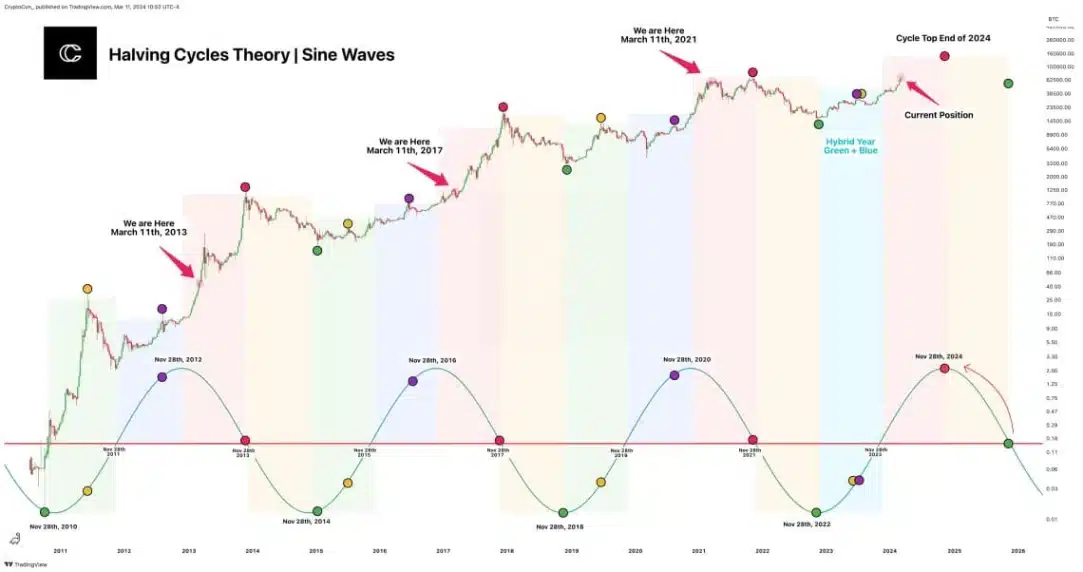

The reward to miners for each block found will be halved next month, from 6.25 to 3,125 BTC in an event known as halving. Halving is part of Bitcoin’s currency supply and occurs every after 210,000 blocks are mined, which equates to approximately every four years. Hashrates often decrease after halvings because some miners become unprofitable from the reduced rewards. However, the revised forecast from Bernstein shows that the halving hashrate decrease will not be as severe as before.

Taking a long-term view, Bernstein has revealed predictions for a “monster” crypto market cycle, forecasting total market capitalization to surge to $7.5 trillion by 2025, nearly three times compared to its current value of $2.53 trillion. The report reasoned that this increase would bring significant growth to Robinhood’s crypto revenue, which could increase by a factor of nine.

Bernstein’s bullish outlook includes predictions for each cryptocurrency, including that Bitcoin’s market capitalization is expected to reach $3 trillion by 2025, up from its current market capitalization of $1.31 trillion, which means BTC price will double next year, surpassing the $150,000 mark.

Related: Bitcoin Surges to $67,000, Triggering $300 Million in Liquidations

Ethereum ($ETH), the second largest cryptocurrency by market capitalization, is predicted to reach $1.8 trillion, up from the current level of $422.4 billion, helping the Ethereum price surpass the 10,000 threshold USD to trade near $15,000, up from current levels of $4,000.

The report also predicts a total market capitalization of $1.4 trillion for other top blockchain tokens, with analysts Gautam Chhugani and Mahika Sapra writing that they believe “the crypto market is experiencing level of acceptance from the organization never seen before.”

Yes I m interested

Masha Allah

Agamechiele

Can’t wait

J’accepte ces projets merci

Mazhar Abbas

Honestly

I’m interested