Over the past 24 hours, the price of Avalanche [AVAX] increased by 13.13%, surpassing the $50 threshold. This price increase comes from more than just a few fundamental factors.

According to IntoTheBlock, the spike in trading volume has influenced the price increase. A report from the cryptocurrency intelligence platform has shown that trading volume reached $329 million on March 11. This is the highest level since December 2023. Despite the large increase in trading volume There is no guarantee that it will lead to price increases, but with AVAX, this has special significance.

Source: X

AVAX cannot X2 in the near future

Not only is there an increase in large investors, but AVAX is also experiencing greater buying pressure than selling. If this situation continues in the near future, the price of cryptocurrencies could double.

However, it should be remembered that this prediction does not come out of nowhere. Therefore, it is important to evaluate capabilities from a technical perspective.

Source: Coinalyze

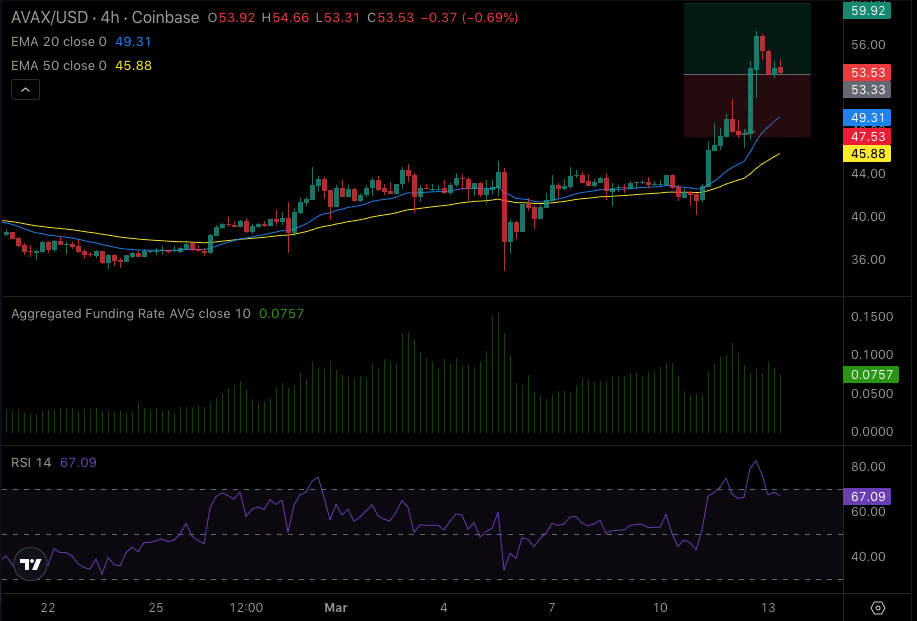

Based on 4-hour analysis, AVAX reached $57 on March 12. However, the break above the key resistance was unsuccessful. Currently, the bulls are trying to retest that area. A successful close above that level could see AVAX continue to rise to $59.92.

Related: Avalanche (AVAX) Surges as Significant Capital Flows into the Network

But if the rejection happens again, the token’s price could drop to the $47.53 support. Previously, the Relative Strength Index (RSI) had touched the overbought zone. Upon reaching this zone, the index fell, leading to a decline in the price of AVAX.

If the oscillator continues to decline, AVAX may lose its hold at $50. However, the Exponential Moving Average (EMA) shows other signals. For example, the EMA 20 (blue) has crossed above the EMA 50 (yellow).

Bears track tokens

Source: HyblockCapital

Such a position implies that the uptrend is not over yet. As long as the price does not fall below $45.89, AVAX could recover. Additionally, the funding ratio is positive, suggesting that the price could touch the resistance level and break through that area.

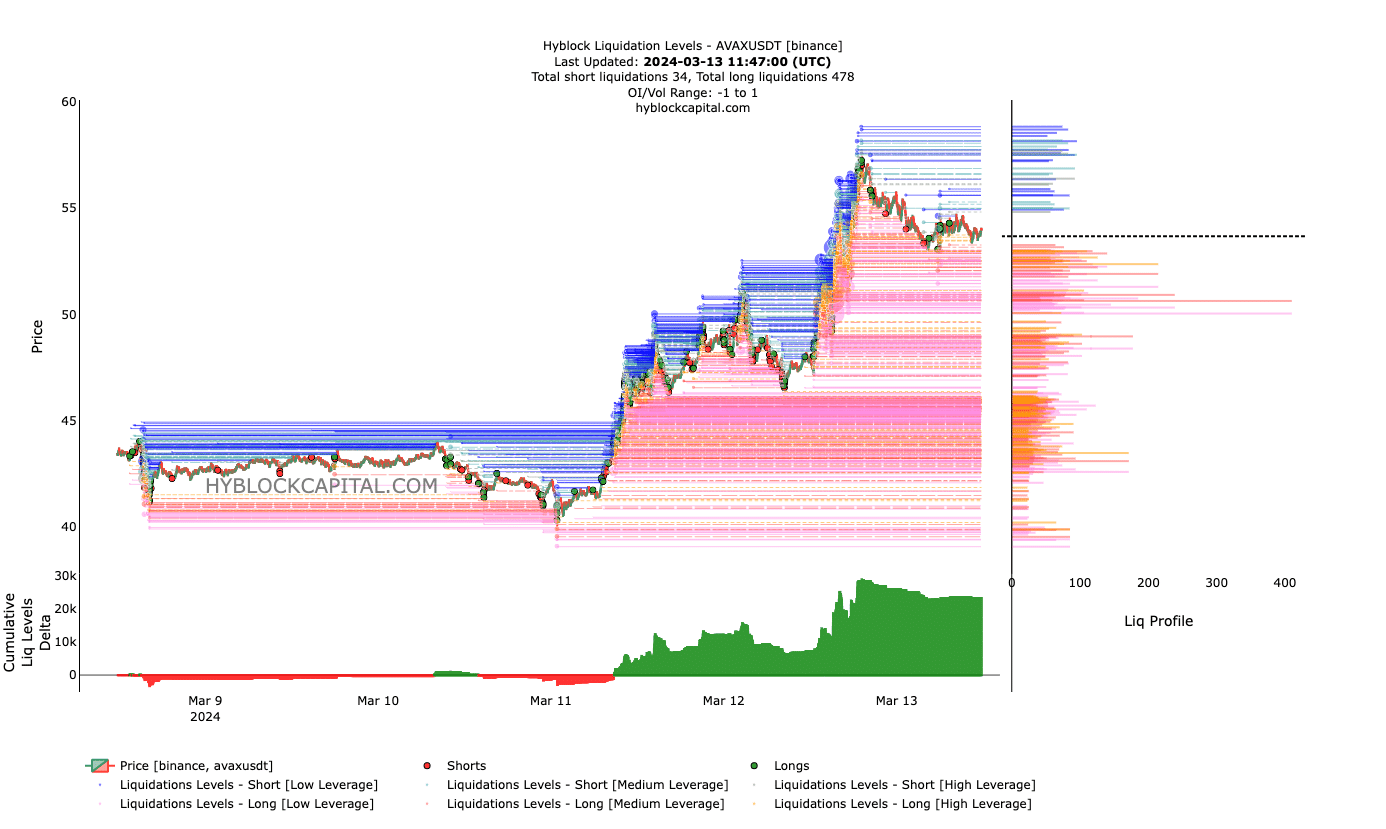

On the liquidation front, AMBCrypto has found that traders desire high-risk positions at $57 and above. This type of market condition suggests a possible reversal as the price may have difficulty establishing an uptrend.

If this situation does not change, the price of AVAX could fall below 50 USD. Furthermore, the cumulative liquidation level delta (CLLD) is positive, indicating a slight bearish trend.

In a sharp bearish situation, the price of the cryptocurrency can drop to as low as $45. However, this does not mean that the value cannot reach three digits.

Hi

Hi