Arbitrum [ARB] has solidified its position as a leading force in the Layer 2 (L2) sector since its inception, and recent indicators suggest a further strengthening of its dominance. Recent data from L2 Beats highlights Arbitrum’s consistent performance, positioning it as one of the standout assets in the current year.

Breaking records with an all-time high TVL

L2 Beats data reveals a significant upswing in Arbitrum’s Total Value Locked (TVL). The latest analysis underscores that the current TVL marks an unprecedented peak for both the Arbitrum network and the broader spectrum of Layer 2 solutions. At present, the TVL stands at approximately $10.4 billion, representing an impressive 16% surge.

Notably, the cumulative TVL across various networks has surpassed $21 billion, largely fueled by the ascent of Arbitrum’s TVL and that of other networks. With its current TVL, Arbitrum commands a substantial 49% market share.

Approaching the $1 billion milestone in trading volume

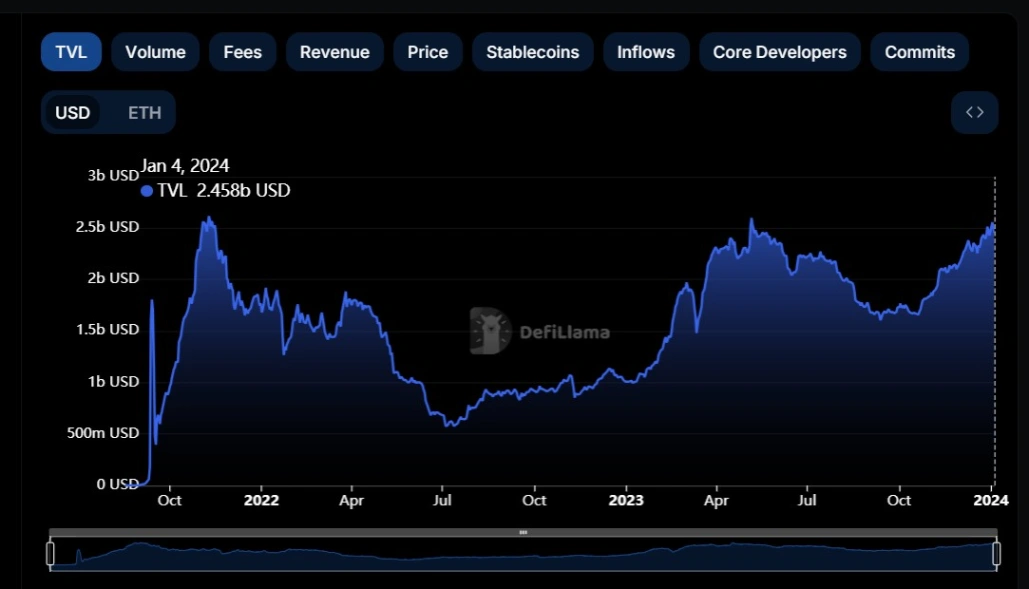

Another noteworthy metric signaling positive momentum is Arbitrum’s trading volume, as reported by DefiLlama. The network’s trading volume has skyrocketed beyond $400 million and, at the time of writing, stands at over $900 million, edging closer to the remarkable $1 billion mark.

The chart indicates a previous instance of reaching this volume range on December 22nd, surpassing $1 billion. Remarkably, over the past nine months, the volume has breached the $1 billion mark only twice.

The last sustained trend within this range dates back to around April 2023.

Growing Interest in ARB

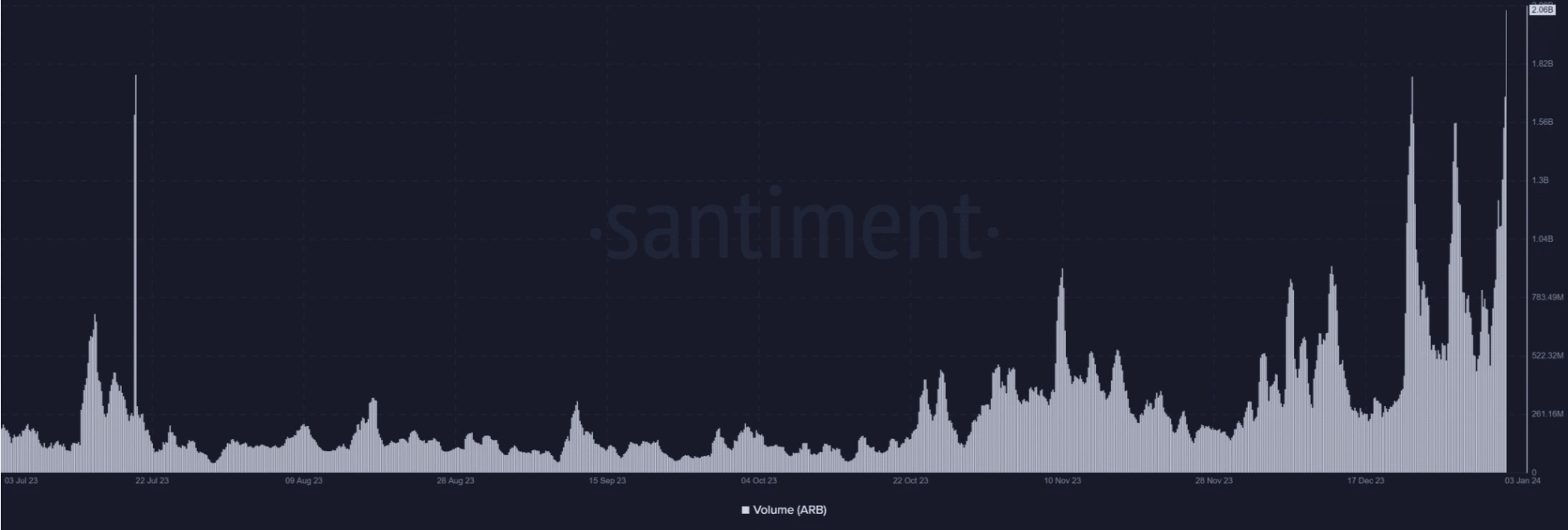

Arbitrum has experienced a significant uptick in trading volume, particularly notable over the last three days. Santiment’s volume chart analysis reveals that on January 2nd, the ARB volume was around $1.3 billion.

However, at the time of this update, it has nearly doubled, exceeding $2 billion. This surge in volume signals heightened ARB trading activity across various exchanges.

Related: Arbitrum Continues to Have Problems Stopping Block Generation

Furthermore, the daily timeframe chart displays a remarkable growth of over 30% in ARB’s value over the past three days. Currently, the trading price hovers around $1.9.