Captain Faibik, a skilled technical analyst, recently shared insights on X (formerly Twitter), suggesting that Solana [SOL] could be heading towards the $333 mark. According to Faibik’s chart analysis, SOL successfully broke out of a descending triangle, signaling a shift from a bearish to a more bullish trend.

The post not only highlighted the current positive momentum but also projected a continued upward trajectory for Solana in the near future. As of the latest update, SOL’s price stood at $105.65, marking an impressive 8.90% increase in the last 24 hours. The substantial surge in trading volume, reaching $3.14 billion during the same period, indicated a heightened interest in the cryptocurrency.

$SOL #Solana is Road to the $333 📈 pic.twitter.com/6FXD3FSKyQ

— Captain Faibik (@CryptoFaibik) January 30, 2024

While a potential 3.17x increase to $333 is on the horizon, the question remains: can SOL achieve this significant price surge within a short timeframe?

Optimistic Opportunities Ahead for Long Positions

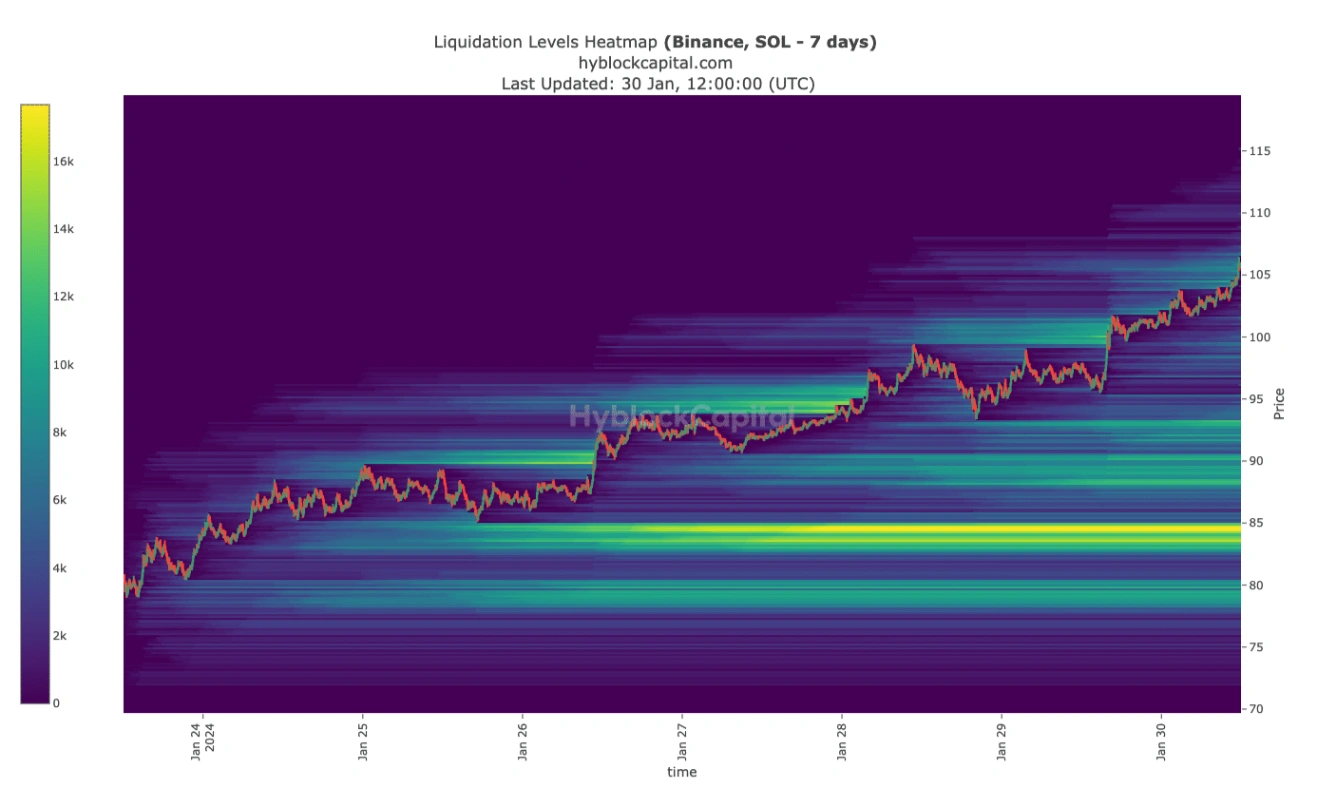

To assess the feasibility, AZC News turned to the Liquidation Heatmap provided by HyblockCapital, a tool enabling traders to pinpoint areas of high liquidity.

Upon scrutiny, our analysis of the Liquidation Heatmap at the time of reporting indicated that traders opting for long positions on SOL might encounter minimal risk of liquidation in the current market conditions.

Yet, opting to short the token and setting sights on the $82 to $85 range poses a substantial risk of liquidation for traders. While those with lower leverage might escape unscathed, open short positions leveraging 25x to 100x expose funds to potential losses.

It’s crucial to note that SOL’s surge to $333 is not guaranteed. However, the ongoing narrative suggests that the Solana native token could effortlessly surpass the $115 mark in a relatively short timeframe. Should SOL breach the $115 threshold, the likelihood of sustained upward price movement significantly increases. The current state of the token indicates that the targeted price might become a reality sooner rather than later.

Related: NFTs Fuel Growth on the Solana (SOL) Blockchain

Growing Open Interest Strengthens Bullish Outlook

Bolstering the bullish outlook is the Open Interest (OI) data from Coinglass, showcasing an increase to $1.26 billion. OI represents the total value of all open contracts and fluctuates based on net positioning. A rising OI indicates growing participant involvement, potentially favoring upward price movement. Conversely, a decline in OI signals liquidity shifting away from contracts tied to the cryptocurrency.

Considering Solana’s price dynamics, the ascending OI could act as a catalyst for further upward momentum. If the price aligns with the increasing OI, there’s a possibility that SOL could experience a 50% surge over the next few weeks, albeit with potential intermittent pullbacks in the process.