The second-largest cryptocurrency has experienced a notable uptick in price in the past month, reaching its year-to-date peak at $2,139. This bullish momentum, fueled by a crypto market upswing and BlackRock’s entry into the scene, has propelled Ethereum ahead of Bitcoin (BTC) and various altcoins, marking a significant shift in market dynamics, as indicated by market data provider Kaiko.

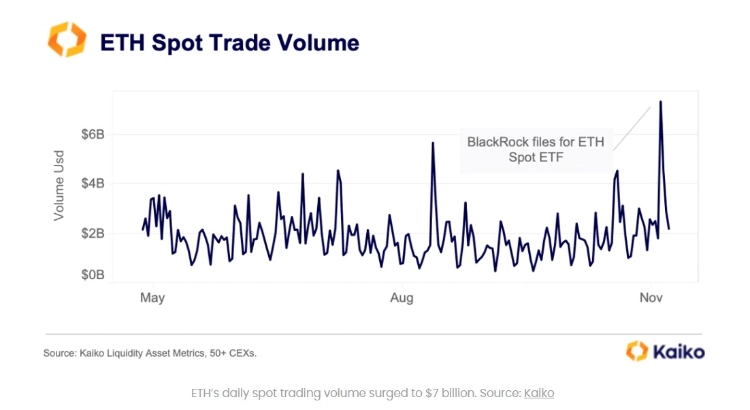

Despite facing challenges in gaining momentum over the past year, even with successful upgrades like The Merge in April, Ethereum’s fortunes turned around dramatically when BlackRock filed for a spot ETH exchange-traded fund (ETF). This move triggered a reversal in the ETH to BTC ratio, resulting in a substantial market impact. Ethereum prices surged past $2,000 for the first time since April, and daily spot trade volumes hit $7 billion, reaching their highest level since the collapse of FTX.

The narrative around the ETH ETF further fueled the ongoing rally, bolstered by an improved global risk sentiment and decreasing US Treasury yields. The dominance of altcoin + ETH volume relative to BTC reached 60%, its highest level in over a year. During bull rallies, altcoin volume typically rises in comparison to BTC.

This surge in demand has also led to an increase in leverage, evidenced by the recovery of ETH open interest to early August levels. Notably, BTC open interest has declined in the past month due to liquidations on Binance, resulting in the Chicago Mercantile Exchange (CME) outpacing Binance as the largest BTC futures market.

Moreover, the surge in ETH funding rates, serving as a barometer for sentiment and bullish demand, has hit its highest point in over a year, underlining a substantial shift in market sentiment. November witnessed a notable increase in both BTC and ETH 30-day volatility, reaching 40% and 50% respectively. This surge follows a multi-year low of around 15% experienced during the summer months.

Prominent crypto analyst Michael Van de Poppe is anticipating a breakthrough for ETH. According to him, if Ethereum successfully breaches the crucial $2,150 resistance level, it could mark the end of the bear market. Van de Poppe draws a parallel with Bitcoin’s pivotal $30,000 barrier, suggesting that surpassing this level could pave the way for a significant rally, potentially driving Ethereum’s price into the range of $3,100 to $3,600.

Nevertheless, Ethereum is yet to touch the $2,150 resistance line, encountering a pre-existing obstacle in the form of its yearly high of $2,139. This crucial level has acted as a robust resistance, impeding the cryptocurrency’s bullish momentum. Consequently, Ethereum has been consolidating within a narrow range between $2,050 and $2,100 over the past three days.

Related: Temporary Pause in Ethereum (ETH) Price Surge: Anticipating the Resumption

The upcoming days will unveil whether Ethereum can overcome its immediate resistance levels and establish a consolidated position above them. Alternatively, there is the possibility of facing a fate akin to Bitcoin, which struggled to surpass the $31,000 level for over seven months before reaching its current trading price of $36,000.