Solana (SOL), one of the prominent cryptocurrencies, has seen a remarkable 20% increase in its price from September 28th to October 6th. This surge has left many in the cryptocurrency community wondering whether SOL’s price movement is in sync with Bitcoin (BTC) or driven by unique factors.

Before SOL’s recent breakout, it had to endure a period of turbulence triggered by a U.S. court’s approval of the sale of $1.3 billion worth of SOL from the bankrupt FTX exchange. The court took measures to ensure a controlled liquidation process, avoiding undue stress on the cryptocurrency market.

SOL’s price saw a dip, hitting its lowest point in two months at $17.34 on September 11th. However, signs of bullish confidence emerged as it reestablished support at $20 on September 29th. Interestingly, this coincided with a successful upgrade to version 1.16, driving SOL up by 16% over the subsequent seven days.

Supporting Factors: DApps and NFTs Driving Solana’s Rally

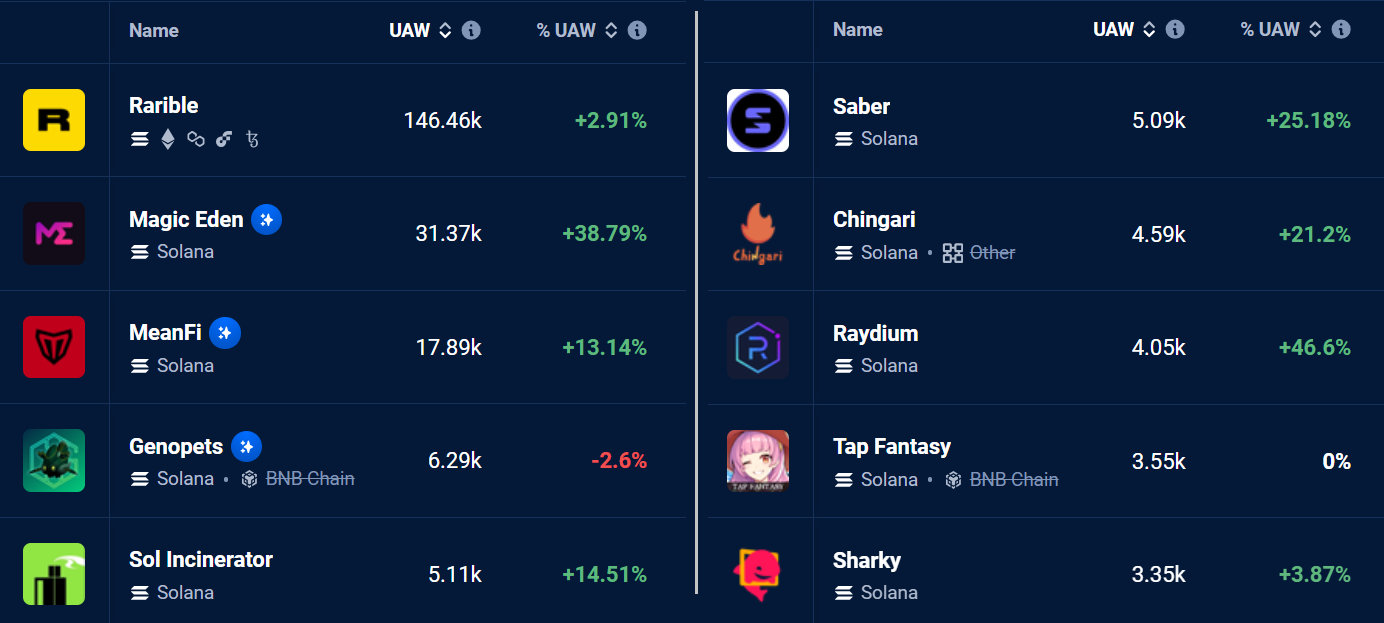

Solana’s recent rally is not solely a product of market dynamics. It is bolstered by the growth of decentralized applications (DApps) and the surge in non-fungible token (NFT) volumes on the Solana blockchain.

Analyzing the activity on Solana’s DApps, it’s evident that the number of active users is a significant driver. Addresses interacting with DApps on Solana have surpassed Ethereum during the same period, indicating growing interest in the Solana ecosystem.

Solana Update: Enhanced Privacy and Network Upgrade

One of the key catalysts behind SOL’s 20% price increase was the network upgrade to version 1.16 on September 28th. This upgrade introduced a “gate system” to ensure a gradual activation of new features on the Solana network. This approach helps maintain network stability and mitigates sudden disruptions caused by rapid changes.

Another noteworthy feature in this upgrade is “privacy transfers,” which employ zero-knowledge proofs to encrypt transaction details, enhancing user privacy. Additionally, the release includes improvements in RAM usage for verification, resizable data accounts, and a mechanism to detect corrupt data. These enhancements mark a significant milestone in the development of the Solana blockchain.

Competition from Ethereum Layer-2 Solutions

Despite Solana’s impressive growth, it faces stiff competition from Ethereum’s layer-2 solutions. Arbitrum holds $1.73 billion in total value locked (TVL), and Optimism boasts another $637 million, both surpassing Solana’s $326 million. This underscores the challenge SOL faces in gaining traction against Ethereum’s dominance in the decentralized finance (DeFi) space.

>>>> Related: Arbitrum and Optimism: Who will be the winner?

In conclusion, while Solana has made significant strides in terms of price growth and network upgrades, it faces challenges in competing with Ethereum’s established ecosystem. The cryptocurrency market continues to evolve, and Solana’s journey will be closely watched as it seeks to carve out its niche in the blockchain space.