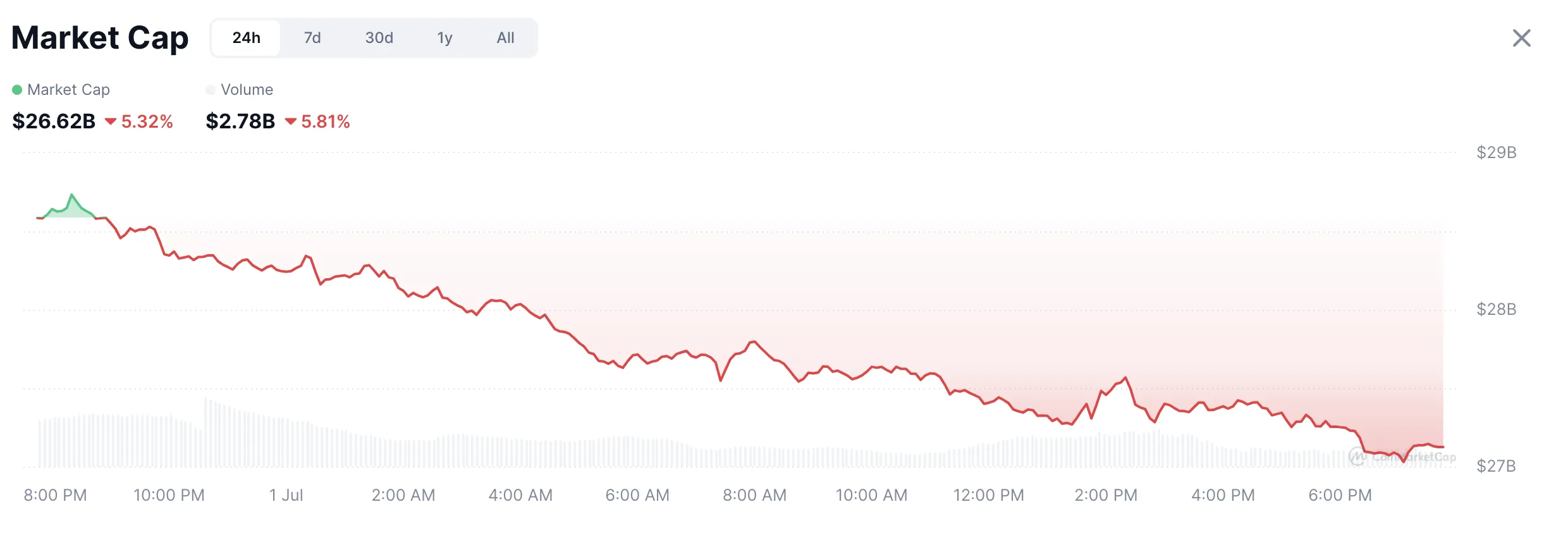

The prices of many AI-related tokens dropped as much as 10% after the U.S. Senate officially rejected a proposed 10-year moratorium on AI regulations in the “Big Beautiful Bill” backed by former President Donald Trump. Within just 24 hours, the market capitalization and trading volume of AI crypto assets both declined by over 5%.

Senate Overwhelmingly Rejects AI Freeze Proposal

The “Big Beautiful Bill” initially proposed a decade-long suspension of AI regulation across all U.S. states. It also included a $500 million fund for AI infrastructure development, accessible only to states that imposed no AI-related restrictions. The plan had the backing of major tech firms like Google and OpenAI.

However, the Senate voted overwhelmingly against the proposal, with a 99–1 result. Even crypto-friendly lawmakers withdrew their support, signaling deep bipartisan concern. The only senator voting in favor, Thom Tillis, has already announced he won’t seek re-election.

Lawmakers warned that freezing AI regulations could open the door to a wave of tech-related crimes — including fraud, copyright infringement, and even the misuse of AI to simulate illegal content. These fears prompted prominent Republicans like Marsha Blackburn to oppose the bill outright.

AI Tokens Continue to Struggle

On the market side, AI-related crypto tokens had already been in a downtrend over the past month, and the news of the bill’s revisions triggered further selloffs. Over the past 30 days, trading volume in AI tokens has plummeted by 38%.

This event adds to growing pressure on the AI token sector, which is already in a broader correction phase. Interestingly, some Musk-themed meme coins rallied after Elon Musk publicly opposed the bill — though Dogecoin still lost over 5%.

While it’s too early to tell how the Senate’s decision will affect AI tokens long-term, it’s clear that investor confidence in the legal outlook for AI is weakening. For now, the sector faces continued uncertainty and likely headwinds ahead.