Miners Outperform as Bitcoin Falters

October brought heightened volatility for Bitcoin (BTC), breaking its usual “Uptober” streak as the leading cryptocurrency fell below $107,000, posting a 0.28% daily and 4.43% weekly decline.

However, while BTC stumbled, Bitcoin mining companies have taken center stage, delivering up to 500% higher returns thanks to artificial intelligence (AI) integration and innovative new revenue models.

Bitcoin Mining Transforms into Data Infrastructure

According to Bloomberg, 2025 marked a historic turning point for the Bitcoin mining sector. Instead of relying solely on block rewards, miners began adopting hybrid models that combine AI processing and high-performance computing (HPC).

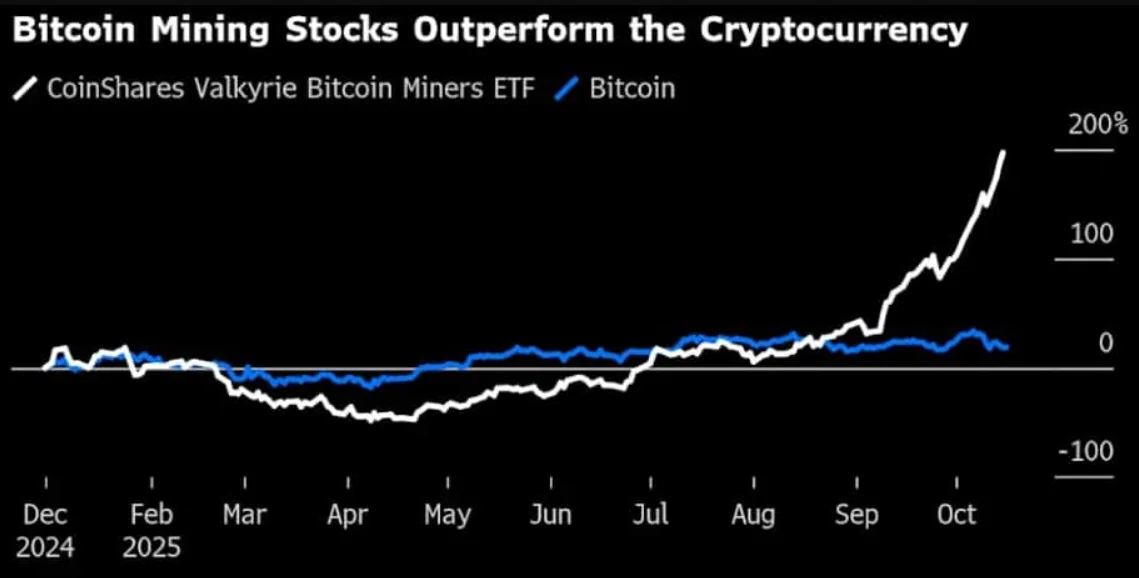

As a result, the CoinShares Valkyrie Bitcoin Miners ETF surged over 150% year-to-date, easily outperforming Bitcoin itself. Investors now increasingly view miners not merely as crypto operators, but as technology infrastructure firms — the new “data powerhouses” of the AI era.

Cipher and Iren: The New Faces of the AI Mining Boom

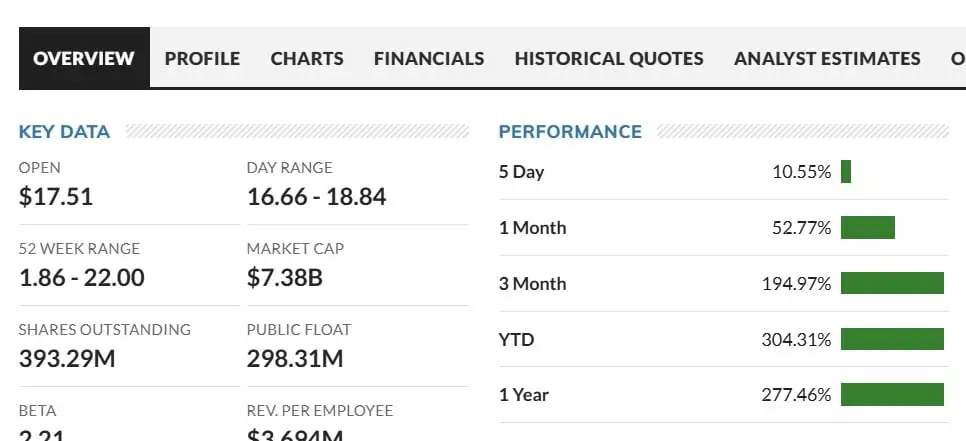

Among the top performers, Cipher Mining Inc. and Iren Ltd. led the charge:

-

Cipher Mining surged 304% in 2025,

-

While Iren Ltd. skyrocketed 519% within the same period.

Both firms are redefining the Bitcoin mining model, pivoting from traditional crypto mining to AI infrastructure services — diversifying revenue streams and reducing dependence on BTC price cycles.

Cipher sealed a $3 billion partnership with Fluidstack, while Iren raised $1 billion through convertible notes. These strategic moves blur the line between AI computing and crypto mining, enabling miners to sustain profits even as block rewards drop to 3.1 BTC after the most recent halving.

Stable Revenues, Lower Selling Pressure

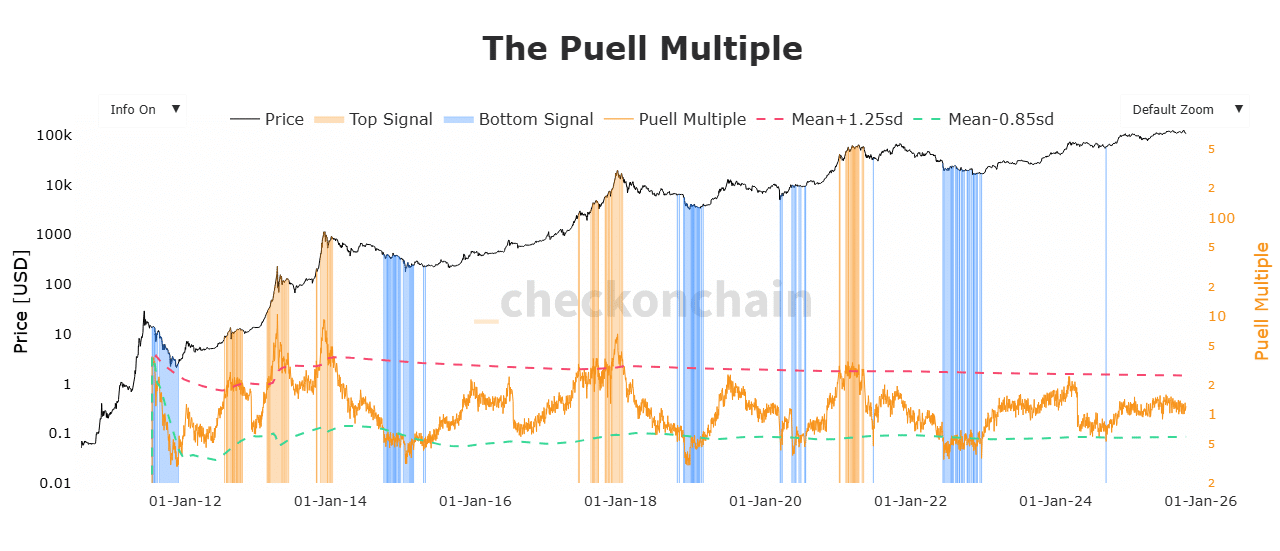

Despite market fluctuations, miner profitability has remained solid. Since June 22, the Puell Multiple — a key profitability indicator — has hovered between 1.2 and 1.3, signaling a healthy mining ecosystem.

Thanks to steady income from AI operations, many miners are holding onto their BTC reserves rather than selling them, which reduces exchange inflows and eases downward pressure on the market — a crucial support for potential recovery.

Could This Be the Spark for Bitcoin’s Next Rally?

The surge in miner performance may serve as an early signal for Bitcoin’s next bull phase. By tapping into AI-driven revenue, miners achieve cash flow stability and less selling pressure, which could help strengthen BTC’s supply dynamics.

If this trend continues, analysts expect Bitcoin to regain momentum and test the $109,000–$113,000 range in the near term.

However, if miners remain cautious and market pressures persist, BTC may consolidate between $105,000 and $112,000 before breaking out again.