The Crypto Black Friday meltdown wiped out $19 billion in leveraged positions, exposing deep transparency flaws between centralized (CEX) and decentralized (DEX) exchanges. While Binance faltered and was forced to compensate users, Hyperliquid — a relatively new decentralized exchange — stood firm, emerging as the biggest stress test since the 2022 FTX collapse.

The Crash That Shook Trust

According to Bloomberg, Hyperliquid processed over $10 billion out of the $19 billion in liquidations, while Binance suffered outages and refunded users. The DEX maintained 100% uptime, proving its resilience amid extreme volatility.

Matt Hougan, CIO of Bitwise, commented that “blockchains passed the stress test,” noting that DeFi platforms like Hyperliquid, Uniswap, and Aave stayed fully operational while Binance struggled to compensate traders. His takeaway: decentralization preserved market integrity as overleveraged traders were wiped out.

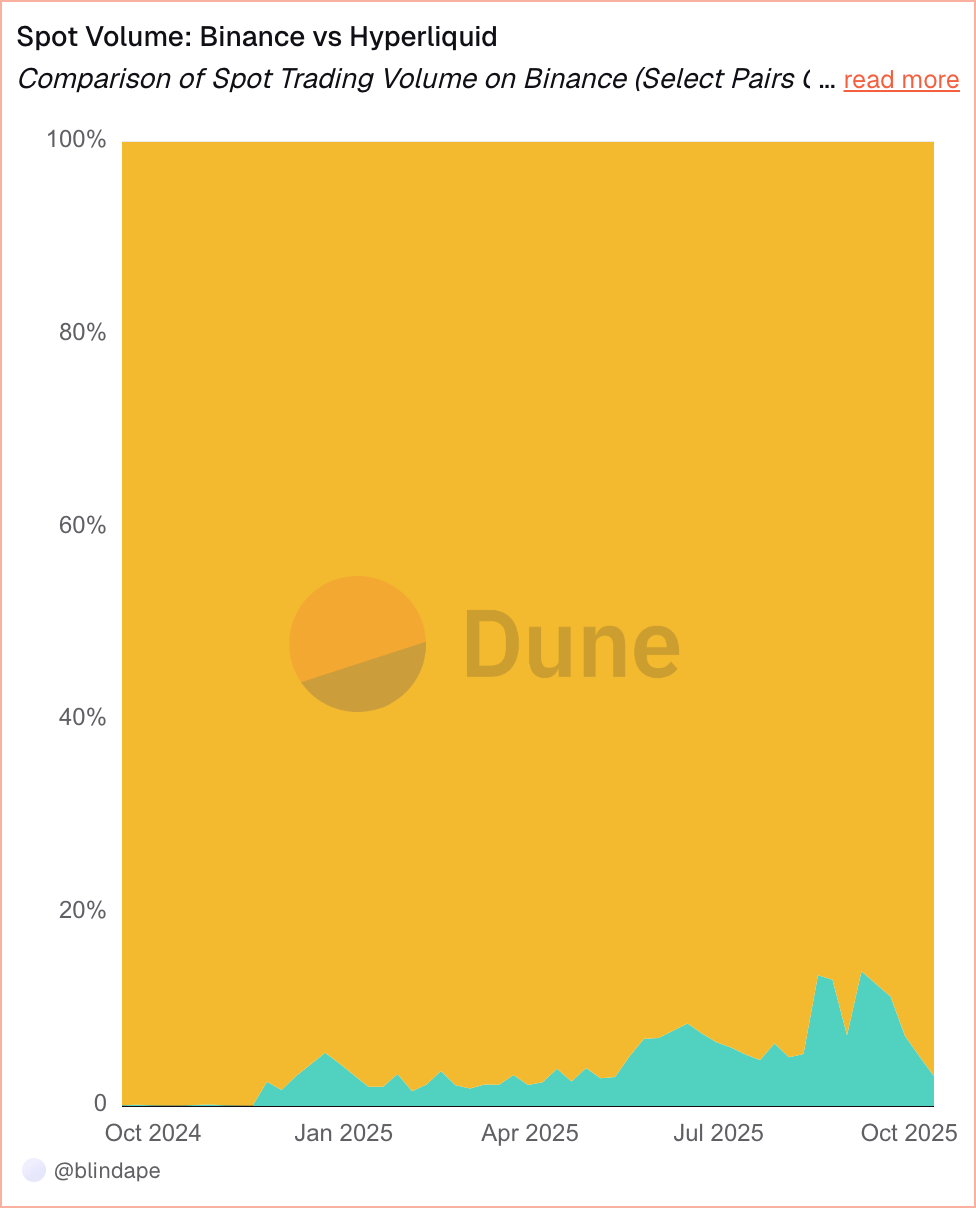

Data from Dune Analytics shows Binance still dominates spot trading, while Hyperliquid’s market share remains below 10%. Yet, the crash reignited doubts about centralized transparency — especially as the “listing fee” controversy erupted soon after.

Binance Faces Listing Fee Backlash

Limitless Labs’ CEO accused Binance of demanding up to 9% of a project’s token supply and multimillion-dollar deposits for listings. Binance denied the claims, calling them refundable deposits under its Alpha program. Still, CEX credibility continued to decline.

Former Binance CEO Changpeng Zhao (CZ) responded that “every exchange follows its own model” and quipped, “If you dislike fees, build your own zero-fee platform.” Hyperliquid quickly fired back: “We have no listing team, no fees, no gatekeepers.” On its network, anyone can deploy a token by paying gas fees in HYPE and earn up to 50% of trading fees.

Uniswap founder Hayden Adams added, “DeFi already offers free listing and open liquidity. If projects still pay centralized exchanges, it’s purely for marketing.”

Hyperliquid – The Rising On-Chain Challenger

VanEck reported that Hyperliquid captured 35% of blockchain fee revenue in July. Circle integrated native USDC onto the chain, and Eyenovia launched a validator and HYPE treasury. The HIP-3 upgrade introduced permissionless perpetuals, allowing builders to create futures markets for any asset.

Grayscale’s latest report found that DEXs are becoming price-competitive with CEXs, naming Hyperliquid the “breakout platform of 2025.” The DEX’s greatest strength lies in efficiency: a team of just ten engineers operates a trading venue rivaling Binance’s 7,000 employees and $500 million marketing budget.

Instead of spending on ads and bureaucracy, Hyperliquid channels those savings into token value and liquidity rewards. VanEck describes this as “profit without marketing spend” — a moat no centralized player can replicate.

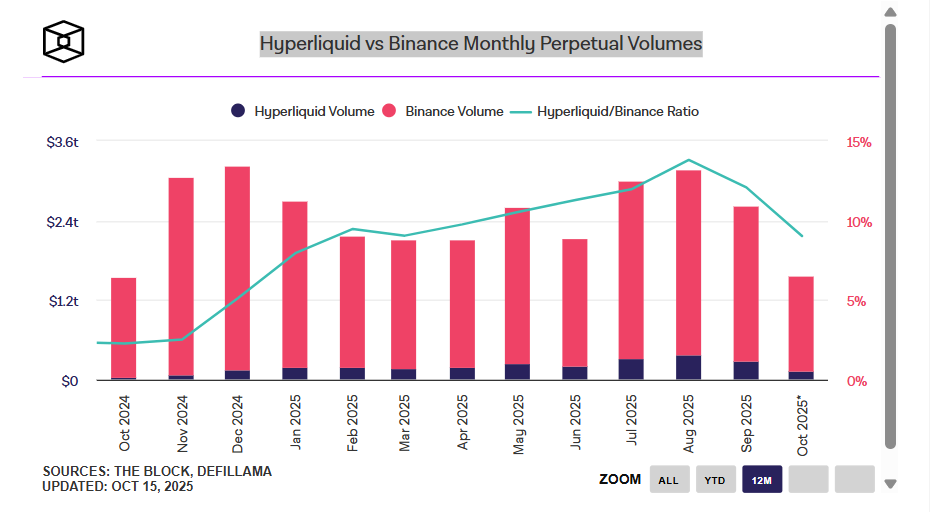

Data shows Hyperliquid’s volume reached roughly 15% of Binance’s in August before slightly easing — a clear signal that traders are increasingly migrating toward on-chain platforms.