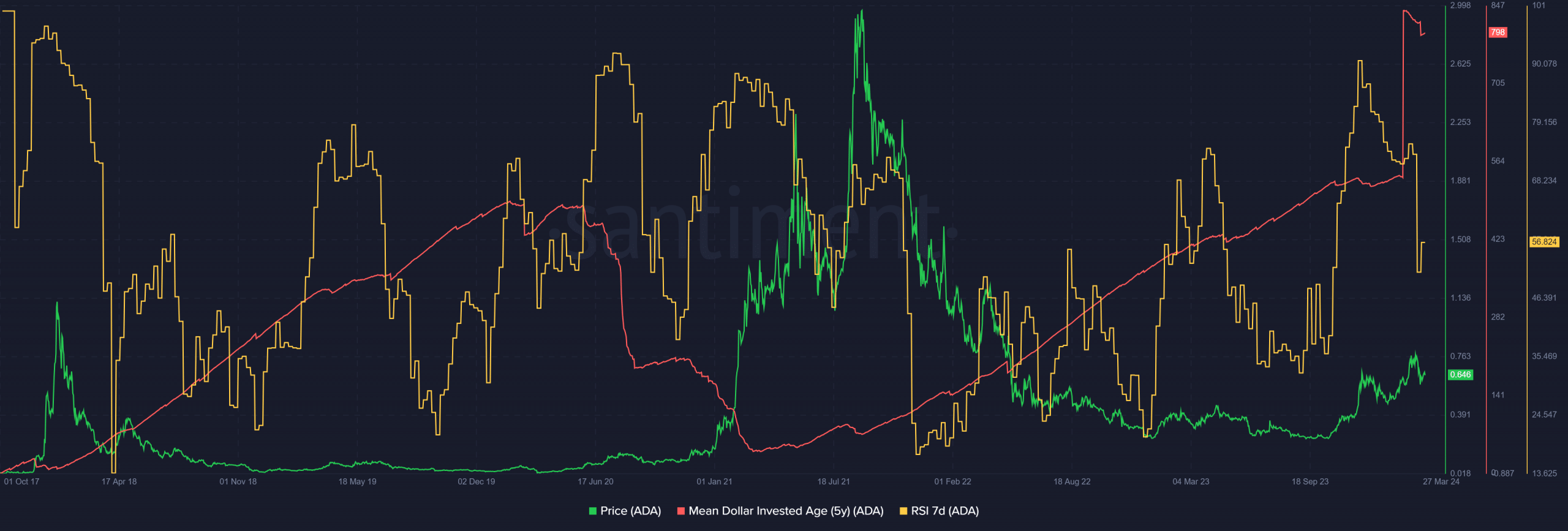

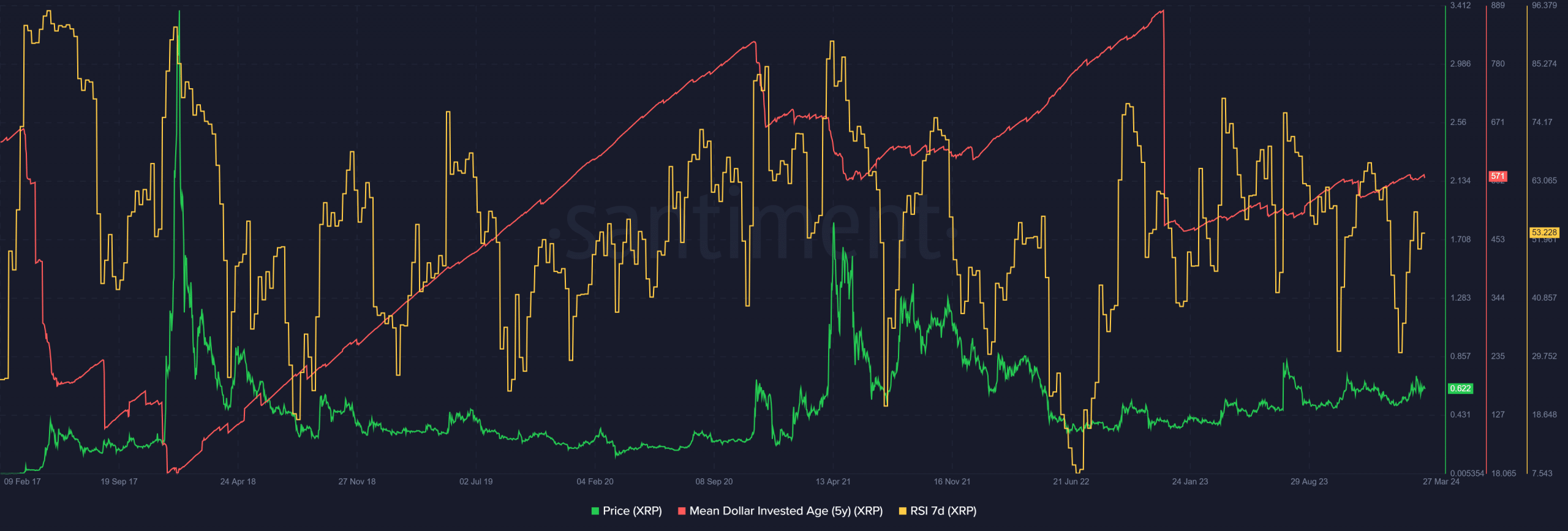

Santiment’s tweet highlighted a crucial factor fueling a bull run, emphasizing its significance in market dynamics. Analyzing Cardano (ADA) and Ripple (XRP), both Santiment and another source utilized the Mean Dollar Invested Age (MDIA) metric to gauge the potential initiation of a bull run.

MDIA, distinct from mean coin age, incorporates the purchase price of dormant BTC or any asset, offering a nuanced perspective. An upward trend in MDIA is customary, indicating coins aging in wallets—a sign of strong holder confidence, generally favorable for the asset.

However, prolonged periods of high MDIA suggest network stagnation, potentially hindering price growth. A decline in MDIA signals awakening dormant coins, aligning with investor expectations of lower MDIA as prices ascend.

Cardano is off the marks

For Cardano, MDIA exhibited an upward trend since July 2021 until a notable plunge in early March, signaling positive developments for long-term investors. A decrease in stagnant ADA typically heralds the onset of a robust bull market, potentially enduring for several months.

Source: Santiment

Historically, Cardano’s MDIA maintained a consistent downtrend in July 2020, coinciding with a remarkable price surge from $0.09 to $3.1, illustrating the correlation between MDIA trends and significant price movements.

At the time of writing, Bitcoin (BTC) was trading at $70.2k, slightly below its all-time high of $73.7k, with ETF inflows showing robust activity.

A recent Santiment post on X (formerly Twitter) highlighted a noteworthy observation: previously dormant wallets were becoming active, reintroducing older BTC into circulation.

During the upward trajectory of the price, the weekly Relative Strength Index (RSI) displayed a pattern of lower highs, technically indicative of a bearish divergence. However, given the current phase of price discovery, this divergence isn’t necessarily a reliable trading signal. Interestingly, this pattern of lower highs wasn’t evident on the weekly RSI at the moment.

Related: Ripple’s XRPL Blockchain Expands Cross-Chain DeFi Integration

Meanwhile, concerns loom among XRP investors. XRP experienced a decline in its Mean Dollar Invested Age (MDIA) metric from September 2020 to April 2021, coinciding with a downward trend in prices. This trend intensified as the bear market deepened, suggesting accumulation despite sliding prices.

While XRP investors fret

Source: Santiment

Similar to ADA, XRP also witnessed a significant drop in MDIA, occurring in early December 2023, followed by an upward trend thereafter. This abrupt decline, not accompanied by a subsequent uptrend, could be attributed to profit-taking or substantial selling pressure from large holders.

However, relying solely on MDIA isn’t sufficient to ascertain XRP’s current position within the market cycle. Nonetheless, its upward trend since January strongly suggests an ongoing accumulation phase.

XRP’s price remained range-bound, unable to breach the crucial $0.7 resistance level. The increase in MDIA may foreshadow a potential bull run in the forthcoming months.

i like XRP

Pray for me