At press time, BTC had slipped below the $110,000 threshold, raising the question: was this wave of liquidations simply a direct consequence of Bitcoin’s fall, or a sign of deeper cracks in overall market sentiment?

Bitcoin and Ethereum Lead $813M Bloodbath

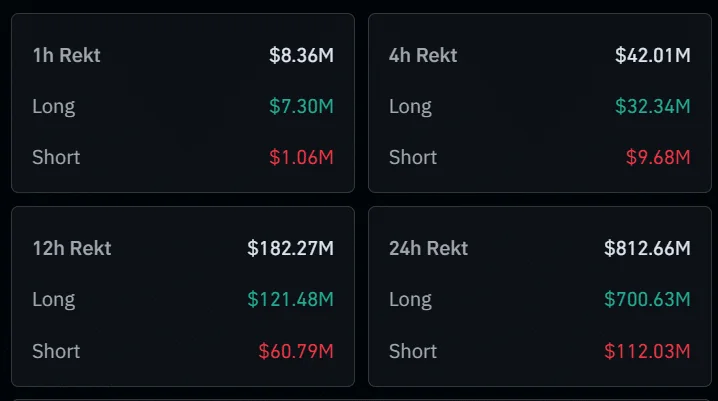

In just 24 hours, more than 180,000 traders saw their positions wiped out, pushing total liquidations to $813 million.

Bitcoin accounted for the largest share with $277 million.

Ethereum (ETH) followed closely with $263 million.

Major altcoins were also hit hard: Solana (SOL: $38M), Dogecoin (DOGE: $18.7M), and Ripple (XRP: $17.3M).

Most of the liquidations came from over-leveraged long positions, with the single largest wipeout being a $39.24 million BTC-USDT order recorded on HTX.

Is Bitcoin to Blame?

Bitcoin’s slide toward the $110,000 mark appeared to ignite this liquidation wave. On the price chart, a series of bearish candles throughout the past week underscored the bears’ dominance, while the RSI slipped to around 39, hovering close to oversold territory.

Ethereum also faced selling pressure after its 27% rally in recent weeks. The simultaneous drop in both BTC and ETH left over-leveraged traders vulnerable, triggering a domino effect of liquidations across major exchanges.

CoinGecko co-founder Bobby Ong summed it up bluntly:

“No red candle is the best day. But that’s not life, and we have to endure painful liquidation days in order to go higher.”

Volatility has always been part of crypto’s DNA. While the nearly $800 million in liquidations left traders reeling, such shakeouts often serve to flush out excess leverage, paving the way for healthier market movements ahead.

For now, the market remains fragile — but in crypto, brighter days are rarely too far away.