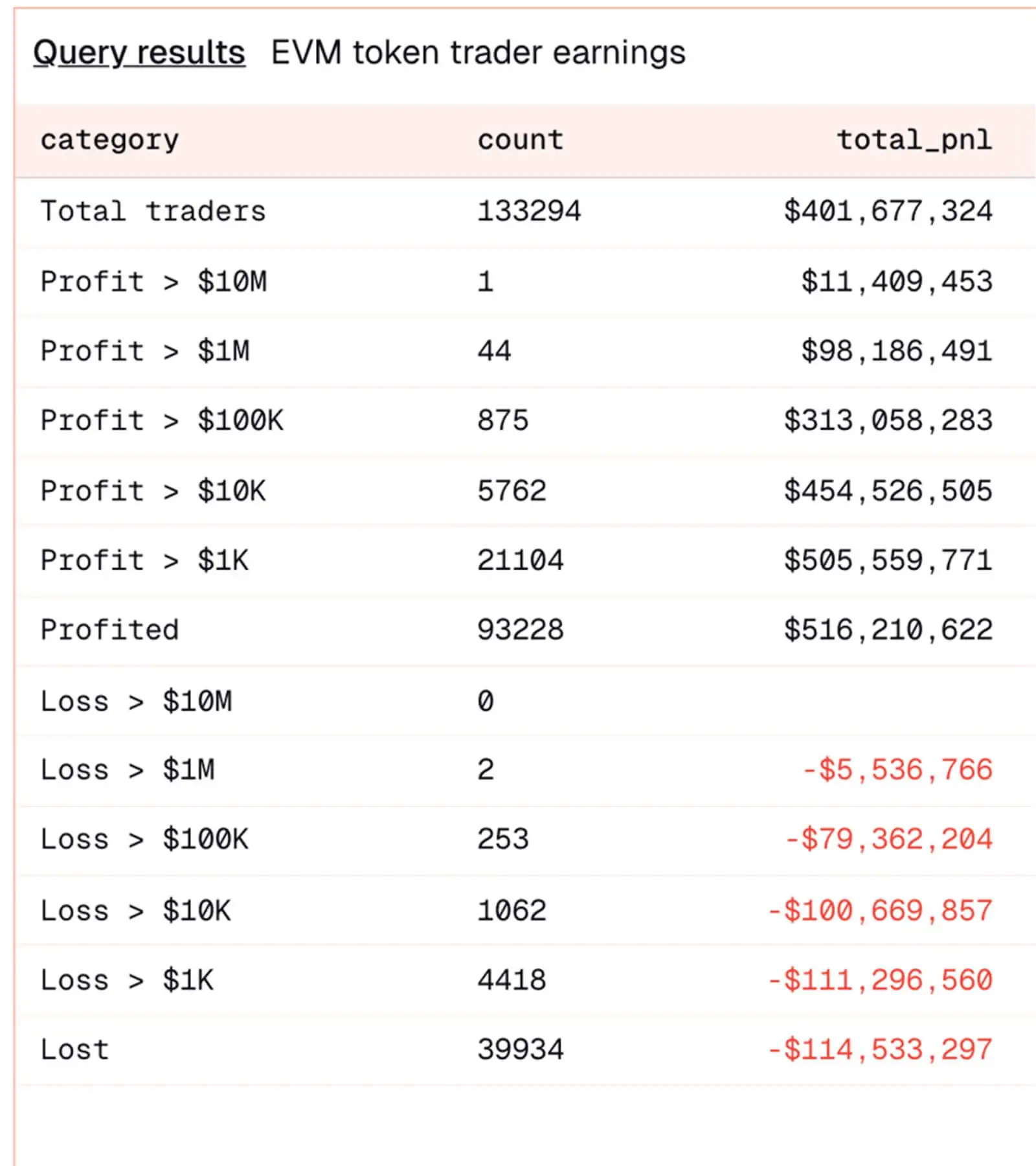

According to the latest data from Bubblemaps, more than 70% of over 100,000 investors are now in profit from the new wave of memecoins on the BNB Smart Chain (BSC). Standout names in this frenzy include $PALU, $币安人生 (Binance Life), $PUP, and $4, all of which have been dominating the “degen” trading community.

The biggest winners in this cycle tend to be experienced traders armed with advanced tools — or even insiders who understand the inner workings and capital flows of the BSC ecosystem.

Capital Inflows Surge Across BNB Chain

The BSC ecosystem is witnessing a massive influx of liquidity. On-chain data reveals:

-

DEX trading volumes remain robust, exceeding $6 billion per day, highlighting the strength of decentralized trading activity.

-

Inflow of +$531 million within just 24 hours, primarily from Ethereum and Solana via the deBridge cross-chain protocol.

-

A strong shift from CeFi to DeFi, fueled by FOMO around the Aster project, has further accelerated the BNB memecoin boom.

Notably, CZ, Binance’s founder, has officially confirmed that “BNB meme season is here,” reinforcing the community’s confidence in this wave. Many traders are now “thanking CZ” as their wallets grow fatter by the day.

BNB’s Expanding Utility – More Than Just Market Hype

Behind the memecoin frenzy, BNB continues to demonstrate strong long-term fundamentals. Its recent rally reflects not only market excitement but also the expanding utility and on-chain activity within its ecosystem.

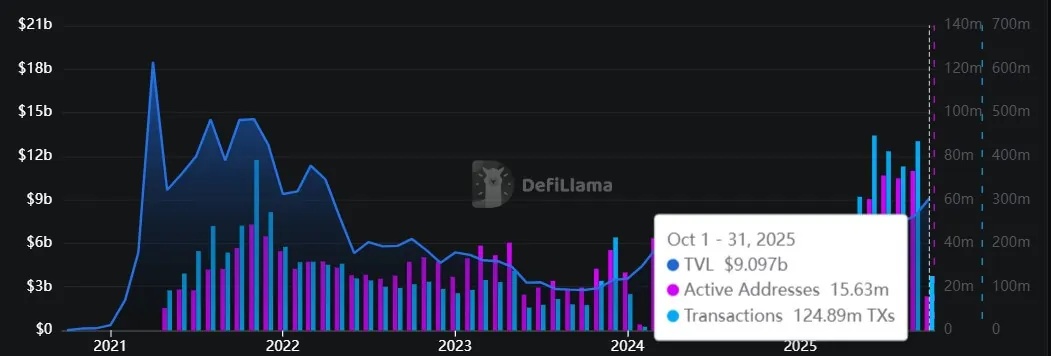

Decentralized exchanges such as Aster have recorded surging trading volumes, increasing demand for BNB as the network’s core gas and governance token. According to DefiLlama, BNB Chain’s total value locked (TVL) has risen by over 7% in just 24 hours, reaching approximately $4.5 billion, while network revenue hit $2.23 million.

The number of active addresses has also spiked — with 73 million in September and an additional 15 million already added this month.

Venture capital firm YZi Labs noted that BNB remains “built for mass adoption,” driven by several key catalysts:

-

Strong on-chain momentum.

-

A deflationary dual-burn mechanism.

-

Lower transaction fees following the Maxwell Hard Fork.

-

Growing institutional integration of BNB for treasury and liquidity management.

Conclusion

The convergence of speculative memecoin capital and solid BNB fundamentals has created a perfect storm for the BNB Chain. As retail investors rush to chase profits and institutions begin incorporating BNB into their operations, it’s clear that BNB’s “meme season” is more than just a passing trend — it could be the spark that ignites the next growth phase of the Binance ecosystem.