These AI systems collectively anticipated that BTC would likely range between $40,000 and $50,000 by the year’s conclusion. Now, as we approach the final two months of the year, we revisited the experiment to see if the AI chatbots’ predictions have changed.

Revisiting the Bitcoin Price Forecast Experiment with AI Chatbots

Back on June 23, 2023, our newsdesk embarked on a journey to test the predictive capabilities of six popular AI-powered chatbots: Claude Instant, Claude 2, Chatgpt 3.5, Chatgpt 4, Bing Creative, and Google’s Bard. The goal was to estimate Bitcoin’s price on December 31, 2023.

It’s worth noting that Anthropic is the creator behind both versions of Claude, Google developed Bard, and OpenAI is responsible for Chatgpt 3.5 and Chatgpt 4, as well as the model powering Microsoft’s Bing Creative. On the third day of November 2023, we once again challenged these AI models with the same question, making a few minor adjustments for accuracy.

The inquiry posed to the six chatbots closely mirrored the one from June, with only slight modifications to the date, BTC’s current price, the countdown of blocks to the halving event, and the ongoing uncertainty in the global economic landscape.

In the most recent experiment on November 3, 2023, we presented the following question:

The purpose of this experiment is to gauge the price of Bitcoin by the end of 2023. Drawing upon your expertise in the field of Bitcoin and cryptocurrency assets, please assess the probability of Bitcoin’s price at the close of 2023 and provide a rationale for your prediction. It is important to note that the global macroeconomic environment remains uncertain.

As of November 3, 2023, the current price of Bitcoin stands at $35,075 per unit. There are 58 days remaining until the year’s end, and we are approaching the next reward halving, expected on April 20, 2024, with less than 25,000 blocks left. In your capacity as an expert, what is your forecast for the price of Bitcoin on December 31, 2023?

Claude Instant’s response:

Bitcoin (BTC) has historically witnessed substantial price increases in the 1-2 years leading up to a halving event, when the new coin reward for miners is halved. As we approach the next halving in April 2024, there’s potential for Bitcoin’s price to experience an upward surge in late 2023 in anticipation of this event.

Considering this factor, my estimate places Bitcoin’s year-end price in the range of $35,000 to $45,000 per coin. I anticipate ongoing volatility over the next two months, but overall, I foresee an upward trajectory as the halving event approaches. Of course, unforeseen black swan events could potentially influence this prediction in either direction. Given the long-term scarcity of Bitcoin and the continuous growth of the cryptocurrency ecosystem, I hold a cautiously optimistic outlook regarding its price prospects.

Claude 2’s response:

I don’t have a particularly strong opinion on what the price of Bitcoin will be at the close of 2023. Predicting cryptocurrency prices is notoriously challenging due to their high volatility.

However, it’s plausible that Bitcoin’s price could remain within a broad range of $15,000 to $40,000, depending on how various factors evolve. Short-term Bitcoin price predictions have proven to be extremely challenging to make accurately. My expertise lies in analyzing the factors that may influence its price over time.

Bing AI Creative mode’s response:

I believe that the most likely scenario for Bitcoin’s price by the end of 2023 falls somewhere in the middle of the range, approximately around $40,000 per unit. This suggests a modest increase of approximately 15% from the current level of $34,728, which seems reasonable given the inherent uncertainty and volatility in the cryptocurrency market.

I anticipate that positive factors like the upcoming halving, increased adoption, and ongoing innovation will outweigh negative factors such as inflation, regulatory changes, and competition in the long run. However, I don’t expect these factors to trigger a massive bull run in the short term. Therefore, my expectation is that Bitcoin will trade relatively sideways for most of the remaining 58 days of the year, with some fluctuations influenced by news and events.

Please bear in mind that this is just my perspective and not financial advice. The price of Bitcoin can change rapidly, and there are no guarantees that it will align with any specific prediction or trend.

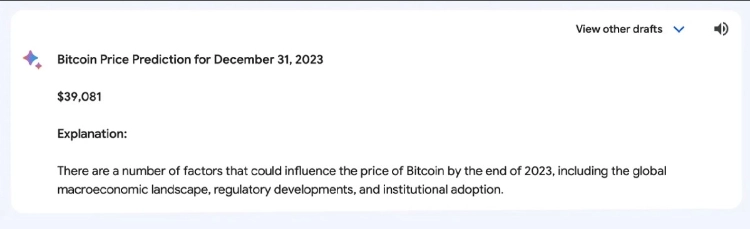

Bard’s response (not available in text format, please refer to the screenshot for Bard’s answer).

Chatgpt 3.5’s response:

The price of Bitcoin is influenced by numerous factors, and even experienced experts often provide a range of possibilities rather than a specific figure. Furthermore, the short time remaining until the end of the year makes precise predictions even more challenging.

I recommend staying updated with cryptocurrency news and developments, taking into account the factors mentioned earlier, and seeking insights from multiple experts and sources to gain a more comprehensive understanding of the situation.

Chatgpt4’s response:

Considering a modest bullish trend driven by the anticipation of the halving and taking into account the uncertainty in the global economic outlook, it’s plausible that the price of Bitcoin at the end of 2023 could range from maintaining its current level to experiencing a potential increase in the 10-20% range in an optimistic scenario, which would place it between $38,000 and $41,500.

This estimate considers both the potential upside from halving anticipation and the potential downside from economic uncertainty. However, it’s important to emphasize that this is not investment advice, and actual prices could vary based on unforeseen events.

Read more: Bitcoin Surges Over 100% Since the Beginning of the Year, Outperforming Most Other Assets

AI Forecasts for Bitcoin Price Show Caution Compared to Enthusiastic Projections

Naturally, the six generative AI chatbots began their predictions with a disclaimer, clarifying that their insights were speculative and not guarantees of future outcomes. Despite a 26.5% increase in BTC value over the past month, driven by the anticipation of approval for a spot bitcoin exchange-traded fund (ETF), there seems to be a lack of news regarding additional ETFs at the moment.

The holiday season typically experiences subdued trading volumes, but one undeniable factor supporting the price, as highlighted by the chatbots, is the approaching halving event. The current predictions of the chatbots reflect more cautious estimates compared to their projections from four months ago, which sharply contrast with the lofty figures that some industry experts have been suggesting.